What is a Share Purchase Plan?

31 August 2020 @ 12:00am SPP Harvester

A Share Purchase Plan (SPP) is a form of capital raising by a listed company that offers shareholders the opportunity to apply for new additional shares. The price is usually set at a discount to the trading price, to make it attractive to investors.

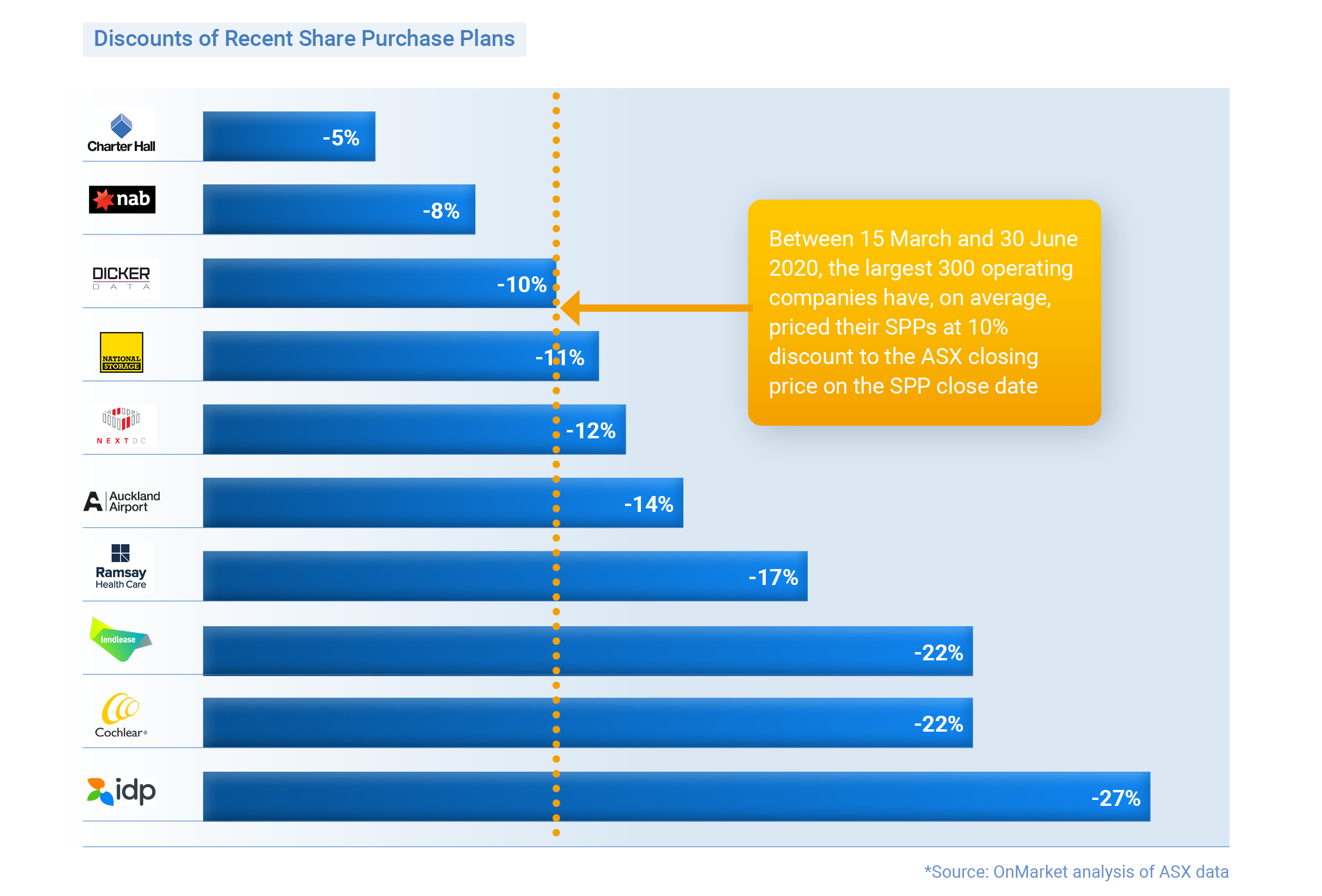

Over the 12 years to 31 December 2020, the largest 300 operating entities listed on ASX:

- undertook 27 SPPs per year on average

- at an average discount of 9% to the closing price on the SPP closing date

Many of the largest and most well-known companies listed on the ASX complete Share Purchase Plans in conjunction with a placement. There are a couple of reasons for this.

Why do companies complete share purchase plans?

The first reason is that companies seek to deflect valid criticism that placements dilute retail investors. So, why not do a rights issue instead of a placement plus a share purchase plan? We are a fan of rights issues. But, in times of uncertainty, placements provide a faster outcome with more certainty. And additionally, ASX currently allows companies to issue 25% of capital (up from 15%) by way of placement, provided its accompanied by an offer to all shareholders.

However, in order to access these discounted capital raises you must be a shareholder on the record date set by the company. Nearly always, the record date is set prior to the date that the share purchase plan is announced.

This means investors can’t buy shares after the SPP is announced and participate in the SPP.

As mentioned at the start of this article, the largest 300 ASX-listed companies complete an average of 27 SPPs per year. But, because no-one knows which 27 companies out of the top 300 are going to raise capital, to get the maximum number of opportunities, you need to be a shareholder in all 300 companies before the record date.

But, and here’s the rub for a DIY investor, the minimum purchase order for shares is $500 meaning to buy a holding in these 300 companies would cost $150,000.

Can I access share purchase plans?

So, we have created SPP HarvesterTM. By operating under a custodial structure, we don’t need to buy $500, then sell ‘all-bar-one’ shares, to give you a single holding in every company. For a start, this halves the brokerage versus ‘doing it yourself’. You don’t have both a buy transaction, and a sell-transaction. And, you don’t need to have $150,000 for purchases. The cost of a 1-share portfolio is approximately $3,500. And, by combining investor trades, SPP HarvesterTM can pass on the cost-savings to investors.

SPP HarvesterTM buys you a 1-share portfolio in 300 of Australia’s largest operating companies, identifies and applies for in-the-money SPPs and automatically sells the new securities, efficiently recycling your capital into the next share purchase plan. This automatically harvests the discount for share purchase plans, with minimum capital outlay, low establishment costs and minimal administration.

Don’t miss out on the next share purchase plan - join SPP HarvesterTM.