Australia's home of IPO investment

Providing you with fair, fast and easy access to more IPOs than anywhere else

281

Successful Raisings

$192.3M

Capital Raised

68,934

OnMarket Crowd

Fair, easy access to IPOs

Gain access

Now everyone can invest in IPOs. Get ASX IPOs delivered to your inbox. It’s never been easier to get fair, free access to IPOs.

Informed investing

View free digestible, relevant, research and video interviews with company management before deciding what to invest in.

Easy bidding process

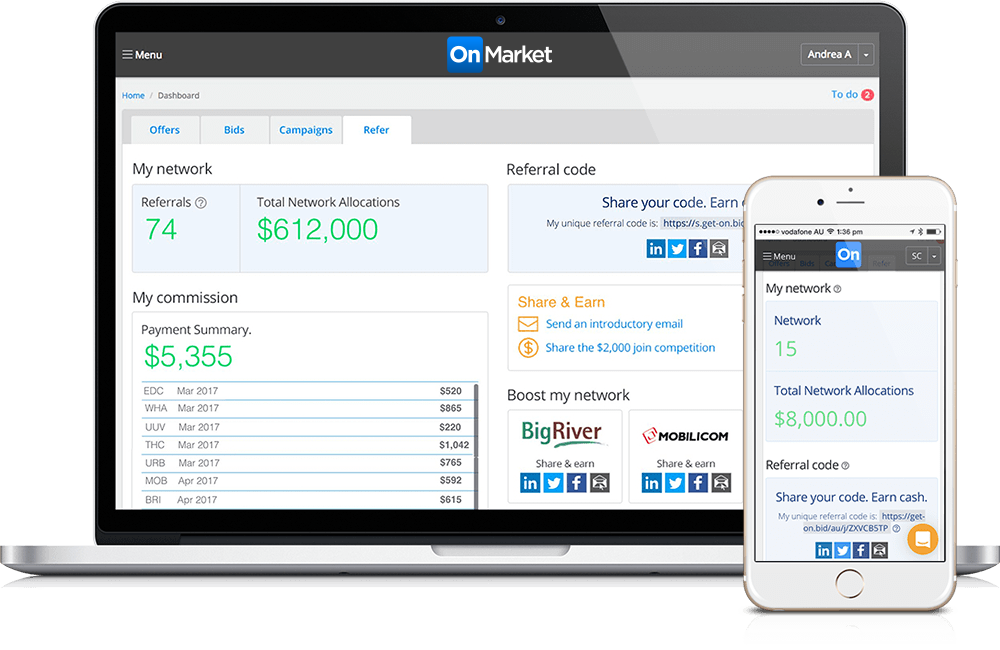

Fast, simple, secure bidding into IPOs either via the OnMarket app or website. Buy shares directly from your phone.

Performance of OnMarket IPOs and Placements

*Based on both open and closed positions of the 220 listed offers as at 1 June 2024.

Performance figures are calculated using a simple average method.

See comprehensive breakdown and calculation of returns

OnMarket allows me to invest in companies that I want to see succeed and make an impact on the world, read my investor story

Refer OnMarket

Over $346,746 in reward payments so far

Join OnMarket

Refer OnMarket

Earn 25% of our selling fee