SPP Harvester: What is scale-back?

When a company raises new capital, they will set a target amount of capital to raise that enables them to meet their short to medium term targets. Lets take a look, specifically, at Share Purchase Plans (SPPs).

Where demand exceeds the total size of the of the SPP, a company may allocate less shares to investors than they apply for (and return the excess funds). This is commonly referred to as scale-back. While the Australian Shareholder’s Association recommends that scale-back is calculated based on the size of the application, it is not uncommon for companies to calculate it on the number of shares that each shareholder holds.

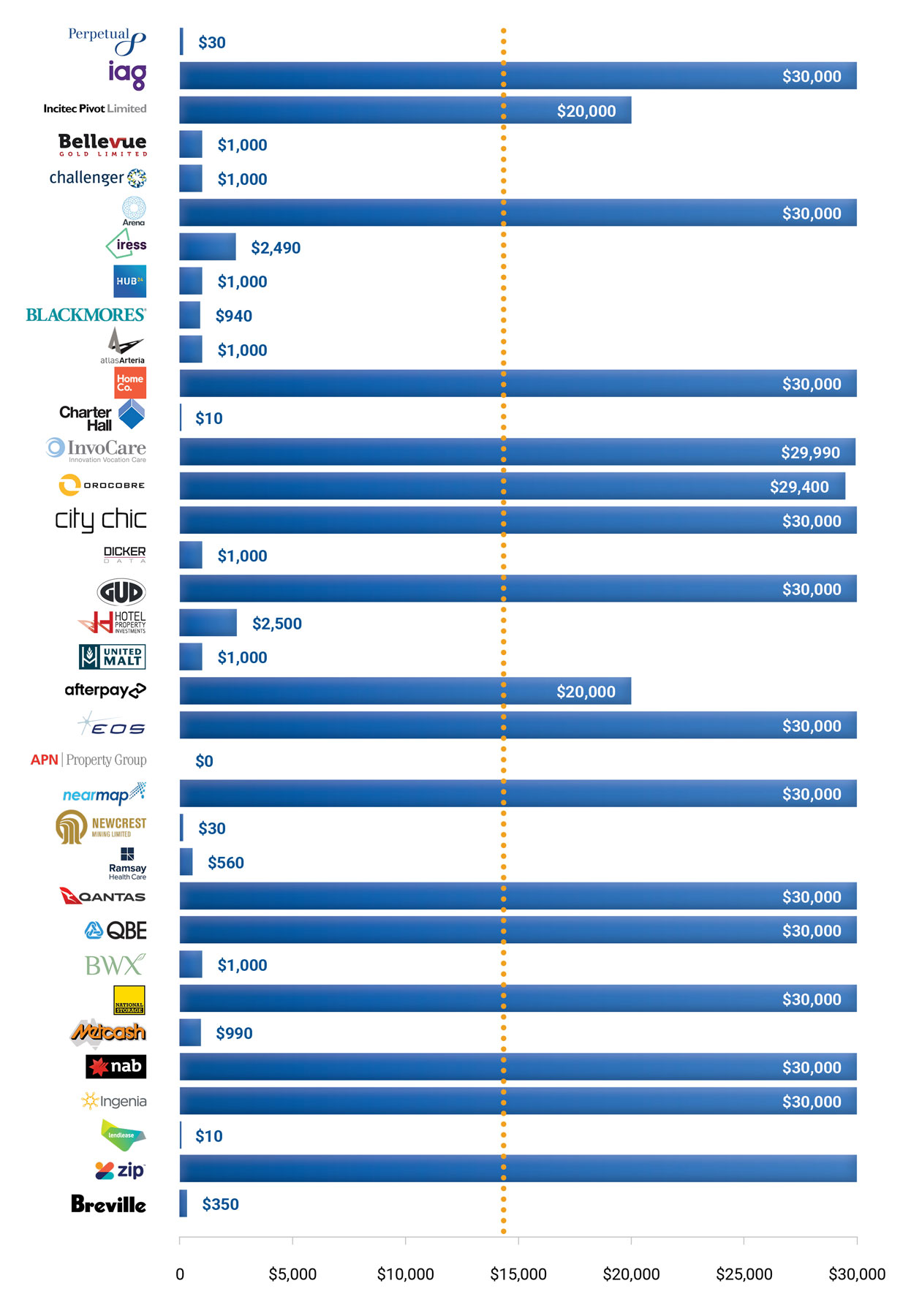

Luckily, much of the time companies will increase the size of the SPP, or apply a minimum amount that each investor is entitled to. An SPP Harvester that had sufficient funds to apply for $30,000 in the relevant SPP received the following allocations.

Allocations on a $30,000 application in each SPP since inception (10 April 2020)

|