Investor Guide: Equity Crowdfunding vs The Stock Market

23 February 2022 @ 12:00am Equity Crowdfunding Investors

Interest in the Equity Crowdfunding (ECF) space has spiked due to amplified awareness, the skyrocketing number of Australian start-ups, and the potential returns illustrated by the UK and U.S. market. Equity crowdfunding has quickly become a reliable source of raising capital for small Australian businesses, whilst also proving to be an opportunity to magnify capital gains for investors.

To truly appreciate the magic of an ECF raise, we must differentiate ECF investing to traditional investing methods, such as the stock market.

Let’s dive into the six major differences!

Difference #1: Listed vs Unlisted

When you invest in the stock market, like the ASX, or in an initial public offering (IPO), you can buy and sell shares at ANY time, as it is a secondary market. This is not the case with Equity Crowdfunding. A key difference between ECF and the stock market is that companies executing an ECF raise are unlisted, whilst companies on the stock market are publicly listed.

Once you’ve invested into a company’s ECF raise, there is no promise of when and if you will receive your investment back. Companies enter a raise with an exit plan, but that’s all it is – just a plan. This may be executed through an IPO on the ASX or a trade sale. Ultimately, investing in an ECF offer is classified as a long-term investment as you may not receive a return on your investment (ROI) for 3 – 5 years, or longer.

An element of ECF’s enticement for SMEs is that under ASIC’s Regulatory Guide 261, which deals with Equity Crowdfunding, any individuals who have acquired shares under an ECF raise do not count towards the company’s 50-shareholder limit.

Difference #2: Size and type of the company

Companies that raise capital via ECF are predominantly Seed or Series A stage companies seeking capital for growth, development, and expansion. This differs significantly from companies listed on a secondary market. To provide perspective, roughly 15% of companies raising capital via ECF are pre-revenue, and 85% are revenue generating (but may not yet be profitable).

The type of companies undertaking an ECF raise are primarily digitally native, innovative, and disruptive to the traditional status quo. In 2021, the most popular sectors that small Australian businesses raising capital via Equity Crowdfunding operated in were:

- Food and Beverage ($16.64m raised from 21 deals)

- Financial Services ($12.59m raised from 9 deals)

- Sustainability ($8.97m raised from 6 deals)

- Software ($8.07m raised from 15 deals)

Difference #3: Company stage

Some, but not all ECF companies, are in the early stages of their life cycle as they’re still developing their network and revenue model. These SMEs are testing the market to determine what element of their product best resonates with consumers, and what angle best influences purchases. They are continuously testing and executing pilot studies to better understand:

- How their business model differentiates from their competitors

- Their total addressable market

- Their 3-5 year trajectory and

- The roadmap to success

Publicly listed companies on the ASX are distinguished with years of experience and operational insight. Dissimilarly, most companies crowdfunding are just beginning to create their brand values and identity, with only one unvarying factor – their bright idea and market need.

Every business must start somewhere, and by investing in an ECF raise, you’re hopping onboard at the first stop instead of the last. Depending on your investing style and preferences, this is commonly seen as an exciting opportunity to watch the development of a disruptive business model.

Difference #4: Raise size

As illustrated in differences #1 & #2, companies partaking in an ECF raise are smaller, and therefore are seeking capital to increase distribution channels, partnerships, and brand exposure. ECF is unique in empowering companies to raise a maximum of $5m over a 12-month period. However, ultimately, it’s the company’s discretion to determine their ideal minimum and maximum raise size, based on the preferred dilution of the business.

ECF raises regularly sit between $250,000 and $3m (although a raise up to $5m is permitted). This raise size is smaller than an IPO raise, which normally sits at +$10m. Based on OnMarket’s research, the average raise size of an equity crowdfunding offer in 2021 was approximately $709k.

Equity crowd funding is never solely about the capital being raised. This method of raising capital is unique in that it can provide multiple invaluable purposes for a company, such as:

- An opportunity to increase the company’s brand awareness

- A customer acquisition opportunity

- An opportunity to receive expert advice on the company’s key messages and point of difference from investors and advisors

Of course, as the total raise size differs, so does the minimum investment size! When investing in an IPO, the minimum parcel size is $2k. This is not the case with ECF, in fact, the minimum investment usually sits between $250 - $500. In FY20, according to OnMarket’s research, the average amount invested in an ECF offer per investor was roughly $1,300.

From an investor’s standpoint, equity crowdfunding investing provides an opportunity to start your own mini venture capital fund, where you're able to invest early and often into a diversified portfolio of disruptive and innovative Australian companies.

Difference #5: Return on investment (ROI)

This is best summed up in a single statement: ‘The higher the risk, the higher the reward’.

If you’ve read the above differences, you’ll now know that ECF contains a higher level of risk for investors. There is no promise regarding the success of a company you chose to invest in. It’s you, the investor, who is responsible for completing your due diligence, and determining whether your bid into a particular start-up is a wise investment decision or not.

The valuations of early-stage companies undertaking ECF campaigns are low compared to IPOs that list on the ASX. From OnMarket’s experience, the sweet spot for an equity crowdfunding company’s valuation is somewhere between $4m - $10m, being mainly Series A stage companies.

With more risk comes more reward, which is the status quo with ECF. A strategy to minimise this risk is portfolio diversification. When trading on the ASX you would purchase shares in multiple companies in various sectors to lower your exposure to any one sector. You must apply this strategy when investing in ECF companies. There are plenty of choices,

this may be AgTech, CleanTech, HealthTech, PropertyTech, Ecommerce, etc. By investing in companies operating in different industries/sectors, you decrease the impact of having all your ‘eggs in one basket’ and potentially minimise any losses.

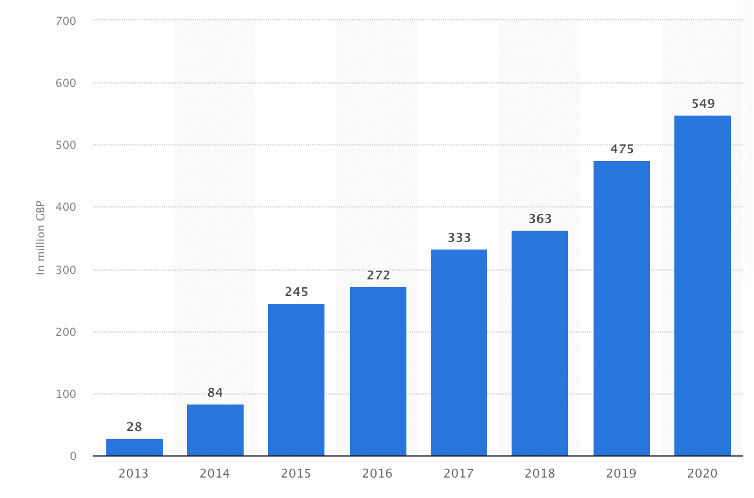

Although the Australian ECF market is too premature to extract solid data on the returns of ECF, we can look to the UK market as an example. The UK market is 5 years ahead of the Australian equity crowdfunding market and it is illustrated in Figure 1 below.

Figure 1. Number of offers & Capital raised in the UK Equity crowdfunding market 2013 - 2020.

Source: Statistica.

A good example of a successful ECF exit is Revolut. In July 2016 UK’s leading equity crowdfunding platform, Crowdcube, completed an ECF raise for Revolut for £1.01 million, where the crowd was allowed to invest anywhere between £10 - £5k.

In April 2018, Revolut received a $250m investment led by DST Global, setting a valuation for the company of ~£1.2 billion, making it one of the first crowdfunded unicorns. To give you an idea on the potential ROI of the ECF raise, an investor who invested the maximum of £5k in 2016 could have exited in 2018 with 19 times return. (P.S. Revolut is worth £5.5b today.)

Difference #6: Investment limit for retail investors

ASIC has regulations on the amount that can be invested by retail investors in equity crowdfunding offers to prevent detrimental losses. Only sophisticated investors (s708) can invest greater than $10,000 in a single ECF raise.

Hopefully this article has clarified the major differences between investing in Equity Crowdfunding raises in comparison to the stock market (aka, ASX). Click here to check out current Equity Crowdfunding campaigns live with OnMarket.