Crowdfunding Models Explained

07 February 2018 @ 8:20am Equity Crowdfunding Issuers

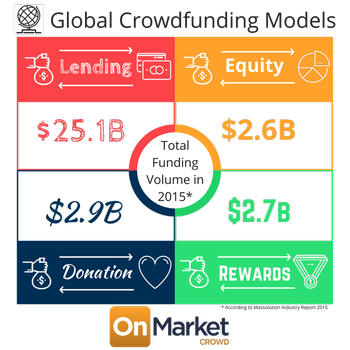

Crowdfunding is gaining a lot of traction lately and is considered a solid option for alternative financing. Through the evolution of technology and Fintech, online crowdfunding platforms have emerged bridging the gap between investors and startups. Simply put, crowdfunding involves raising funds from the general public, mainly through online platforms and social media. There are many different types of crowdfunding business models. While the crowd remains crucial, the relationship between the business or person raising the funds and their supporters comes in many shapes and forms, from funding via donations, to equity and debt investments.

Here we explain more about the four most common crowdfunding models out there.

Debt crowdfunding

Debt crowdfunding platforms such as Lending Club in the USA and Kiva Microfunds in the UK involves individuals lending money to businesses or other individuals with the expectation that it will be repaid over a determined timeline along with interest. There are multiple types of debt-based crowdfunding, including peer-to-peer (P2P), where debt-based platforms match individuals with money to lend, with those looking to borrow. As well as, peer-to-business (P2B) lending, where investors lend money directly to small and medium sized businesses.

Donation crowdfunding

This one could be considered the simplest method of crowdfunding. It is common in politics i.e. when a political party is running a campaign, supporters can make donations to help fund it. As another example, you might have helped your friend raise funds for a charitable cause through platforms like GoFundMe, donators do not obtain any rights to the project or get anything in return, but simply donate to an honourable cause. Projects may range from charitable organisations looking to fundraise for disaster relief, or individuals looking to help a friend that needs to cover their medical bills.

Rewards crowdfunding

With rewards-based platforms like Kickstarter and Indiegogo, investors provide funding in return for a non-financial reward. This ‘reward’ could be as simple as a ‘thank you’ note or a sample of their product. Usually, the main purpose of such platforms is to assist in increasing brand awareness and market knowledge about a new product launch and to receive feedback from potential customers. The biggest rewards based crowdfunding project to date Pebble Time, raised a massive $20 million from 78,000+ investors on the USA platform Kickstarter, illustrating the power of the crowd.

Equity crowdfunding

Equity crowdfunding enables a group of individuals (‘the crowd’) to invest in startups or early-stage growth businesses. In return investors receive part-ownership (equity) in the business. The key difference to the other types of crowdfunding models is that those who invest their funds become owners or shareholders in the business.

A great example of the difference between equity crowdfunding and rewards-based crowdfunding is the story of Oculus Rift, a US company that makes virtual reality goggles. Two years before Oculus Rift was acquired by Facebook for US$2 billion, they had run a Kickstarter campaign where they raised US$2.4 million from 9,522 people. In return for their investment each investor received anything from a thank you note to a prototype of the latest Oculus Rift goggles, depending upon the size of their investment.

The distinct difference with equity crowdfunding, is that investors can still back companies with brilliant ideas like Pebble Time and Oculus Rift, but in exchange for the funds investors become owners in the business. This means any potential exits such as a sale or IPO could generate more than just a “lousy t-shirt” for the investor.

In Australia, up until the new equity crowdfunding legislation, which has just come into effect, only high net worth/ sophisticated/ wholesale investors could invest in unlisted early stage and growth stage businesses. Equity crowdfunding has been booming overseas, and very soon retail investors in Australia will be able to invest in and support startups and high growth businesses with ideas that could change the world.

For an investor at OnMarket Crowd, equity crowdfunding is free of charge, and you can start investing in businesses with as little as $50.

Find out more about how to join OnMarket Crowd here.

If you are an entrepreneur and would like to know more about how equity crowdfunding works, and how it may be appropriate for your business, get in contact with one of the OnMarket Crowd team.