Cogniss: Equity Crowdfunding Case Study

14 March 2022 @ 12:00am Equity Crowdfunding: Case Studies

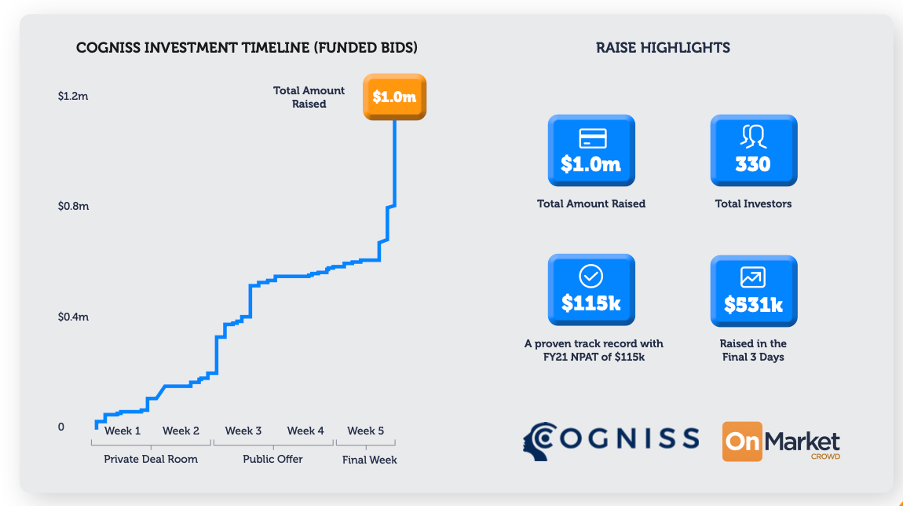

Raising $1m from 330 investors with OnMarket.

Who is Cogniss?

Cogniss is a no-code app development platform designed for the Edtech and Digital Health Markets to make it easier, faster and more cost-effective to build these transformation apps.

What is the market opportunity?

The no-code app development industry is expected to grow at a CAGR of 31.1% to 2030, highlighting a growing trend as companies seek to find cost-effective and efficient ways to develop and apply applications for their day to day operations. Cogniss is specifically focusing on digital health, an area of increasing global awareness in a forever connected world. This combined with the likes of the NSW Government and Lendlease using the Cogniss platform, FY21 revenue reaching $1m and NPAT of $115k meant Cogniss hit an investor’s sweet spot – a growing industry, ESG values and a proven business model.

How much did Cogniss raise?

Cogniss successfully generated early momentum raising $200k during the private deal room phase of the offer before achieving their $300k minimum target within the first week of going live with their public offer. Media appearances on Auzbiz and in Thrive Global, a technology company focused on mental health, ensured Cogniss continued to broaden their investor reach during the offer period.

The final week saw Cogniss experience one of the major benefits of the CSF regime – a firm close date. $531,000 was invested in the final 3 days of the offer as investors feared missing out on a proven business in a rapidly growing industry. With a firm close date required to be set for CSF offers, it is common to see a large number and value of bids come in the final days of the offer with no certainty for investors of a future investment opportunity.

With the funds raised from their CSF offer, Cogniss is planning to scale, increasing their marketing and sales whilst improving the technological capabilities of their platform.