A note for prospective issuers: Does equity crowdfunding inhibit later rounds or VC investment?

17 February 2020 @ 12:00am Equity Crowdfunding Issuers

We get asked this question a lot, so we thought it would be worthwhile sharing it here.

In summary, no. Equity crowdfunding (Crowd-sourced funding or CSF) does not restrict you from getting VC or other investment in later rounds. Equally, if you already have a VC on your cap table, you can still do a CSF raise.

How do I manage a large cap table/shareholder register?

The CSF regime allows companies to raise funds from a large number of investors, and in the case of a Pty Ltd company, these are not counted towards the 50 shareholder limit. The effort and cost of managing a large shareholder base is surprisingly low and any additional effort from managing these investors is far outweighed by the benefits of having a group of loyal advocates out there telling their friends, family and work colleagues about your business.

The nuts and bolts of managing the cap table is outsourced to a share registry at a nominal cost. The registry can act as an effective firewall between the shareholders and the company, promote better governance within the business as it scales and can assist with corporate actions with the regulator. Some examples of share registries provided below, ranging from low cost, start-up focused providers through to ASX listed registries.

Our platform is designed to support these types of raises at scale, with our largest raise having ~15,000 individual investors participate. As investors accept the terms and conditions on our website and agree to be bound to the company via a constitution, there’s no need for investors to sign anything, and there’s no need to name every investor in the document like a shareholders’ deed.

How does the constitution and shareholders’ agreement work?

The constitution is an agreement between the company, its directors and its shareholders. All publicly listed companies are required to have a constitution. While it is optional for Pty Ltd companies to have a constitution, our view is that the constitution is a better instrument for good governance, containing company specific provisions as opposed to the replaceable rules from the Corporations Act which apply blanket provisions in absence of a constitution.

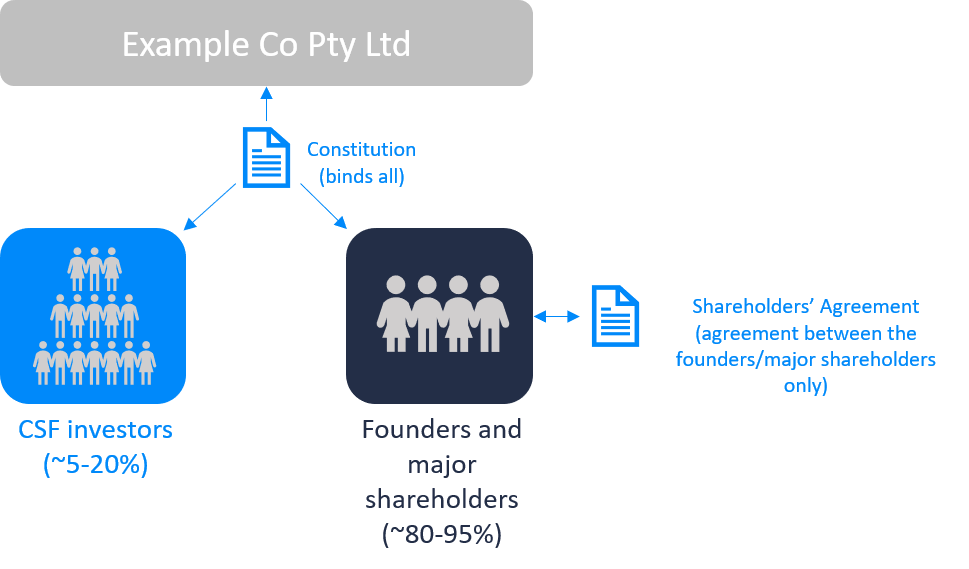

A shareholders’ agreement is a contract negotiated by the shareholders of a company outside the Corporations Act to govern their relationship. It regulates matters not covered by a company’s constitution and is therefore supplementary to a company’s constitution. You can keep that agreement in place for major shareholders. The constitution on the other hand is a document that binds the company and all shareholders. The constitution is a useful document to manage minority shareholders at scale (think of ASX listed companies with thousands of retail shareholders), you just need to ensure there is no conflict with the shareholders’ agreement.

Example below assuming company is raising 5-20% of new equity (fairly standard for CSF post-seed to Series A):

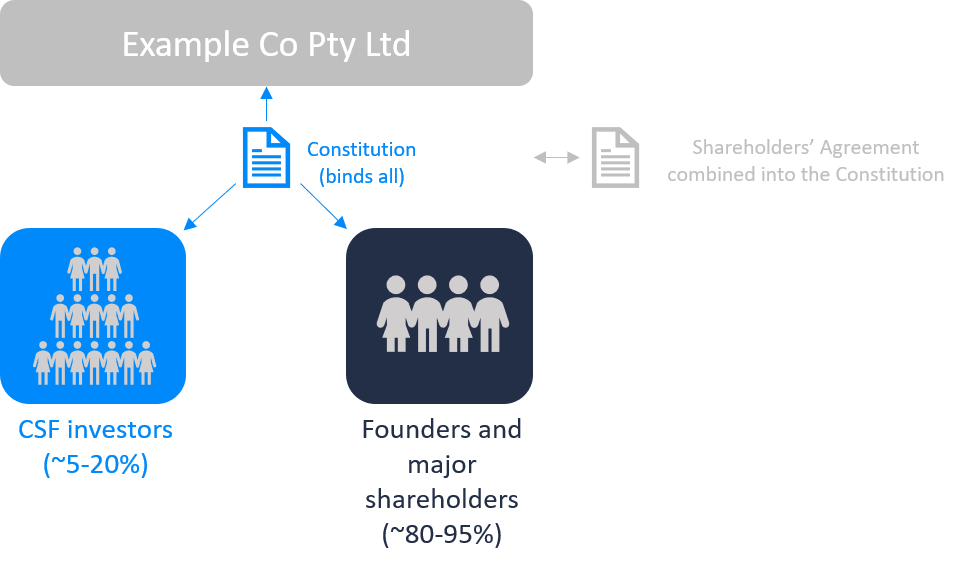

Or you can embody any specific provisions of the shareholders’ agreement into the constitution and just have the one document (get some legal advice on this):

Won’t small investors get in the way?

Given that CSF investors each appear separately on the cap table, they are very much minority investors. Let’s look at an example where you want to raise 20% new equity. This 20% could come from one investor, or from one hundred investors. The difference is that the one hundred investors are all very small, minority investors with minimal influence on your company (average holding of <0.2%). They are likely to be passive and might not even vote on matters at shareholder meetings, given they have such a small stake. The one investor with 20% on the other hand will likely have a reasonable amount of influence and may want to be more involved. An investor with a large holding may even want to get involved with the day to day or overall strategy of the business, and may be able to add value in this regard, though they might also hinder. It’s a question for companies as to which type of investor they prefer, though the two can co-exist.

What if I want to raise capital down the track

Generally, it’s the Directors that have the right to issue new shares, without needing to get shareholder approval. You’d need to check your shareholders’ agreement or constitution. Even if you do require shareholder approval, remember, CSF investors are small, minority investors.

What happens when I want to sell the business

The best way to manage this is by including ‘drag along’ and ‘tag along’ rights in the constitution. The drag rights allow large investors that want to sell their stake to ‘drag’ minority investors into the sale where it makes sense to sell the entire company, rather than just the major shareholdings. Similarly, tag rights allow small investors to ‘tag’ themselves into a sale where large investors are looking to sell their stages, compelling the buyer to buy the entire company. We think this is a good thing for both minority and majority owners.

Key takeaway

At the end of the day, we are a platform with a large database of passive investors. These investors don’t want to take over your company or tell you how to run it. They are trusting you, the company, to make the right decisions to maximise the return on their investment, and they are happy to wait for that to happen. They just want to be updated every quarter along with every other investor on your mailing list.

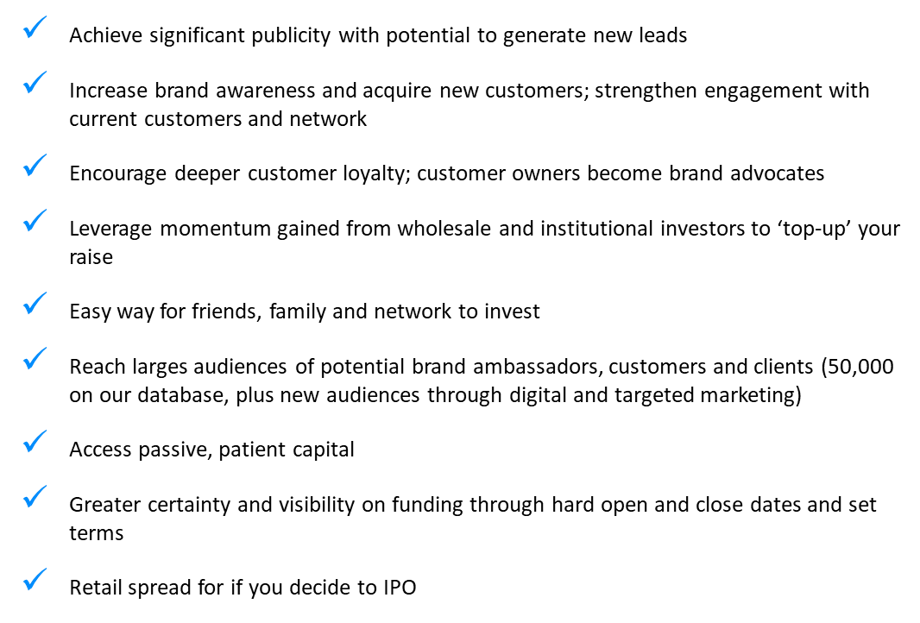

A reminder on the benefits of CSF