2021 Capital Report - Another Record Year for OnMarket!

01 February 2022 @ 12:00am

2021 was another record year for OnMarket, with our investors investing $32.2m across 80 capital raises in local SMEs. Across IPO and Equity Crowdfunding, we achieved a record number of offers in 2021 and marked the 1-year anniversary of our investment service SPP Harvester.

Cummulatively, we hit another big milestone - 200 successful capital raises. For over 200 Australian businesses, we’ve now raised $172m from 66,000 investors.

Initial Public Offerings

|

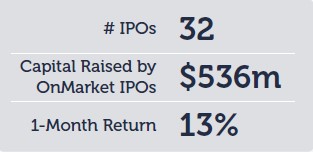

2021 involved significant IPO activity, challenging long held records for the number of listings and the total amount of capital raised. OnMarket provided access to 32 ASX IPOs and played a key part in supporting $536m in total capital raised for those companies seeking to list on the ASX, while providing our investors with an average one-month return of 12.7%. Copper explorer Revolver Resources Holdings Ltd was the standout performer for OnMarket IPOs, returning 102.5% one-month after listing and 145.0% at 17 December |

|

Equity Crowdfunding

|

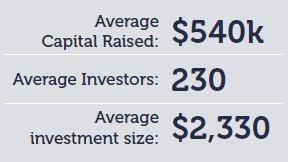

After COVID-19-interrupted 2020, Equity Crowdfunding bounced back in 2021 and continues to grow in its fourth full year since the Crowd-Sourced Funding regime was introduced. The benefits of crowdfunding were once again on show as CSF offers via OnMarket raised an average of $540,000 from 230 investors. Consumer Products and Services, and Technology were popular via OnMarket in 2021, making up 85% of successful offers. 1Question, an educational technology for students, was the largest OnMarket raise of the year raising $1.9m in June. No-code app development platform, Cogniss, was also a stand-out performer raising $1m from 284 investors in December. |

|

Capital Club

|

OnMarket’s Capital Club continued to provide wholesale investors access to a diverse range of exciting early-stage raisings, pre-IPO raises and listed placements. Of the 13 offers to Capital Club investors, the stand-out performer, and OnMarket’s most successful offer for the year, was the placement for hard rock lithium miner, AVZ Minerals Ltd (ASX: AVZ). Investors who participated in AVZ’s $40m placement at 13c per share in July 2021 enjoyed an eyewatering 454% return by 17 Dec. For more information on becoming a member of the OnMarket Capital Club follow the link below. |

|

SPP Harvester

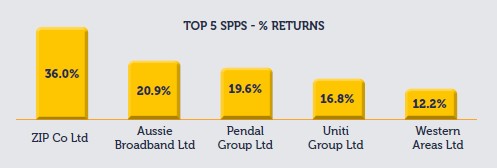

2021 marked the first full calendar year of operation for SPP Harvester, with SPP Harvester investors gaining access to 22 Share Purchase Plans (SPPs), of which 18 were in-the-money. The average discount of SPPs at the SPP announcement date for 2021 was 6.4%, noticeably lower than 2020 and this contributed to a slightly lower average return in 2021.

Despite lower volume, 75% of SPPs in 2021 showed positive returns, headlined by the performance of Zip Co Ltd, where investors realised a 36% return on a full allocation. The strong performance of Zip Co Ltd’s SPP came on the back of their Q2 results announcement highlighting an 88% increase in revenue year-on-year. Zip Co Ltd’s SPP was followed by the strong returns of Aussie Broadband Ltd, 20.9% and Pendal Group, 19.6%.

The inaugural OnMarket 2021 Capital Report is a must-see for anyone interested in raising capital or investing in Australia’s equity market.

*All data as at 17 December 2021.