Own a piece of Australia's leading gluten free brewery

Open for investment Two Bays (Next Wave Brewing Co P/L)

Two Bays Brewing Co. | Equity Crowdfunding

Min reached, now targeting $2.5M max

$1,830,601

Raised631

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Australia's beer revolution has begun, join us on the journey

Two Bays Brewing Co. is Australia’s leading dedicated gluten-free brewery, born from a passion to make beer accessible to everyone. Based on the Mornington Peninsula in Victoria, we brew with alternative grains like millet, buckwheat and rice - creating award-winning beers that are naturally gluten-free, flavour-packed, and crafted for discovery.

We’re more than a brewery - we’re leading a movement to reimagine what beer can be. From crisp lagers and hop-forward IPAs to bold seasonal releases, our beers open up a world of choice for those who avoid gluten, without compromise.

At Two Bays, inclusivity and quality go hand-in-hand. We believe everyone should be able to enjoy a great craft beer experience - whether you’re gluten-free, health-conscious, or a beer fan exploring the world of beer brewed from different ingredients.

Want to learn more? Watch the Investor Webinar and Q&A here.

Why invest now

- Market Leader in fast growing Category – Australia’s leading dedicated gluten-free brewery, tapping into the fast-growing gluten-free and health-conscious consumer segment.

- Two Strong National Brands – Well-established reputation for quality, inclusivity, and innovation, available nationally with two distinct brands.

- Loyal Community – Most craft beer brands service their local community. We are different – our community is every person avoiding gluten in Australia.

- Award-Winning Range – Recognised as the best gluten free beer in the world for 2024 and 2025. Consistently recognised with industry awards for flavour and brewing excellence, proving gluten-free beer can rival mainstream craft

- Category Growth Potential – Gluten-free beer is predicted to grow at 14.65% CAGR over the next few years – significantly higher than any other beer category.

- Scalable Production – Purpose-built, dedicated gluten-free brewery with capacity to meet rising national and international demand.

- Diverse Sales Channels – With diverse revenue streams, we have ample opportunity to continue our growth trajectory. Strong distribution through retail bottle shops, hospitality venues, and a growing direct-to-consumer presence.

- Experienced Leadership – Founder and team combine deep craft brewing expertise with lived experience in the gluten-free community, driving authentic brand storytelling.

- Featured on Channel 9: Is this the future of Aussie Beer? Watch here

Two Bays in the media

- Channel 9 News: Is this the future of Aussie Beer? Watch here

- Drinks Digest: Melbourne brewer calls out pubs for ignoring millions of Aussies. Read article here

- Drinks Trade: Are independents missing gluten free beer’s potential? This brewer thinks so. Read article here

- Crafty Pint: TWØBAYS Brewing Launch Equity Crowdfunding Campaign. Read article here

- Herald Sun: Award winning Victorian brewer Two Bays secures big backing for expansion. Read article here

Behind the Scenes

If you're interested in learning what happens behind the scenes at Two Bay Brewing. Watch the brewery tour here.

Ensuring nobody misses out on the bar shout

At Two Bays Brewing Co. our mission is to make great beer accessible to everyone - especially the growing number of people who avoid gluten for medical or lifestyle reasons.

We generate revenue through multiple channels:

- wholesale distribution to major retailers and independent bottle shops,

- on-premise sales through pubs and restaurants,

- direct-to-consumer via our online store, and

- in-person experiences at our popular taproom.

This mix provides strong brand visibility, steady recurring sales, and direct engagement with our community.

Customers with coeliac disease, gluten intolerance, or those choosing to avoid gluten have historically been excluded from beer drinking occasions. Two Bays offers them the opportunity to be included, with beers that don’t compromise on taste, variety, or quality.

Demand far exceeding supply

The market for gluten-free products is expanding rapidly, with global gluten-free beer expected to grow at 14.65% CAGR between 2025–2030 (Mordor Intelligence). In Australia alone, approximately 27% of the population—around 6 million people—actively avoid gluten, highlighting a substantial underserved consumer base.

Despite this demand, gluten-free beer remains a segment with limited quality options available. Two Bays Brewing Co. is uniquely positioned as Australia’s leading dedicated gluten-free brewery, already recognised as the market leader in this space. Our ability to deliver a wide variety of award-winning beer styles sets us apart.

With our purpose-built gluten-free brewery, scalable production capacity and strong distribution partnerships, we are poised to capture share in a category where consumer demand outpaces supply. The growth trajectory of gluten-free beer represents not just a niche, but an opportunity to bring millions of people back to beer, opening the door to sustained domestic expansion and global scaling.

Our journey so far

Since launching, Two Bays Brewing Co. has built a strong track record of growth and market leadership in the gluten-free beer category. We have achieved over $20 million in lifetime sales, underpinned by consistent double-digit growth, including 18.6% year-on-year revenue growth in FY25.

Our beers enjoy national distribution, available through all major retailers, key wholesalers, and a broad network of independent bottle shops. We have also secured tap and venue placements across every state - ranging from small community pubs to iconic venues such as the Melbourne Cricket Ground (MCG) - cementing Two Bays as a truly national brand. From Port Douglas in Queensland around to Darwin in the Northern Territory, our beers can be found in every corner of the country.

Strategic partnerships and contracts with leading retailers and distributors have accelerated brand visibility, while our taproom and direct-to-consumer channels deepen customer engagement and loyalty. These achievements validate both the demand for quality gluten-free beer and our ability to scale effectively.

With a strong foundation of sales performance, distribution breadth, and consumer advocacy, Two Bays Brewing Co. has positioned itself as the clear category leader, ready to capture future growth both domestically and internationally.

A brewery unlike any other

Two Bays Brewing Co. represents a standout investment opportunity in a fast-growing, under-served sector of the beer market. There are more than 700 breweries in Australia competing for the 75% of the beer market who consume gluten. We are one of only a handful catering for the other 25%, meaning we can access shelf and fridge space others cannot.

Our competitive advantage is built on several significant barriers to entry:

- Exclusive access to the world’s best gluten-free malts, giving us unrivalled product quality and consistency.

- A dedicated gluten-free brewery, ensuring zero cross-contamination for complete consumer trust. For us, gluten free is not a side show, it’s what we live and breath 24/7.

- Leadership in brewing capability with alternative malts allows us to lead the market in range, variety and quality. Offering styles from lagers to IPAs and seasonal releases, and recognised as Australia’s and the World’s best quality GF beers in 2024 and 2025.

- Unquestionable credibility within the gluten-free community, positioning us as the trusted brand of choice and amplifying loyalty and word-of-mouth growth.

- Early to market - we may not be the first, but are already the category leader in Australia, with proven traction and national distribution.

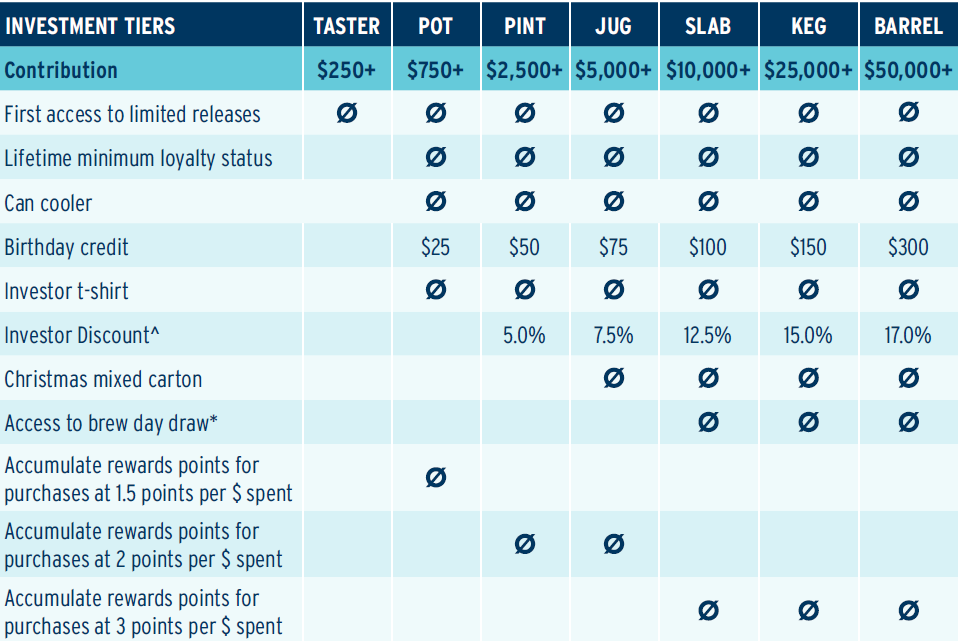

Become our best brand ambassadors

We’ve curated a list of perks to thank you for investing in the next stage of our journey, but the most important perk here is driving the gluten free beer category forward to make sure we can all enjoy a beer with a mate.

^ website purchases only

* Our Brew Day gives the lucky investor the opportunity to spend a day with our brew team brewing a limited release beer (it will go into kegs only). Only one winner per year.

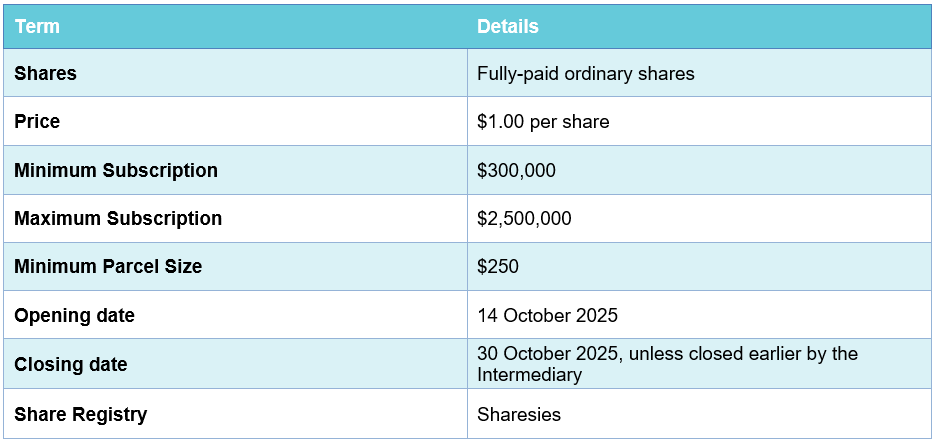

Terms of the Offer

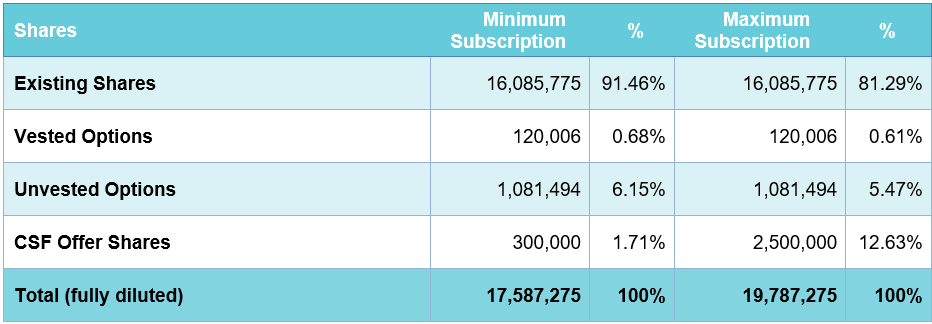

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

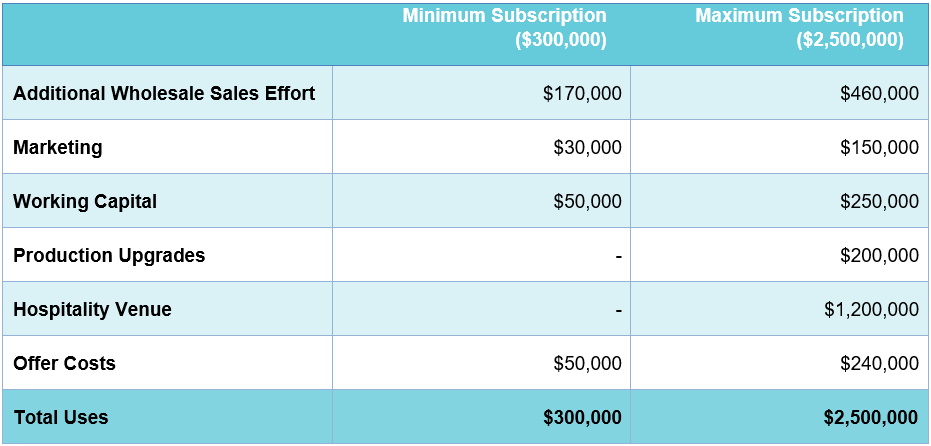

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risk

Two Bays Brewing Co. is Australia’s leading dedicated gluten-free brewery, born from a passion to make beer accessible to everyone. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, capital or cash flow, supply chain & input costs, demand and competition, key person dependency, excise and regulatory cost, or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $2,500,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.5% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Two Bays (Next Wave Brewing Co Pty Ltd) ACN 624 773 468. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

I would like to get $500 Worth of shares

Keirnan R (OnMarket member) on 15/10/2025Hi Keirnan, you should be able to buy some shares by hitting the 'Invest now' button above. Cheers

Richard J (Two Bays (Next Wave Brewing Co P/L) representative) replied to Keirnan R on 15/10/2025I dont see the invest now button. Is there a link for this option

Matthew E (OnMarket member) on 15/10/2025Hi Matthew, you should be able to see it towards the top of our Offer page (just below the video and progress box)

Richard J (Two Bays (Next Wave Brewing Co P/L) representative) replied to Matthew E on 16/10/2025Hi, are you able to explain the loan from next wave brewing to two bays and when this is expected to be repaid or an impairment recorded?

Morgan S (OnMarket member) on 16/10/2025Hi, we took equity into Next Wave as the holding company (mainly in case we wanted to operate other subsidiaries at some point in the future) instead of directly into Two Bays as the operating entity. We expect that any potential acquirier will buy the assets of Two Bays, rather than the equity of Next Wave, and the funds received will then be used to repay any intercompany loans at that time. We are not expecting to recognise any impairment to the loan as it gets reconsiled when we consildate the entities.

Richard J (Two Bays (Next Wave Brewing Co P/L) representative) replied to Morgan S on 16/10/2025Can you please explain how you got to a pre-money valuation at $16.1m given revenues are $4.7m and EBITDA is at a loss. This is implying an EV/Revenue at almost a 3.5x multiple which seem high for a brewery. Has this been calculated on a forward multiple?

Wade R (OnMarket member) on 16/10/2025Hi there, does your raise amount include OnMarket interests?

Sally C (OnMarket member) on 16/10/2025Please sign in to post a question