Market leading business and IT consulting firm with Tier 1 clients

Live StepChange Holdings Ltd ASX: STH

StepChange Holdings Ltd IPO | ASX: STH

The IPO is fully underwritten by lead manager Ord Minnett. OnMarket has a limited allocation.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

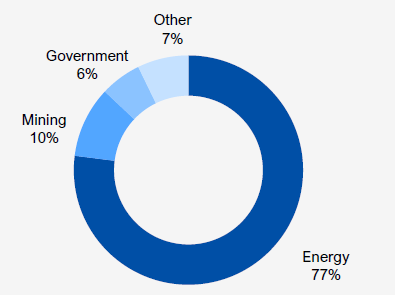

Key Investment Highlights

Introduction

StepChange Holdings Ltd (ASX: STH) is a leading SAP Enterprise Resource Planning (ERP) consulting company which operates in the digital transformation space with a team of approximately 150 personnel, delivering transformation solutions to global and local businesses.

The Company was established to pursue IT services acquisition opportunities and has entered into the Acquisition Agreement enabling it to acquire StepChange Consultants Pty Ltd (StepChange), a leading SAP ERP consulting company which operates in the digital transformation space.

StepChange, which can trace its business origins back to 2003 and which was incorporated by the current directors in 2014, is an Australian-based SAP ERP consulting firm which delivers transformation solutions to global and local businesses, with a diversified client base featuring several “Tier 1” customers, being entities considered by the Directors to be highly attractive in the industry on account of their operation and financial scale and breadth of their requirements and a focus on the energy and resources sector.

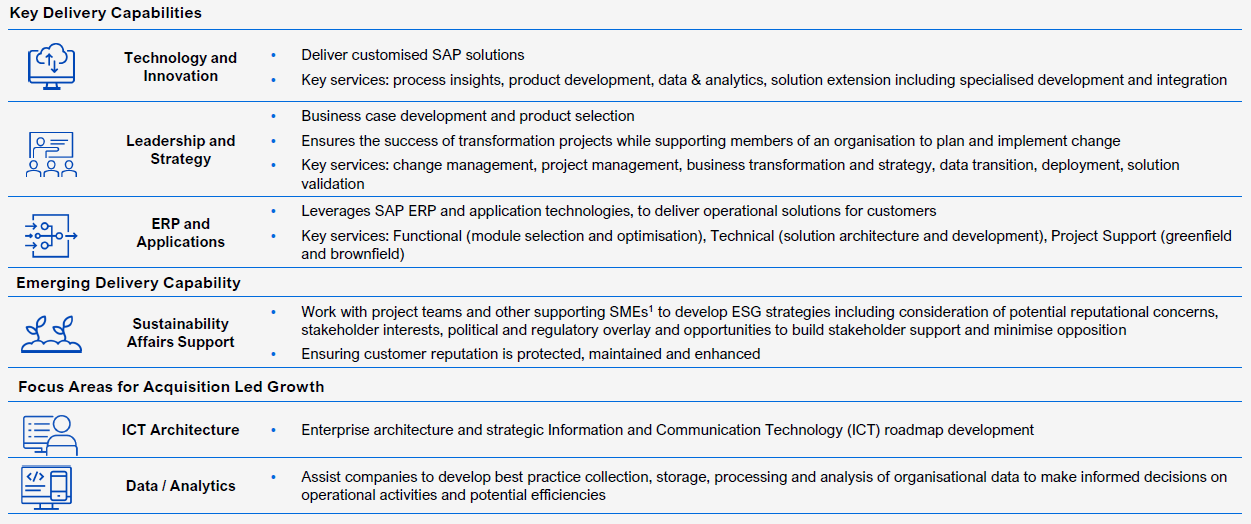

While the overall offering is flexible and can be tailored to particular customers, StepChange’s capabilities can broadly be categorised as:

- Technology and Innovation;

- Leadership and Strategy;

- ERP and Applications; and

- Sustainability Affairs Support.

StepChange has a sole focus on SAP as its primary strategic technology partner.

StepChange also boasts a track record of strong financial performance, recording approximately $42.8 million of revenue and $3.65 million of EBITDA in FY24, continuing a history of profitability.

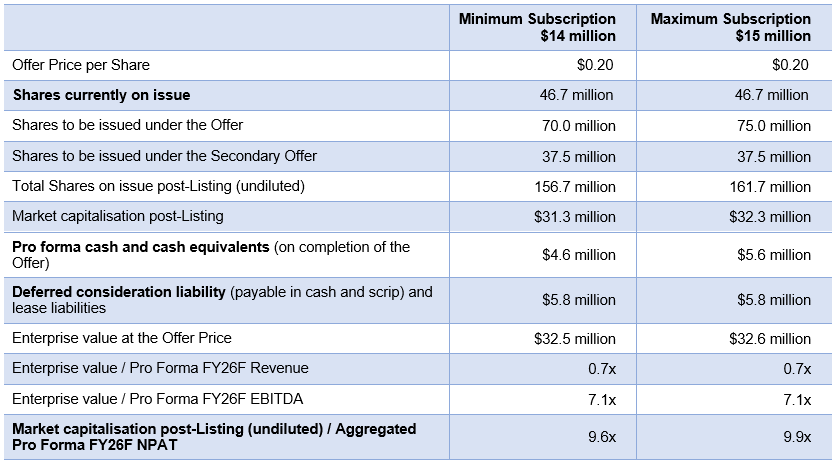

Offer Overview

StepChange Holdings Ltd is looking to undertake an IPO on ASX to raise between $14 million and $15 million via the issue of between 70 million and 75 million shares at an offer price of $0.20. The company will have enterprise value at the offer price of $32.6 million with a market capitalisation post listing and aggregated pro forma FY26F NPAT of 9.9x at maximum scription.

The minimum subscription in relation to the Offer is $14,000,000, and the Offer is fully underwritten by lead manager Ord Minnett. The Company may, at the discretion of the Directors, choose to accept oversubscriptions under the Offer to the value of up to $1,000,000 in total (meaning that the Offer will have a maximum subscription of $15,000,000).

Industry Overview

StepChange operates within the IT services market in Australia, within which its focus is on providing SAP-focused ERP services.

In 2024, the overall IT services market in ANZ was estimated at $58.6 billion and is forecast to reach $67 billion in 2026. Between 2019 and 2026 the market is anticipated to grow at 7.2% CAGR, well ahead of GDP growth over this period.

The ANZ market for SAP services (excluding services provided by SAP itself) is estimated at $5,850 million in 2024. The SAP services market grew at 7.6% CAGR from 2019 to 2024, a stronger growth rate than the broader IT services market and particularly reflecting the strong demand for services to support S/4 HANA migrations as well as mid-market implementations.

Key trends that are driving the use of IT services include:

- the digital transformation of enterprises;

- changing business models;

- migration to cloud services;

- increased propensity to outsource; and

- business process automation.

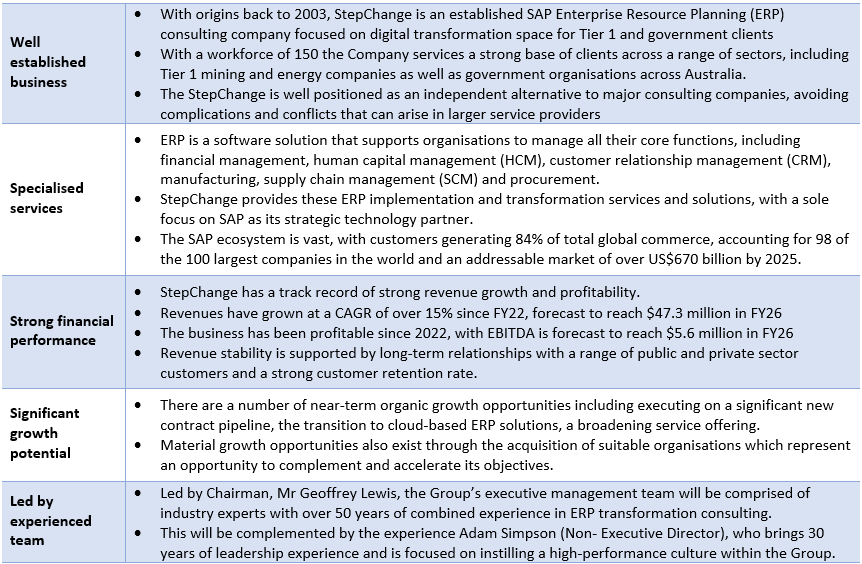

SAP services involve the design, build, and run of SAP applications by third-party providers. SAP has built out its software suite over recent years to include a range of applications for both Enterprise and Mid-market customers. The breadth of SAP’s solutions offers significant scope for service providers, with many specialising in individual solutions, industry sectors, or implementation methodologies/stages.

SAP Solution Landscape, Global, 2025

Company Overview

The company was incorporated in Western Australia on 12 June 2024 for the primary purpose of pursuing IT services acquisition opportunities. The Company has subsequently signed the Acquisition Agreement, pursuant to which the Company is entitled to acquire all of the shares in StepChange.

StepChange was formed by a group of former SAP professionals and business consultants from large consulting firms, with a vision of supporting both global and local businesses on key transformation projects. StepChange began building its reputation through delivering complex SAP ERP implementations for large Western Australian-based mining, oil and gas, resources and utilities companies and has continued to build on its foundations as one of the longest affiliated SAP partners in Western Australia, offering a diverse suite of enterprise, technology and change management solutions.

StepChange has continued to grow organically under the leadership of Jason Nesa and Kim Carroll, who joined the business in 2013 and 2014 respectively before acquiring full ownership in 2017.

Key Strengths

Key strengths of StepChange’s business include:

Breadth of offering: StepChange’s offering provides the capability for customers to be supported through the full ERP project cycle, from project inception through to design, execution and support.

Independent provider: StepChange’s comprehensive ERP capabilities provide favourable differentiation and a clear competitive advantage against competitors with more application-specific or niche offerings. Equally, the Group will be well positioned as an independent alternative to major consulting companies, avoiding complications and conflicts that can arise in larger service providers.

Technical leadership: StepChange has an established extensive track record of delivering large and complex SAP ERP projects to major enterprises across a range of industries, resulting in strong expertise and frameworks.

Scalable platform: StepChange had a headcount of approximately 150 as at 31 March 2025, with the Group intending to hire and onboard new consultants in order to expand the billable resources of the Group.

Sector-specific solutions: StepChange has the ability to offer customers sector-specific packaged solutions, which serve as a point of validation and demonstrator of domain expertise with new customers in those sectors, enable new customers to onboard in a time and cost-efficient manner, and allow StepChange to offer reasonable price points while maintaining profit margins.

Management and Board with extensive experience in IT services: the Group’s executive management team will be comprised of industry experts with over 50 years of combined experience in ERP transformation consulting. This will be complemented by the experience of Mr Geoffrey Lewis (Non- Executive Chairman) as a founder of 2 successful ASX IT services companies, ASG Group Limited (formerly ASX: ASZ) and COSOL Limited (ASX: COS), and Adam Simpson (Independent Non- Executive Director), who brings 30 years of leadership experience and is focused on instilling a high-performance culture within the Group.

Strong financial profile: StepChange has demonstrated an ability to grow both revenue (FY22 FY24 CAGR: 25%) and profitability over the past few years, possessing capacity to support debt which could provide the Group with an increased ability to fund potential future acquisitions.

Customer Base

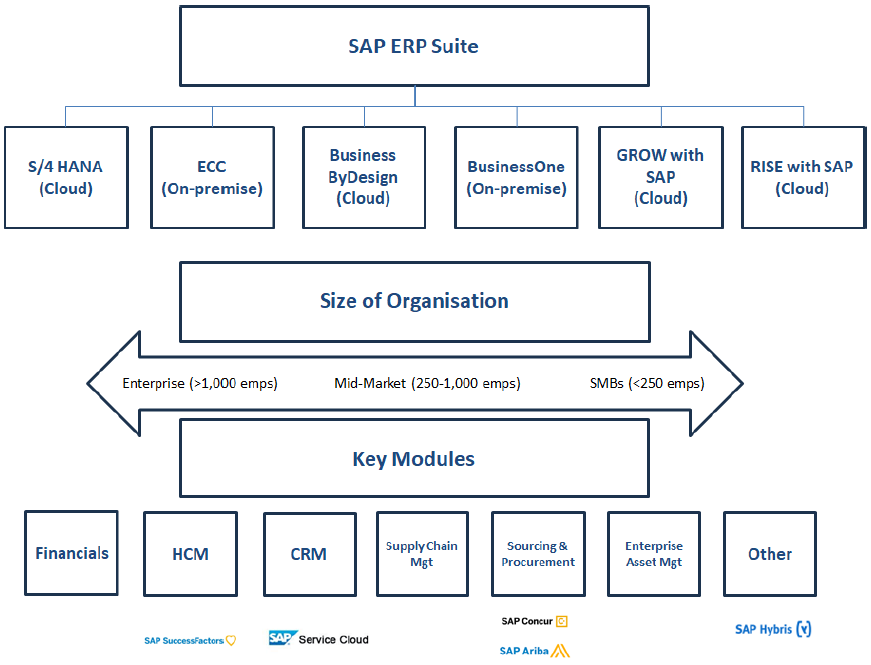

StepChange is a leading provider of transformation services to government organisations in Western Australia, including national and state government departments and bodies, and local councils. The Directors expect opportunities in the government sector across Australia to continue to grow.

StepChange’s mining customer base comprises several global Tier 1 enterprises, Australian miners and mining services providers. The Directors view mining as a highly attractive sector, with organisations in the sector typically placing high importance on keeping modern system infrastructure in place due to the asset-intensive nature of their businesses

StepChange has provided services to Tier 1 energy producers for a number of years. The Directors consider the Company’s exposure to the energy sector as highly attractive given the strong recent demand resulting from large energy projects, with the green energy transition presenting a strong medium-term organic growth opportunity.

FY25 revenue by sector

Delivery capabilities

StepChange provides a comprehensive service offering to ensure its customers are supported through the full project cycle and it is expected that this capability will be further enhanced with the creation of the Group. While the overall offering is flexible and can be tailored to particular customers, StepChange’s capabilities can broadly be categorised as:

Growth Strategy

The Group has numerous levers to drive growth across its businesses, with key areas including:

Transition from on-premise to cloud, with SAP terminating mainstream maintenance support for its legacy ERP ECC solution at the end of 2027, and only 33% of ECC users having bought or subscribed to licences to allow them to begin moving to S/4HANA (as at October 2023).

Revenue growth from StepChange’s existing customer base, with a number of existing StepChange customers having growing businesses which present additional opportunities for StepChange.

New logo wins from StepChange’s significant pipeline of opportunities with potential customers across Australia.

Expansion of service offerings, with a number of opportunities to support a wider range of SAP-related ERP solutions.

Growing its presence across Australia, including in the economic centres on Australia’s east coast.

Inorganic growth opportunities through the acquisition of suitable organisations which represent an opportunity to complement and accelerate its objectives.

Revenue

The majority of StepChange’s revenue is generated through the provision of project-based services. Revenue for such project-based services is primarily generated based on an agreed fee being payable to StepChange for services provided in accordance with a specific scope and subject to a range of assumptions (largely estimated time and materials).

StepChange’s revenue is generated through project delivery Contracted delivery of ERP and Applications, Leadership and Strategy, Technology and Innovation or Sustainability Affairs Support projects and based on an agreed fee for a specific scope (usually estimated based on time and materials). They also generate revenue by, at the customer’s election – extension of contracted projects.

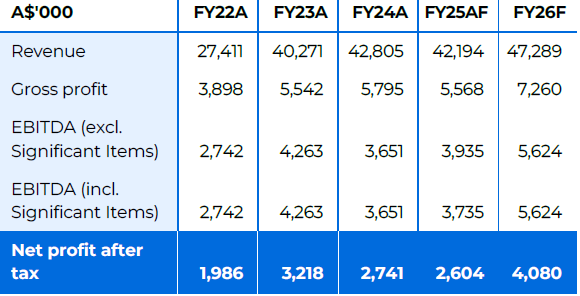

StepChange has a track record of profitability, with annual net profit after tax over the financial years ended 30 June 2022, 30 June 2023 and 30 June 2024 averaging $2.65 million.

The Forecast Financial Information indicates that StepChange is anticipated to continue to experience profitability throughout the Forecast Period.

The table below summarises StepChange’s statutory historical and forecast financial performance.

Financial snapshot

Board and Management

StepChange Holdings Ltd are led by a highly experienced board and management team industry with over 50 years of combined experience in ERP transformation consulting. This includes:

Geoffrey Lewis – Non-Executive Chairman

Mr Lewis established formerly listed ASG Group Limited (ASX: ASZ) in 1996 and was its Managing Director until it was acquired and delisted in late 2016 for $350 million by Japanese multinational IT services and consulting business Nomura Research Institute, Ltd. He since founded COSOL Limited (ASX:COS) and has been its Non-Executive Chairman since inception. Mr Lewis has over 25 years’ experience in the delivery of IT services and outsourcing.

Shane Bransby – Managing Director

Mr Bransby is an experienced IT services professional with particular expertise in areas including company strategy, mergers & acquisitions. He has been involved in the acquisition, consolidation and integration of multiple IT services companies and has over 20 years’ experience as a director and key executive of both public and private companies, including having held the role of Head of Mergers and Acquisition and Strategy with ASG Group Limited (formerly ASX:ASG) with NRI Australia Limited, part of the multi-billion dollar Nomura Group. Mr Bransby was instrumental in the strategic planning and execution of NRI’s acquisition in 2021 of Planit (a leading quality assurance business with offices in Australia, New Zealand, India and the United Kingdom) and subsequent follow-on acquisitions. In 2022-23, he was involved in the roll-up of 3 NZ cyber security firms to form Bastion Security Group, in respect of which he is currently a Non-Executive Director.

Adam Simpson – Independent Non-Executive Director

Mr Simpson is well-known for his career in the Australian Football League (AFL) as both a player and coach. Mr Simpson was captain of the North Melbourne Football Club from 2004 to 2008 and his strong work ethic and collaborative leadership was acknowledged with All-Australian honours. Mr Simpson transitioned from a successful playing career to a coaching career with the West Coast Eagles, coaching the team from 2014 to 2024 and leading the team to a premiership in 2018. Beyond AFL, Mr Simpson has also achieved significant success in the business world. Mr Simpson has a strong skill-set in matters such as goal setting, team dynamics, continuous improvement, resilience, and innovation, drawing on his 3 decades of experience within high-performance sport environments.

Emma Wates – Company Secretary

Ms Wates has over 20 years‘ experience in providing company secretarial and corporate compliance services to listed companies. Ms Wates has advised on a number of successful ASX listings as well as being involved in various secondary and seed capital raisings for public and private companies. Ms Wates is a chartered accountant and a senior associate of the Financial Services Institute of Australia.

Richard Alan Jarvis – Chief Financial Officer, Company

Mr Jarvis has more than 25 years’ experience as an accounting and finance professional and is a Fellow of the Institute of Chartered Certified Accountants (UK). Mr Jarvis commenced his career working in top tier and boutique accounting firms in their assurance and advisory divisions, which offered integrated services that included audit, tax and business consulting services. For the past 18 years Mr Jarvis has worked as a chief financial officer for several ASX and dual listed companies in the natural resources and technology sectors, with companies including Sylvania Platinum Limited (ASX/AIM: SLV), Nyota Minerals Limited (ASX/AIM: NYO), RooLife Group Limited (ASX: RLG), Connexion Telematics Ltd (ASX: CXZ) and Spenda Limited (ASX: SPX).

Jason Nesa – Joint Chief Executive Officer, StepChange

Mr Nesa is senior business director and general manager with international IT consulting experience across the European and Australian markets. As director of StepChange since its incorporation in 2014, Mr Nesa has significant experience in the ERP consulting market in the energy, utilities and resource industries.

Kim Carroll – Joint Chief Executive Officer, StepChange

Ms Carroll is an IT and management consultant specialist with over 30 years of experience in professional services. Ms Carroll has significant experience as a leader in the sector which includes change management, relationship management, business process transformation and client and industry-specific solutions. Ms Carroll is skilled at ensuring the delivery of multi-dimensional cross-functional solutions to bring together strategy, business and people.

Key Offer Statistics

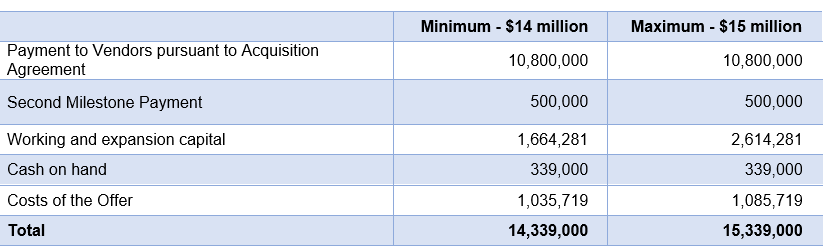

Use of Funds

Funds raised from the Offer will be applied as follows:

For more information, please refer to the Details of the Offer section of the Prospectus

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in StepChange Holdings Ltd carries risk. As set out in Section 7 of the prospectus, StepChange Holdings Ltd is subject to a range of risks, including but not limited to decline in key client sectors, reliance on SAP suite of software products, competition, failure to attract new clients or retain existing clients, loss of key contracts, inability to meet forecasts, key client concentration, and cyber security.

Section 734(6) disclosure: The issuer of the securities is StepChange Holdings Limited ACN 678 129 756. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

OnMarket has a limited allocation. The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.