Invest in a profitable company helping people and planet

Open for investment Seabin Pty Ltd

Seabin Pty Ltd | Equity Crowdfunding Offer

Min reached. Now targeting $1 million

$418,496

Raised274

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Seabin™ And The $7 Trillion Nature Market

Ever wanted to invest in a profitable company that also helps the environment?

Seabin makes over $1 million per year, yet we don’t have a sales team or advertising budget. Imagine what we could do if we did!

Our goal is to raise investment to build a sales team and have an advertising budget so we can scale our revenue to create more impact and increase the value of the company.

Want to know more? Watch the Investor Webinar & Q&A here.

Seabin Profitability, Melbourne and Mandatory Nature Reporting

Proven Profitability:

After years of resilience and lean growth, Seabin™ has reached profitability through disciplined restructuring, improved product offerings, and a stronger data-driven business model. With recurring revenue from environmental data sales and long-term partnerships, Seabin has demonstrated both financial sustainability and commercial scalability.

Melbourne Expansion:

Following our success in Sydney, Seabin is now aiming to scale operations to Melbourne’s Yarra River. This two-year, self-funded pilot will create new jobs and provide vital pollution data to help make the Yarra swimmable again. By replicating our Sydney model city by city, Seabin is building a national - and eventually global - network of real-time ocean health monitoring.

Mandatory Nature Reporting:

The upcoming introduction of Mandatory Nature Reporting in Australia and internationally represents a major revenue catalyst. Just as carbon reporting created the carbon market, nature reporting will drive billions in investment for credible, auditable environmental data. Seabin’s proprietary datasets position the company as a trusted supplier of plastic pollution reporting and footprint reduction services to governments and corporations. With profitability achieved, proven data systems, and expansion underway, Seabin is ready to scale - leading the charge in a $7 trillion nature market where accountability and environmental data drive real value.

Seabin: Cleaning Oceans, Creating Impact

Seabin generates revenue through:

- Corporate Partnerships - Companies partner with Seabin to support cleanup programs, meet ESG goals, and demonstrate environmental leadership.

- Impact Certificates - Certified environmental impact generated by Seabins are sold, allowing organisations and individuals to offset their plastic footprint and verify tangible results.

- Environmental Data Services - We monitor and remove plastic pollution at specific sites, delivering real-time data to support corporate reporting, compliance, and sustainability initiatives.

The $7 Trillion Nature Market

Seabin™ sits at the forefront of an emerging $7 trillion nature market, driven by the global shift toward Mandatory Nature Reporting and corporate accountability. While carbon markets focus on emissions, nature markets will require businesses to measure, report, and reduce their broader environmental impacts - including plastic pollution. Few companies are ready for this transition, giving Seabin a first-mover advantage as a proven, data-driven operator.

Over the past five years, Seabin has built one of the world’s largest baseline datasets on floating plastic pollution, capturing billions of litres of water and cataloguing millions of microplastics across Sydney Harbour. This dataset forms the foundation for scalable, compliance-grade environmental reporting services.

Seabin’s client portfolio includes more than 40 major brands and government partners - such as Sydney Airport, Multiplex, Sydney Metro and Infrastructure NSW that already pay for monitoring, reporting, and impact measurement. Backed by a global reputation for innovation, transparency, and credibility, Seabin is now expanding city by city, beginning with Melbourne’s iconic Yarra River. As nature reporting becomes mandatory, Seabin’s data, brand trust, and track record uniquely position it to lead this market - converting environmental impact into measurable business value.

Profitability And Proven Impact

Seabin™ has demonstrated strong commercial traction, achieving an average of $1 million in annual recurring revenue - without a sales team, ad spend, or marketing budget. This growth has come entirely from inbound demand, word of mouth, and Seabin’s global brand credibility.

Over five years, Seabin has evolved from hardware innovation to a profitable environmental data and digital impact company, providing compliance-grade reporting and plastic footprint reduction services. With 40+ major clients, Seabin’s organic client acquisition demonstrates clear market demand and product fit.

In 2024, Seabin launched its first digital impact products — including Impact Certificates that quantify litres filtered and plastic removed - converting real environmental data into verified, tradable business value. Market testing of these products has been highly successful, generating over $300,000 of impact allocation within the first six months (no sales team and no ad spend).

With five years of baseline data, a proven business model, and strong recurring revenue, Seabin is now poised for exponential growth. Scaling city by city, and supported by the coming wave of Mandatory Nature Reporting, Seabin is turning ocean data and measurable impact into a profitable, scalable global business.

First-Mover Advantage with Data-Driven Impa

While most competitors focus on selling hardware to marinas as once-off sales, Seabin™ chose a smarter path - investing in environmental data services and recurring revenue (ARR). Instead of chasing one-time hardware sales, Seabin targets governments and corporates that need credible, auditable environmental data for annual sustainability and compliance reporting.

This strategy has created a stable, compounding revenue model that doesn’t plateau - because sustainability reporting is required year after year. Seabin’s clients return annually for updated data and verification, generating repeat business and long-term relationships in a market that’s just beginning to formalise under Mandatory Nature Reporting.

Unlike hardware competitors, Seabin’s true value lies in its data and impact insights - measuring plastic pollution by brand, type, and volume to help clients reduce their footprint and prove progress. As nature reporting becomes mandatory, Seabin’s profitable, recurring, and data-driven model positions it to lead globally.

Investor Rewards

- Investors from $500 and above will receive an iconic “Seabin Shareholder” enamel tin mug. Perfect for reducing single use plastics from your daily routine.

- Investors contributing over $5,000 will receive the iconic “Seabin Shareholder” tin mug and also be invited to meet CEO Pete Ceglinski and the team at our Science Lab in Sydney, located at the Australian National Maritime Museum, in Darling Harbour, for an exclusive behind-the-scenes look at how Seabin turns ocean pollution into the data that is helping shape a $7 trillion nature market.

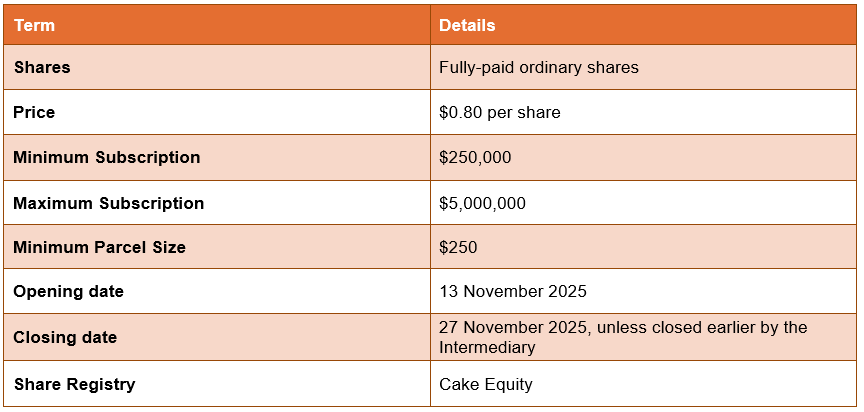

Terms of the Offer

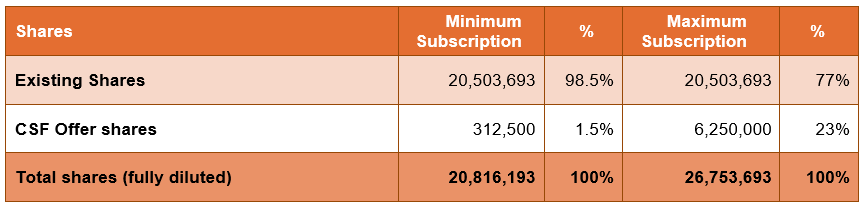

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

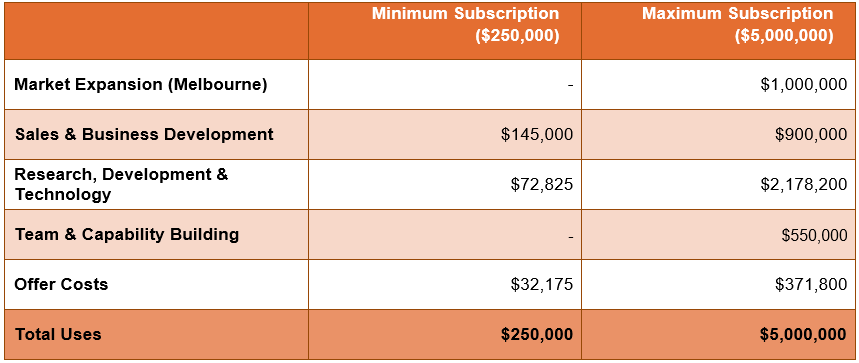

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risk

Seabin Pty Ltd is a profitable environmental data company that monitors, prevents, and removes ocean plastics. Each Seabin filters billions of litres of water, capturing microplastics and generating real-time data for sustainability reporting. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, IP risk, regulatory and market, reputational risk, dilution, or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $5,000,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.5% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Seabin Pty Ltd ACN ACN 608 283 521. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

Why can't I download the offer document?

Paul S (OnMarket member) on 13/11/2025Hi Paul, im not sure but i will ask the On market team now. Thanks for your interest in Seabin. Pete

Pete C (Seabin Pty Ltd representative) replied to Paul S on 13/11/2025Same question as the other person - I need to be able to down load

mary sue r (OnMarket member) on 13/11/2025Hi Mary Sue, im not sure, but i will ask the On Market team also (same as above) Thanks for your interest in Seabin. Pete

Pete C (Seabin Pty Ltd representative) replied to mary sue r on 13/11/2025Hi all, The On Market team just enabled downloading of the offer doc. Thanks all. Pete

Pete C (Seabin Pty Ltd representative) on 13/11/2025on page 43 it talks about if the minimum spend is raised, the company may require further funding to carry out intended activities. Are the intended activities the melb opening or the sales team, or both? It also said about a potential second raise, will that then dilute the shares from this raise, and all previous raises? Can you elaborate on what the scale back operations will be, I assume operating the same as before the raise occurred? Thank!

Charlie S (OnMarket member) on 14/11/2025morning Charlie. First priority activity for us is to get a sales professional onboard so we can scale up our revenue. Melb expansion is if we hit our max target only. The text is mainly to advise that the company may do additional raises, and yes the shares will be dilluted because of that. But at the same time, and if we do things right, in theory your share value should increase.

Pete C (Seabin Pty Ltd representative) replied to Charlie S on 14/11/2025In previous On Market campaigns you could see how many individuals invested and the amount on a running basis - this does not seem to be showing.

mary sue r (OnMarket member) on 14/11/2025Hi Mary, im not sure why that is. We havent used On Market before. It might be becuase its still a private period? It goes public next Tuesday. We just passed our minimum target in less than 24hrs with $256K invested and 129 investors. Hope this helps a bit. i will ask OM team about seeing the live dashboard. Thanks for your interest. Pete - CEO & Co Founder

Pete C (Seabin Pty Ltd representative) replied to mary sue r on 14/11/2025Hey Mary, just spoke to OM and its becuase of the private period, but they are going to turn the function on now. Thanks again, Pete C

Pete C (Seabin Pty Ltd representative) replied to mary sue r on 14/11/2025Im struggling to actually pay as i keep being told my CRN is wrong

Shane C (OnMarket member) on 14/11/2025any suggestions as to how i can give you money ?

Hi Shane, im asking the OM team now. Thanks for your support and will msg you soon. Pete (CEO & Co Founder)

Pete C (Seabin Pty Ltd representative) replied to Shane C on 14/11/2025Please sign in to post a question