Consolidating the $356bn Australian mortgage broker market industry

OnMarket bidding closed Recludo Ltd

Recludo Limited | Wholesale Offer

$5.0 million already committed under the convertible notes offer from sophisticated and professional investors.

Minimum application size of $25,000

This is a wholesale offer and is only open to Professional, Sophisticated and Experienced investors. More information on how to qualify available here.

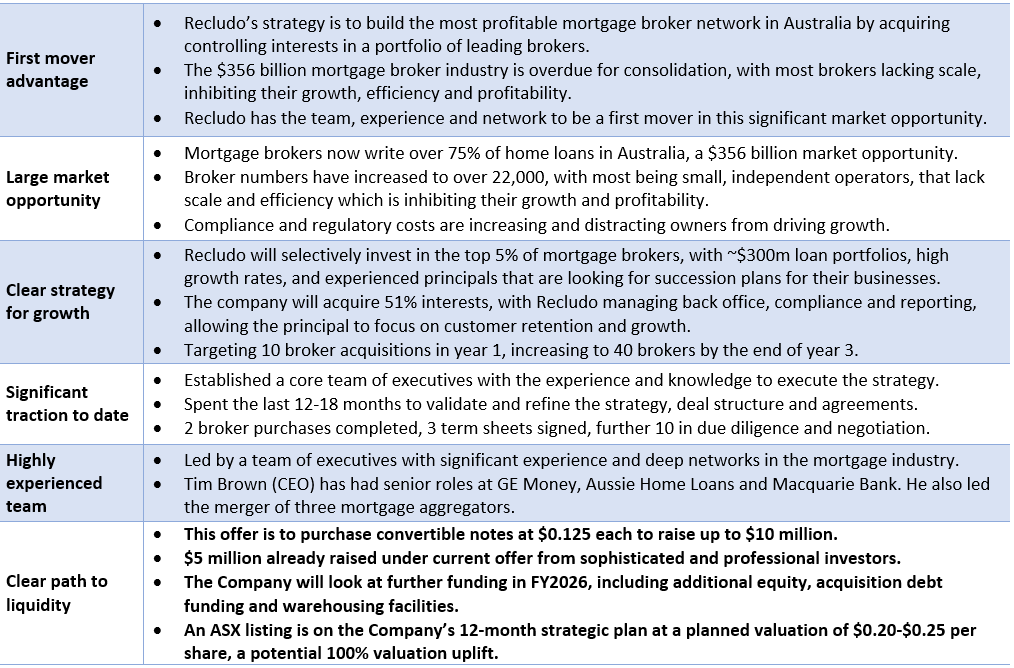

Investment Highlights

Company Overview

Recludo aims to build the most profitable mortgage broker network in Australia by selectively investing in the top 5% of mortgage broker businesses. By taking controlling interests in a portfolio of leading national mortgage brokers and assisting them to grow and improve efficiency, Recludo’s aim is to turn good businesses into great businesses.

The mortgage broker channel now controls 75% of all new home loans in Australia, representing over $356 billion in new loans each year. With over 22,000 independent mortgage brokers, the majority lack scale, inhibiting growth and efficiency improvement, the mortgage broking market is overdue for consolidation.

The proposed consolidation model has been successfully executed in parallel industries, including Steadfast Group (ASX:SDF) in insurance and Kelly Partners Group (ASX:KPG) in accounting. In the UK, Mortgage Advice Bureau (MAB), have delivered a similar strategy to Recludo within the mortgage intermediary market.

Recludo’s management team have a deep understanding of the mortgage industry, and the broker attributes required for the model to be successful. The team are well respected within the industry and have direct access to a broad network of brokers.

The Company will target mortgage brokers with ~$300 million loan portfolios, high growth rates, and experienced principals that are looking for succession plans for their businesses. The strategy is to acquire 51% controlling interests in each business, with Recludo managing back office, compliance and reporting, allowing the principal to focus on customer retention and growth.

The team have spent the last 12 months validating and refining the strategy, deal structure and agreements. With 2 broker purchases completed, 3 term sheets signed, further 10 in due diligence and negotiation significant progress has already been made. Recludo is targeting to exceed 40 brokers by the end of year 3, creating a highly profitable business.

Offer Summary

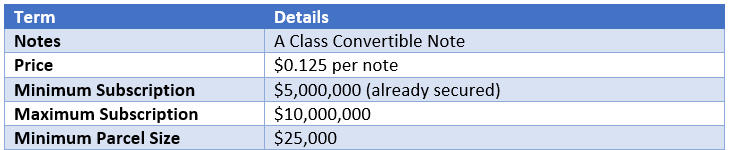

Reculdo is raising up to $10 million to fund the acquisition of the initial businesses, with $5 million already committed from sophisticated and professional investors. This round is being undertaken as a convertible note offer at $0.125 per note.

The Company will look at further funding in FY2026, including equity capital, a potential ASX IPO, acquisition debt funding and warehousing facilities.

Funds raised under the offer will be applied to acquire 51% interests in residential mortgage broker groups with recurring trail commissions, and towards working capital as the business scales.

Market

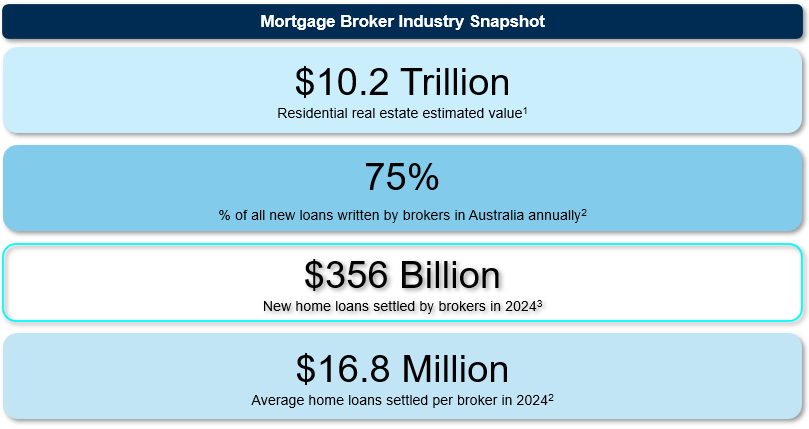

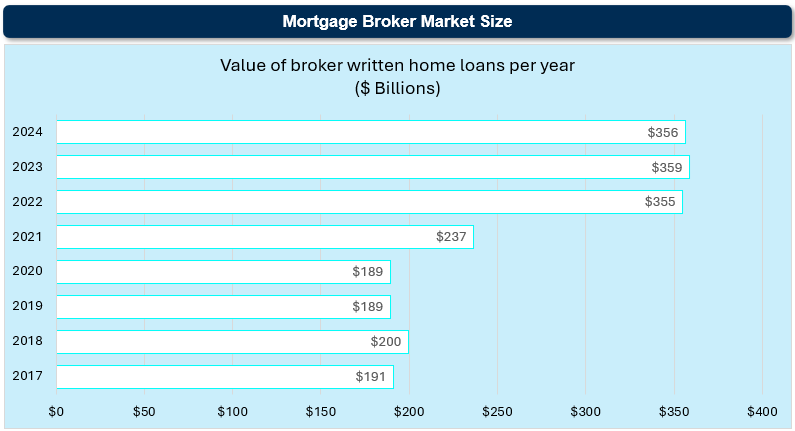

Residential real estate has an estimated value of $10.2 trillion (Core Logic, October 2024). Mortgage brokers continue to be the preferred channel for residential home loans and are increasing their share of residential and commercial lending. Residential mortgage brokers account for more than 75% of all new loans written within Australia (MFAA, March 2024).

Brokers generally offer their services free of charge to clients, and receive commissions from lenders via the aggregators. In 2024, brokers settled $356 billion in new home loans (MFAA, March 2024). The average home loan settled per broker was $19m per annum in 2022 (MFAA, March 2023).

Broker numbers continue to increase, and we have not yet seen the consolidation observed in the insurance market and other similar mature markets. The majority of brokers are sole operators, being the only loan writer within the business. Whilst loan settlements by brokers have reduced in the recent reporting period, their share of settlements remains near all-time highs. Brokers with a strong brand and targeted approach, which can scale loan writing resources cost-effectively, and provide the required compliance support for deals, are growing quickly.

Management Team

Recludo is supported by a highly experienced management team. The management team has significant experience in the mortgage and lending industry. The proposed independent directors include:

Tim Brown | Chief Executive Officer

Tim has held a number of senior executive roles with GE Money, Aussie Home Loans, Suncorp and Macquarie Bank. He established Home Loan joint ventures with LJ Hooker & Elders Home Loans, as well as consulting with Raine & Horne & Century 21. Merged three tier two mortgage aggregators to form Vow Financial the fourth largest aggregator in Australia, with $56B FUM & 1,500 mortgage brokers. Tim was Chairman of the Mortgage and Finance Association of Australia from 2014-16.

Ash Playsted | General Manager of Broker Performance

Ash has been a mortgage and finance industry insider for over 40 years. He has written thousands of loans, hired dozens of brokers, set up large partnerships, and built and exited multiple mortgage businesses. In short, he has been there and done that. He is passionate about the mortgage broking industry and works closely with business owners to maximize business productivity, profitability and value.

Tom Roche | Chief Operating Officer

Tom is an operations and technology executive, results-oriented and business focussed with over 30 years of international experience. Has operated in both scaled mature businesses and start-ups. Tom has held senior executive roles in APAC including with TeleTech, CoverMore and Asurion. Prior experience in the UK with EDS.

Jon Corney | Chief Financial Officer & Co-Secretary

Jon is a commercially focused finance executive with over 25 years’ experience across a range of areas, including financial accounting and control, financial management and reporting, decision support, commercial analysis, risk and capital management. Jon worked for 10+ years at Ernst & Young, prior to moving to Macquarie Bank and leading finance teams for Macquarie Mortgages and other retail banking products. He has also held senior finance positions at Yellow Brick Road.

Chris Slater | Head of Strategic Growth

Chris recently joined the Recludo team and brings 20+ years of experience in finance leadership having held a range of senior management positions at aggregator Australian Finance Group (AFG) over a 17-year career, including as head of sales and distribution and CEO of the asset finance aggregation brand Fintelligence. Chris’s role at Recludo is to focus on selectively partnering with high-performance brokerages and driving long-term business value.

Offer Terms

Recludo is undertaking an offer to wholesale and professional investors, to raise between $5m and $10m to commence residential mortgage broker acquisitions.

Funds raised will be applied as follows:

- 75% towards the acquisition of 51% interest in residential mortgage broker groups with recurring trail commissions

- 25% towards working capital – salaries, advisory services and float costs

Raise details:

- Convertible note offer at $0.125/note.

- The company has received applications for $5 million under the offer, and Directors have the right to accept further funds up to $10m

- Any incremental funds raised will be used to acquire additional mortgage brokers

The Company will look at further funding in FY2026, including additional equity, acquisition debt funding and warehousing facilities. An ASX listing is on the Company’s 12 month strategic plan at a planned valuation of $0.20-$0.25 per share, a potential 100% valuation uplift.

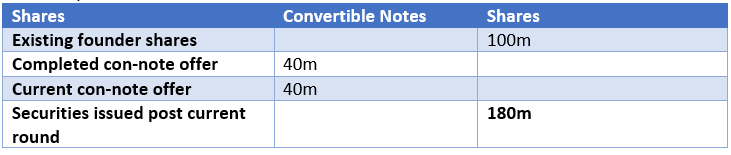

Issued Capital

Risks

Section 708 disclosure: The issuer of the securities is Recludo Limited ACN 675 493 142. The securities to be issued are convertible notes. The information provided on the OnMarket website has been prepared by Recludo Limited, and OnMarket makes no representation as to its accuracy or completeness. No prospectus has been prepared and accordingly, the Offer is being made to sophisticated, experienced and professional investors only.

The information memorandum is intended to provide potential investors with information only and does not constitute a prospectus, short form prospectus or other disclosure document as defined in the Corporations Act 2001 (Cth) (“the Act”). This document has not been lodged with the Australian Securities and Investments Commission ("ASIC") or any other government body. The offer made under this Information Memorandum is only available for persons who qualify as sophisticated or experienced (as defined in s708(8)-(10) of the Act), professional investors (as defined in s708(11) of the Act), investors to whom personal offers are made under s708(1), or investors to whom disclosure is otherwise not required under Part 6D of the Act (collectively, “Qualified Investors”).