Seaweed biotech disrupting the billion-dollar supplement market

Offer Closed PhycoLife (Venus Shell Systems P/L)

PhycoLife (Venus Shell Systems P/L) | Equity Crowdfunding

Offer Closed

$1,888,481

Raised810

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Unsustainable Sourcing: Seaweed Innovation Creating a New Market

The global demand for health supplements is booming, with the chondroitin sulfate ingredient alone valued at over $7.5 billion, and projected to grow. However, a troubling truth underpins the chondroitin industry: it is sourced from animal bones with 30% sourced from shark cartilage due to its high chondroitin concentration compared to bovine or synthetic alternatives. This practice sees millions of wild sharks like Blue Sharks and Hammer Heads harvested annually, devastating marine ecosystems and alarming ethically-conscious consumers worldwide.

This critical issue creates a significant market opening. PhycoLife is strategically positioned with a scientifically validated, sustainably farmed seaweed alternative, delivering the important molecular structure found in shark cartilage without ecological devastation.

As consumer demand for ethical, plant-based solutions intensifies, PhycoLife has a clear pathway to capture a substantial share of this expanding multi-billion dollar market, offering potent innovations that heal people and our planet.

We are turning an environmental crisis into a frontier for biotech investment.

Did you miss PhycoLife's Investor Q&A? Watch it here

High-Growth, High-Impact Investment Opportunity

By Investing in PhycoLife, you're investing in a revenue-generating seaweed biotech leader disrupting a $7.5B global shark-cartilage supplements market.

- Scaled, proven and de-risked model: our traction means we are in a position to lead Australia's rapidly expanding blue bio-economy, benefiting both human health and our oceans.

- Huge Market Disruption: Targeting the $7.5B global chondroitin market, replacing unsustainable shark cartilage (currently 30-40% source) with our unique, clinically proven seaweed alternative.

- Rapid Revenue Growth & Loyalty: $1.2M+ revenue (FY25), fuelled by 160% sales growth (revenue tripled in 6 months) and exceptional ~60% customer retention, demonstrating strong market demand.

- Pioneering De-risked Model: Australia’s first fully integrated seaweed biotech—from innovative indoor farming and bio-refining to proven medical and food-grade finished products.

- Proprietary & Clinically Validated: Proprietary seaweed ingredients (e.g., Phyaluronic™) backed by two human clinical trials showing significant gut health, cholesterol, and anti-inflammatory benefits.

- Scaling for Global Impact & NSW Leadership: Investment can potentially 10x production for global D2C/B2B reach, spearheading NSW’s visionary $2.3B seaweed economy.

Integrated Innovation, Creation, and Control

Building on our proven model highlighted previously, PhycoLife's core strength lies in our comprehensive mastery of the entire seaweed value chain. We are not simply product sellers; we are fundamental creators, meticulously managing every stage from proprietary indoor marine cultivation and advanced bio-refining to the formulation of market-leading health products that meet stringent food and medical standards.

This end-to-end Australian-based supply chain control is crucial for our innovation, ensuring premium quality, traceability, and the rapid development of novel solutions.

Our commitment extends deeply into pioneering research and development. PhycoLife functions as a deep-tech innovation engine, actively driving glycobiology and marine biotechnology advancements that could lead to opportunities beyond what the market can see.

This R&D focus generates significant intellectual property, which underpins our unique ingredients like Phyaluronic™ (SXRG84) and our next-generation SeaFibre supplements. This integrated system of sustainable cultivation, controlled processing, and frontier science allows us to consistently deliver our diverse range of clinically validated supplements, bioactive skincare, and award-winning functional foods to a discerning market.

Join the $2.3 billion NSW Seaweed Economy Vision

PhycoLife is strategically positioned within a rapidly expanding wellness landscape. Our initial targeted disruption is the ~$7.5 billion global shark cartilage supplement market (projected ~6.5% CAGR), offering a scientifically validated, ethical alternative to an ingredient that currently supplies 30-40% of the broader $7.5 billion chondroitin sulfate supplements market. This precise entry point is just the beginning.

The global demand for sustainable, plant-based, and clinically proven health solutions is accelerating, creating enormous uplift. This trend directly fuels our international scaling strategy, particularly for the B2B supply of our proprietary seaweed ingredients to global nutraceutical, food and medical brands. Furthermore, our ongoing R&D in marine glycobiology continually unlocks significant growth opportunities across functional foods, advanced skincare, and new therapeutic applications.

PhycoLife is not just meeting current demand; we are building an innovation platform to lead within Australia's $2.3 billion NSW seaweed economy vision and the multitrillion dollar global wellness industry. NSW is well poised for real estate and resources to support this growth.

$1.2m in Revenue FY25 + 60% Customer Retention

PhycoLife has achieved significant milestones, validating our business model and strong market demand. We proudly surpassed $1.2 million in revenue in FY25, driven by 160% annual sales growth and revenue tripling in the last six months alone. Our product efficacy and brand loyalty are confirmed by an exceptional ~60% customer retention rate and a customer base that more than doubled in the past year.

Operationally, we pioneered Australia’s first fully integrated seaweed value chain—from proprietary indoor cultivation and biorefining to creating novel ingredients like Phyaluronic™ that are clinically tested and that meet food grade standards. Our science is robust, with two pioneering human clinical trials published, leading to strong research partnerships across 4 universities and with numerous industry partners. This innovation and market leadership have garnered significant industry recognition, including multiple Australian Food Awards, "Most Innovative Protein Source" (International Food Expo London 2025), and prominent features in Forbes, BBC, and ABC.

These accomplishments showcase a de-risked, revenue-generating business primed for accelerated scaling.

Our Unique Advantage: Integrated Science, IP & Proof

PhycoLife’s competitive advantage is multi-layered and deeply entrenched, built on being Australia's pioneering, fully integrated seaweed biotech company.

Replicating our model is a formidable challenge due to the significant investment and specialised expertise required to master the entire value chain—from proprietary indoor cultivation and advanced bio-refining in Australia to creating medical-grade ingredients. This end-to-end sovereign control ensures unparalleled quality, traceability, and rapid innovation.

Crucially, we are an IP-generating, science-first company. Our deep expertise in marine glycobiology fuels a growing portfolio of proprietary ingredients like Phyaluronic™ and now Phychondrin™ . Our solutions are validated by two human clinical trials—a level of rigorous scientific backing rarely seen in this market.

This powerful fusion of a de-risked, scalable Australian supply chain, protected intellectual property, and proven product efficacy allows us to create truly unique, high-value offerings. Investors are backing a category leader with substantial barriers to entry, perfectly positioned to define the future where sustainable biotech meets scientifically proven health.

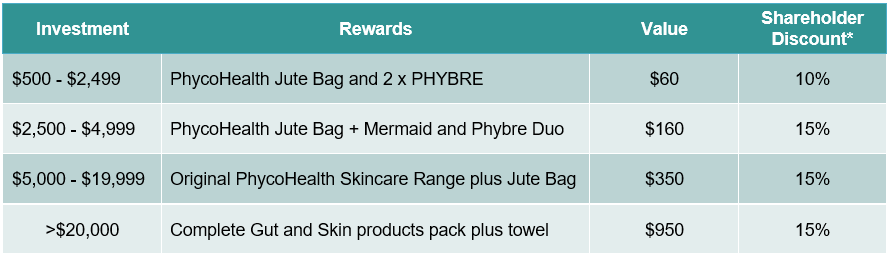

Investor rewards

We want our shareholders to be as big fans of our products as we are, and to reap the health rewards. We are proud off offer a range of rewards for investment in the crowd equity campaign as follows:

*discounts valid for 12 months and apply to fully priced products and online orders >$100

Terms of the Offer

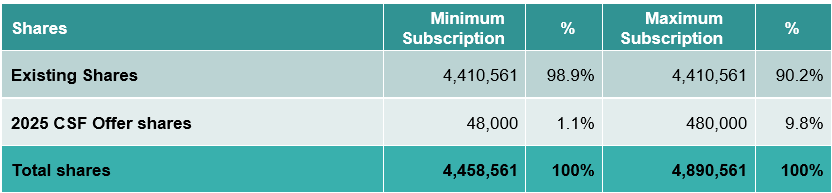

Issued Capital

*Note: The company has established a Staff, Directors and Founder Option Plan (ESOP). Please see detailed Cap Table in the Offer Document.

For more detailed information, please read the Capital Structure section of the offer document.

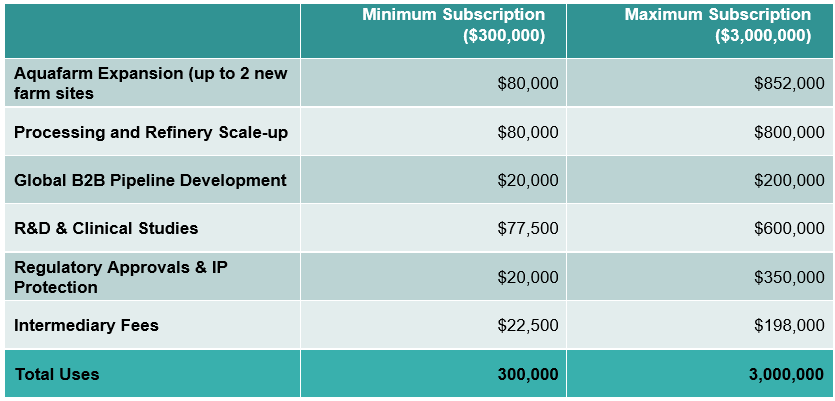

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risks

PhycoLife (Venus Shell Systems P/L) is revolutionising health with sustainable seaweed solutions. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, competition, reliance on key personnel, research and development, economic risk and market conditions, product liability, litigation risk, supply and demand, or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $3,000,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.5% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Venus Shell Systems Pty Ltd ACN 605 271 529. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Company Releases

Shareholders Deed (Individuals) 26 Jun 2025Shareholders Deed (Companies) 26 Jun 2025Company Constitution 26 Jun 2025Offer Document 27 Jun 2025Research

Supplements Study 1: Improved Plasma Lipids, Anti-Inflammatory Activity, and Microbiome Shifts in Overweight Participants: Two Clinical Studies on Oral Supplementation with Algal Sulfated Polysaccharide 20 Jun 2025Supplements Study 2: Oral Supplementation with Algal Sulphated Polysaccharide in Subjects with Inflammatory Skin Conditions: A Randomised Double-Blind Placebo-Controlled Trial and Baseline Dietary Differences 20 Jun 2025Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

What happens if the business is unsuccessful- will I be liable for more than just how much I invest?

Sonali S (OnMarket member) on 27/06/2025Hi there Sonali,

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Sonali S on 27/06/2025Thanks so much for your thoughtful questionits a really important one. Crowd-sourced funding (CSF) can be a bit unfamiliar if you havent invested this way before, so I really appreciate you reaching out.

CSF is a true form of equity investment, meaning you receive shares in the company. Like all investments, there are a range of outcomes: over time, you might benefit financially through dividends, a future sale of shares, or a company buyout. It might also be a longer-term neutral investment, orif the company doesnt succeedthere is a risk that the investment could be lost. Thats the nature of early-stage investing: theres risk, but also potential reward.

Importantly though, you can never lose more than what you invested. You are not liable for company debts or obligations beyond your investment amount. Once you buy shares, you are simply a shareholderlike the hundreds of others who are now part of our journeyand youll receive regular updates from us on how were tracking.

I hope this helps clarify things, and please dont hesitate to reach out again with any more questions.

Warmly,

Pia

Could you outline risks/benefit's to the environment with this expansion of your business? What happens to waste generated from production?

Margery S (OnMarket member) on 30/06/2025Hi Margary thank you so much for this thoughtful question. We LOVE your focus on the environment, because its exactly why we started Venus Shell Systems in the first place.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Margery S on 30/06/2025Youll see that every step of our expansion is designed to clean up coastal water, not add to the problem. Heres a quick, letter-style overview:

You can read about the 9 planetary boundaries and how we work to reverse all impacts through our production system here: https://www.phycohealth.com/pages/about-us

But otherwise, and in a nutshell, globally, nutrient-rich wastewater from food production is choking estuaries and coastlines, driving algal blooms, fish kills and dead zones all over the world, Think South Australia right now, Great Barrier Reef, Baltic Sea, or the fact that the Gulf of Mexico is dead >1m below the surface. We intercept that wasted nutrient at the shoreline, before it ever reaches the ocean.

How It Works:

1) Land-based Pools, Not Open-Ocean Farms

We pump nutrient-laden seawater into on-shore cultivation pools, and even add additonal nutreint load from food processing plants like the wheat refinery from our pilot site in Bomaderry.

2) Nutrient Capture & Water Cleanup

Fast-growing seaweed absorbs excess nitrogen, phosphorus and CO, turning into amazing molecules that are exclusive to our species and the sea, and releasing just oxygen and clean seawater, no additional salt, no pollutants.

Key Environmental Benefits:

Nutrient Remediation: We scrub out excess fertiliser before it causes harm.

Carbon Efficiency: Seaweed converts CO2 into biomass, and buffers coastal acidification.

Zero-Waste Discharge: Everything that comes inwater, nutrients gets either locked in biomass or returned cleaner.

By-Product Management

Harvest Residues: Any off-spec seaweed becomes a soil amendment, animal feed or we can recycle it back into new seaweed.

Process Water: We reuse processing-water internally.

In short, our waste is nothing but crisp, oxygen-rich seawaterand the captured nutrients and carbon live on as value-added products. Were effectively running a coastal oxygen battery, turning pollution into sustainable ingredients without touching the wild ocean environment.

I hope this helps clarify our environmental footprint. Please keep the great questions coming!

Warmly,

Dr Pia Winberg

Founder & Marine Scientist

Thanks so much-really appreciate your reply, and glad that my little stake in Phycolife will help to make a difference.

Margery S (OnMarket member) replied to Pia W on 01/07/2025That is the beauty of Crowd Equity Margery, it is effectively voting with effect, on the solutions for the future..making it happen... that is you.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Margery S on 01/07/2025Just adding a further reply here Margery - you can see our seaweed technology featured on the production The Story of Earth - Episode 2 - Water, here on ABC iView: https://iview.abc.net.au/show/home-the-story-of-earth

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Margery S on 01/07/2025We are featured towards the end of the episode where it explains how seaweed and algae were responsible for creating a planet that is habitable for us today, and that how what we do is revisiting that power of seaweed and algae to solve some of the biggest challenges ahead.

I absolutely love reading your explanation. It sounds like a win-win, ticking all the right boxes. I'm really excited about this. If I may be so bold to ask, and notwithstanding how intensely this would already be occupying your focus and time, with such beneficial effects on disrupted coastal water, are you also inviting government to engage with you in resolving some mess? They'd be mad not to!

Cheryl C (OnMarket member) replied to Margery S on 05/07/2025Love this question Cheryl, so thank you for asking.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Cheryl C on 06/07/2025Thank you for such a passionate and insightful question and yes, I absolutely agree! Governments should be involved, and Im pleased to say that in many ways, they already are.

Firstly, Im genuinely heartened that the NSW Government has taken a bold step by officially recognising the seaweed industry as a strategic opportunity for the state. Through their recently released NSW Seaweed Industry Prospectus, theyve clearly outlined the potential of this regenerative sector not just for economic growth, but as a solution for coastal resilience and sustainability. You can see that document here:

NSW Seaweed Prospectus

But thats just one piece of the puzzle.

In my view, reversing coastal degradation is the shared responsibility of all sectors government, science, business, and society. The damage was collective, and the repair must be too. The challenge is that we often operate in silos and forget the power of common interest. Our approach has always been collaborative working closely with government, universities, other businesses, our amazing customer community, and now our enthusiastic crowd equity investors to build a viable, scalable system that actually makes a difference.

This is about more than restoration. Its about designing a future where business and nature are no longer at odds, but in balance.

And yes were also actively engaging with government funding pathways. Weve applied to the NSW Biosciences Fund, we work with the Federal Governments R&D Tax Incentive, and were proud collaborators within the Marine Bioproducts Cooperative Research Centre, where several exciting new projects are now taking flight.

So, to your question: it's a strong yes. A strategic, measured, and action-oriented yes. And its people like you asking the right questions, and getting involved who help keep the momentum going.

Warmly,

Pia

For the ultimate on the Seaweed Industry Prospectus please copy and paste this as it doesn't work to hyperlink here:

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Pia W on 06/07/2025https://www.investregional.nsw.gov.au/seaweed

Just curious as to how the value of the cost per share is calculated based on current company valuation?

Cindy Y (OnMarket member) on 30/06/2025Great question, Cindy, which may be on a lot of minds.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Cindy Y on 30/06/2025Our Price per Share

The price of $6.25 equals our agreed $27.6 M pre-money valuation divided by the 4,410,561 fully diluted shares on issue immediately before this round. You can trace how that valuation has increased across our previous crowd-equity raises in the Offer Document.

What Drives That Valuation?

1. De-risked Revenue Demonstration

Our D2C FMCG channel has grown from $800 K to an expected $1.4 M in FY25providing a tangible, de-risked pathway to market and, model of profitability. Crucially, this model represents only a fraction of our broader opportunity: decades of seaweed-to-molecule R&D unlock multiple high-value channels and products beyond FMCG.

2. Proprietary Technology Pipeline

Since 2015, weve scaled from lab proof-of-concept to the worlds first seaweed-based biorefinery. High-value ingredientslike Phyaluronic(R) for skincare and Phychondrin(TM) for gut and metabolic healthare in market entry already, ready to address large, underserved markets of ingredients.

3. Market Comparables & Upside

We benchmark against listed and private companies in sustainable ingredientsblending a conservative multiple on our proven FMCG cash flows with upside multiples for our exclusive, deep-tech IP and remediation technologies of the future.

Why Not a Simple Revenue Multiple?

A straight multiple on FMCG revenue alone would understate the value of our exclusive, high-growth biotech pipeline. Our blended approach fairly reflects both the de-risked, revenue-generating channel today and the scale of market potential built on decades of technology development.

I hope this gives you a clear view of how the $6.25/share price was set. Let me know if youd like more detail on any of the underlying assumptions!

Pia

Arent some hyaluronic acids made from seaweed anyway?

Tracy K (OnMarket member) on 03/07/2025Hi Tracey,

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Tracy K on 03/07/2025Thanks for the great question.

In shortno, other seaweeds do not contain hyaluronic acid (HA). HA is naturally an animal-derived molecule, originally sourced from rooster combs and still commonly extracted from pork and bovine by-products. More recently, its been made using genetically modified bacterial fermentation, which allows for a vegan-friendly optionbut its still not plant-based.

What makes our ingredient, Phyaluronic, so unique is that its the first seaweed-derived molecule that mimics both the structure and function of HA. Its not like common seaweed gels such as carrageenan or alginate, which are used for thickening. Phyaluronic has bioactive molecular features that are actually recognised by human skin cells.

This is why weve been able to use it to 3D print full-thickness human skin in the lab for burn healingbecause skin cells bind to it, communicate with it, and begin laying down structured layers of collagen and elastin. In other words, our seaweed has a kind of molecular language that human tissues can understand.

It's a new frontier for plant-based bioactivespowered by seaweed, and proven in the lab.

If you would like to read the hard science on this... please read here: https://pubs.rsc.org/en/content/articlelanding/2021/bm/d0bm01784a

Warmly,

Pia

Fantastic thanks for that info! I love what you are doing.

Tracy K (OnMarket member) replied to Pia W on 03/07/2025Thanks Tracy... there is so much to share, and your question helps that, piece by piece.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Tracy K on 04/07/2025I'm wondering what the earlier share offerings were priced at? I understand it isn't a predictor of future growth, but I'd like to know. thanks

Cathy L (OnMarket member) on 04/07/2025Hi Cathy

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Cathy L on 05/07/2025Thanks for your question regarding the history of our share values.

Since our early inception, the companys share price has naturally evolved alongside our growth milestones and the increasing maturity of our operations:

2015 Initial seed shares issued at $1, reflecting the start-up, pre-revenue, test-tube phase of our journey.

2017 Shares were offered at $1.50, following early proof-of-concept and foundational IP.

20202023 Convertible notes were raised and later converted in 2024 at their cap of $4 per share, reflecting increasing traction and technology development.

Late 2024 Our first crowd equity round launched at $5 per share, supported by strong public engagement and commercial validation.

Mid-2025 A follow-on crowd raise at $6 per share backed by revenue growth and expansion plans.

Current round (2025) Share price now sits at $6.25, reflecting steady value growth as we move closer to profitability at a small scale amd are seeing the need to expand the production of seaweed and enter high value markets at a bigger scale.

This progressive valuation reflects both the rising capability and credibility of the business, and our commitment to building long-term shareholder value through innovation, sustainability, and commercial execution.

Happy to share more context if helpful.

Best wishes

Pia

Cash runway: What happens if you only raise the minimum $300k? How many months of operations can you cover before needing more funding?

Sonali S (OnMarket member) on 09/07/2025Debt servicing: How will you service debt repayments given current cash levels?

GMP progress: What is your timeline and budget to achieve GMP certification for Phychondrin?

Exit options: What are your realistic expectations for an exit (trade sale, ASX listing) in the next 5 years?

Founder loans: Are there any plans to convert founder loans to equity or defer repayment?

Competition: How will you defend your IP and market share as big supplement companies move into seaweed-based ingredients?

Valuation: At $6.25 per share, what does this imply about company valuation (post-money)? How does this compare to sales multiples in the industry?

Sorry, I just checked you've already raised well over the minimum and are targetting $3M, but please answer th second related question

Sonali S (OnMarket member) replied to Sonali S on 09/07/2025Yes indeed - and this is referred to in the answer above Sonali - thanks for making that note.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Sonali S on 09/07/2025Hi Sonali,

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Sonali S on 09/07/2025Thanks for reaching out with even more thoughtful questionsits clear youre taking this seriously and really reading the story of what we do, and I really appreciate the time youve taken to dig in.

As you noted in a second message below yes, were so excited and motivated by already achieving over $1.5M in this round, well past the minimum required, and our sales are currently doubling. In parallel, were leveraging R&D tax incentives, so our burn rate is further offset by these inflows. This raise isnt about plugging cash flowits about accelerating strategic growth and preparing for scale.

Let me walk through your other questions one by one:

Debt Servicing: How will you handle debt with current cash levels?

Were not carrying high-risk or unmanageable debt. Any founder loans (which Ill touch on more below) are long-standing, internal, and flexiblenot commercial debt. They are secured against the R&D rebate which will be more that what the debt is. The e-commerce debt financing is paid off against all sales each day, and these will be paid off in full in September, after which we will not service more. The remaining debt is a solar panel payment scheme which is better than an electricity bill, and so this is not a debt burden but a cost-effective way to manage power, while making a more sustainable business. We are proud to have a 99kW solar array system on our factory roof. No debt repayments will be made from CSF funds raised.

GMP Progress: Timeline and budget for GMP certification?

Were already working with partners on GMP alignment, and a portion of this raise is specifically targeted to that next stage. Our ingredients are already being produced in food-grade facilities, and we can already manufacture and sell our existing products within this framework under a NSW MWIP licence and inspection program. We're designing the next step of purification and formulation to meet GMP requirements for the ingredients market and towards higher value medical ingredients. We may or may not be the whole GMP pipeline for example, clinical invasive materials require endotoxin removal processes which are quite technical, and it may be that 50 80% of the GMP pipeline is here and then extends to a partner manufacturer that specialises in these techniques. But this process of development will happen mostly in the second half of this FY26 and may also be enhanced by a Government grant that we have applied for. Realistically, we expect to have early-stage GMP validated ingredients within 1824 months, aligned with scaling our ingredient supply partnerships. The investment helps us achieve that without overextending internal cash.

Exit Options: Realistic outcomes in the next 5 years?

Were keeping the door open to multiple pathways:

Internal secondary share trading is already facilitated, and external share sales are accommodated but at present we do not have a marketing channel for this (noting that CSF shares cannot be sold again within 12 months of purchase)

A strategic acquisition of our ingredients/IP portfolio (particularly by supplement or skincare companies)

A partial or full trade sale

An ASX listing, which is a real option given our Australian-first IP, product traction, and sustainability mandate, or

We make work with shareholder dividends or share buybacks in the future

Given our pace of growth and the traction with larger B2B and retail partners, we expect that at least one of these outcomes will be well positioned in the years ahead. But we are not permitted to offer real forecasts in CSF offers.

Founder Loans: Any plans to convert or defer?

Yesfounder loans are internal, and have been treated as flexible capital support during the early development years. Theres no pressure or timeline for repayment. In fact, they could potentially be converted to equity, ensuring alignment with shareholder value and minimising any financial drag on the business. They are secured against R&D rebates which I mentioned above.

Competition: How will you defend against larger players entering seaweed?

This is where our first-mover advantage, proprietary species, and full vertical integration come into play. Unlike many who simply source generic seaweed powder or extracts, we:

Cultivate a unique species (Species 84), with tightly held know-how

Have developed proprietary processing systems and IP, from fresh biomass to finished goods

Hold trademarks and trade secrets across food, skincare, and supplement applications

Have conducted human clinical trialsa significant barrier to entry

Weve also built trust and traction with retailers, practitioners, and consumers, and our diversified brand footprint (PhycoHealth, PhycoLife, SXRG84) adds to the defensibility.

Valuation: How does $6.25/share compare to industry standards?

At $6.25/share, were valuing the company at approximately $2527M post-money depending on the final raise. Compared to similar companies in:

Biotech ingredients (with no revenue but IP) valued well above $50M+

Clean beauty/nutraceuticals with single-channel products at 410x revenue

We believe this is a fair and conservative valuation. With real revenue, award-winning products, owned infrastructure, and scientific IP, we're offering value at a multiple that reflects early-stage upside, not late-stage froth.

I hope this gives you a strong sense of how were thinkingnot just about the numbers, but about building a strategic, scalable, and defensible business with meaningful exit potential.

Happy to chat more if youd like to go deeper on any of these topics.

Warm regards,

Pia

Thanks very much for your detailed responses, Pia. I'm excited to have invested and be a part of your amazing story!

Sonali S (OnMarket member) replied to Pia W on 10/07/2025Welcome onboard Sonali!

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Sonali S on 10/07/2025:)

Why is Schedule 1 (Shareholdings in the company) missing from the agreement?

Jennifer S (OnMarket member) on 10/07/2025Why go through all the expense (legal and marketing expenses, which must be significant) to seek crowdfunding instead of getting a loan?

Hi Jennifer

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Jennifer S on 10/07/2025Maybe there is some missunderstanding somewhere, but the Shareholdings are there, as required and available in the Offer Document. If you are referring the original Shareholders Agreement, thatcrefers to original shareholders since that agreement in 2019. Which is now superceded with Crowd Sourced Funding Shareholders.

Regarding loans... it would be.very difficult to find a debt facility that finances the rapid growth in new industries. Debt facilities tend to focus on business as usual industries.

While we are new yet proven in so many ways.... New crop, new ingredients, innovative markets. Standard loans don't typically finance game changers. But we have reliable received and repaid a number of e-commerce debts over time due to our strong e-commerce performance. They rarely come up in the vicinity of $1.8M which we have achieved already tonight with 45 mins to go.

:)

Hi I missed this but are very supportive of the disruptive potential of the seaweed industry. Will there be another offer soon?

Ghislaine L (OnMarket member) on 11/07/2025Thank you so much for that interest Ghislane - and we are sorry to have missed you. There is not an imminent raise in sight - but sometimes existing shareholders are intersted in selling shares, and if you want me to keep you abreast of these things, then please just reach out to me at pia@venusshellssystems.com.au

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Ghislaine L on 11/07/2025Because we are not on the ASX, we don't have the mouthpiece platform to let people know of secondary share sales, but with over 1000 shareholders now - this is usually always going to be an opportunity in a small way, and we can still facilitate such share transactions. Although existing shareholders always get the first right of refusal. Maybe we can see you on the inside one day. :)

Hi, I registered my interest on the 23rd June and would like to know when we will be notified about payment of the shares. Thanks for your help.

Raylene N (OnMarket member) on 11/07/2025Hi Raylene - thanks for reaching out, but I am afraid the window closed in Friday.

Pia W (PhycoLife (Venus Shell Systems P/L) representative) replied to Raylene N on 13/07/2025We have sent out many email updates and alerts of the live offer to invest shares over the last 3 weeks, and maybe they ended up in your junkmail or something. But we are grateful for your interest and will keep you alerted for any shares thaty may be available in the company moving forward.

Please sign in to post a question