WA based oil and gas exploration company with multiple prospects in the Perth Basin

Live Macallum New Energy Ltd ASX: MNE

Macallum New Energy Limited IPO | ASX: MNE

Company has received commitments in excess of $6 million minimum offer size.

OnMarket has a limited allocation.

The 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

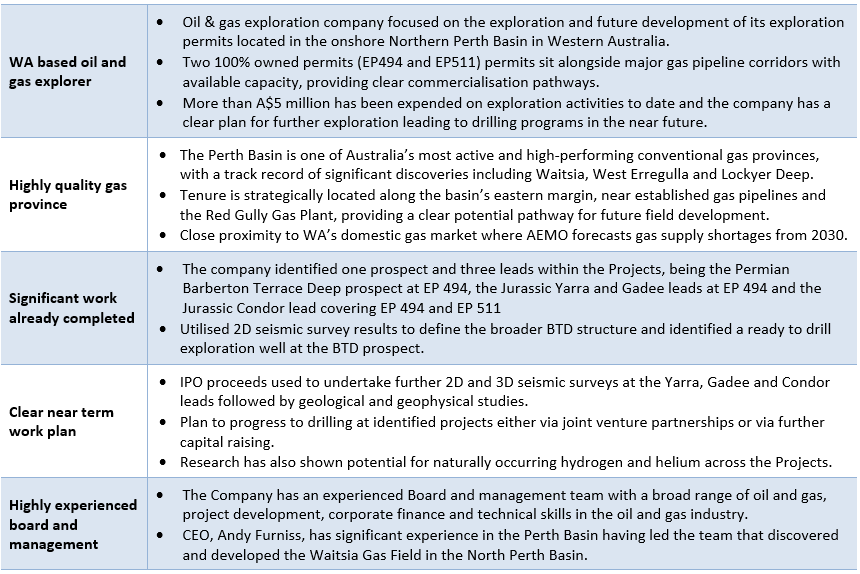

Investment Highlights

Introduction

Macallum New Energy Ltd (ASX: MNE) is an Australian gas exploration company focused on two 100%-owned Projects in the onshore Perth Basin, Western Australia. The Perth Basin is one of Australia’s most active and high-performing conventional gas provinces, with a track record of significant discoveries.

Exploration activities in the Perth Basin region began in the late 1940s and, at present, the Perth Basin comprises 26 discovered petroleum accumulations, of which 13 have proven to be commercial. Most discoveries are located at the onshore Northern Perth Basin with the most significant historical discovery being the Dongara oil and gas field (with initial reserves of 15.3 billion cubic metres of gas and 10 million barrels of oil). In 2014, the discovery of the Waitsia Gas Field, which at the time was the second largest onshore gas discovery in Australia, confirmed a new play that resulted in an increase in exploration activities in the Perth Basin which has led to six commercial gas discoveries in the last 10 years.

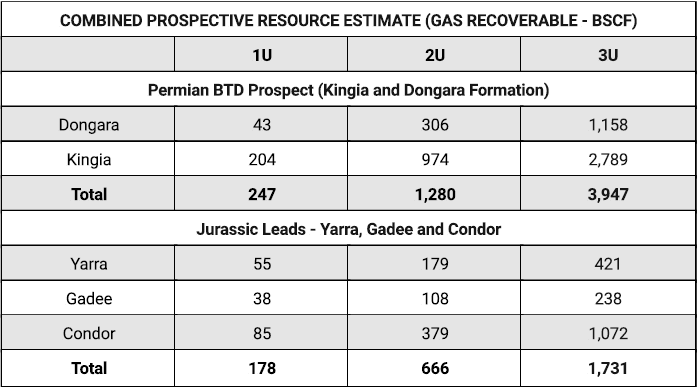

As at the date of this Prospectus, more than A$5 million has been expended on exploration activities at the Projects and the Company has:

- undertaken 2D seismic surveys to define the broader Barberton Terrace Deep structure and identified a ready to drill exploration target at the Barberton Terrace Deep prospect at EP 494;

- identified one prospect and three leads within the Projects, being the Permian Barberton Terrace Deep prospect at EP 494, the Jurassic Yarra and Gadee leads at EP 494 and the Jurassic Condor lead covering both EP 494 and EP 511;

- committed to undertake further exploration activities at the proposed Jurassic leads at Yarra, Gadee and Condor to improve the structural definition of these leads and mature these leads into prospects;

- entered into the necessary heritage and access arrangements to commence the proposed seismic activities and work program at the Yarra and Gadee leads; and

- completed and obtained the requisite approvals required to undertake 3D seismic activities at Yarra and Gadee from the Environmental Protection Authority (EPA) and the Department of Mines, Petroleum and Exploration (DMPE)

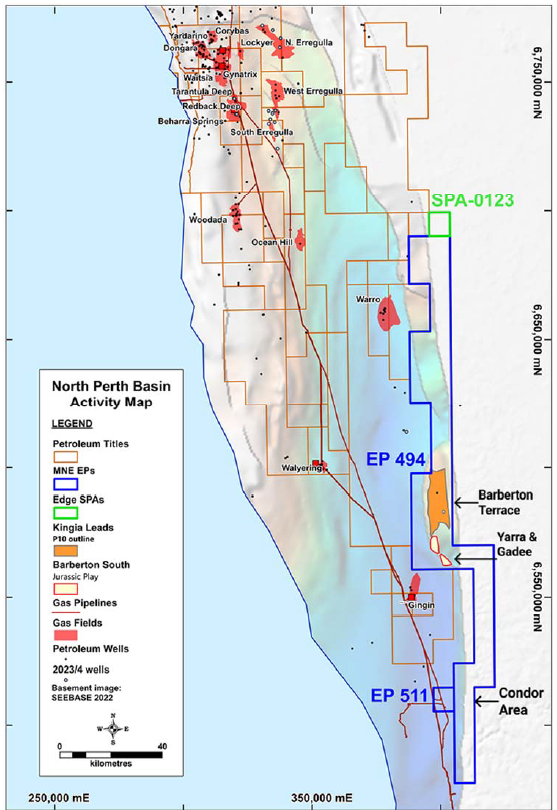

Figure 1 – Geographical map of EP 494 and EP 511

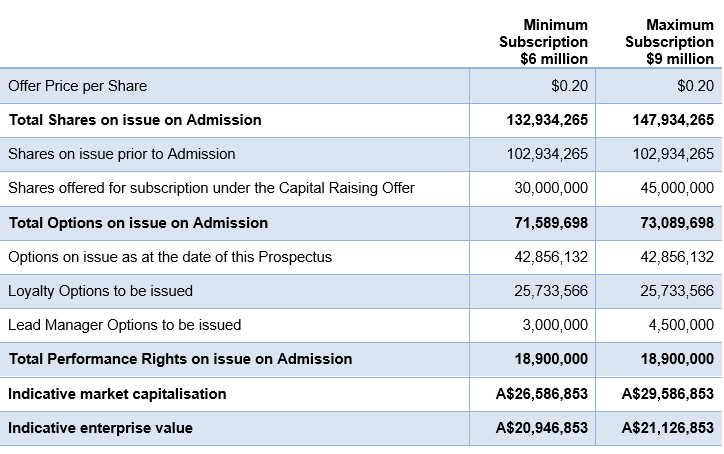

Terms of the Offer

Macallum New Energy Ltd is looking to undertake an IPO on ASX to raise between $6 million and $9 million via the issue of between 30 million shares and 45 million shares under the Offer at an offer price of $0.20. The company will have an indicative enterprise value of $21,126,853 at maximum subscription.

The Company proposes to apply the funds raised from the Public Offer towards:

- undertaking further 2D and 3D seismic surveys at the Yarra, Gadee and Condor leads, with a view to identifying a potential shallower Jurassic well target within the Yarra and Gadee leads (in addition to the deeper drill ready target already identified at the Barberton Terrace Deep prospect);

- undertaking geological and geophysical studies of the results of the planned seismic acquisition activities at the Yarra, Gadee and Condor leads; and

- depending on the results of the seismic acquisition activities at the Yarra, Gadee and Condor leads, either conduct a well planning study for a well at one of the Jurassic leads (Yarra, Gadee or Condor) or the drill ready Barberton Terrace Deep well and, subject to the Company raising .

Company Overview

Macallum New Energy Ltd is an Australian gas exploration company incorporated in Australia in September 2018. The company is focused on the assessment and future development of its exploration permits located in the onshore Northern Perth Basin in Western Australia, being EP 494 and EP 511 (the Projects).

In addition to the Projects, the Company has also applied for three additional SPA / AOs (Special Prospecting Authority with Acreage Option) in the Northern Perth Basin and Pilbara and Great Southern areas.

The Company's primary objective is to increase shareholder value through the successful identification, exploration and discovery of commercial gas at the Projects.

In order to achieve this objective, the Company intends to:

- undertake 3D seismic surveys at the Yarra and Gadee leads;

- undertake a 2D seismic survey at the Condor lead;

- undertake geological and geophysical interpretation of the planned seismic acquisition activities at the Yarra, Gadee and Condor leads; and

- subject to the results of the seismic surveys, either conduct a well engineering study at one of the shallower Jurassic leads or the deeper drill ready well at the Barberton Terrace Deep (BTD) prospect.

If the Company raises the Maximum Subscription, the Company also intends to undertake initial drilling set-up for the proposed well.

The Projects

Macallum New Energy is focused on two 100%-owned Projects The Projects are located in the onshore Northern Perth Basin of Western Australia and comprise EP 494 and EP 511. In addition to the Projects, the Company, via its wholly owned subsidiary Edge Natural Energy Pty Ltd, has also applied for three additional SPA / AO (Special Prospecting Authority with Acreage Option) permits located in the onshore Northern Perth Basin, Pilbara and Great Southern regions.

Project EP 494

EP 494 covers an area of 2577km2 running north-south along the eastern boundary of the North Perth Basin, Western Australia.

The Company has identified the following prospect and leads at EP 494, being:

- the early Permian-age Barberton Terrace Deep Prospect (BTD); and

- the Barberton South Jurassic leads – being the Yarra lead, the Gadee lead and the Condor lead.

The prospect and leads identified by the Company are close to existing gas infrastructures, located 23km from the Dampier-Bunbury and Parmelia gas pipelines (currently with spare capacity) and 20km from the dormant natural gas processing plant at Red Gully. The permits to the west and north-west of EP 494 have also been explored and/or developed for natural gas to supply the Western Australia domestic gas market since 1971.

The BTD prospect main target reservoir is the Permian Kingia Sandstone which forms the upper part of the High Cliff Sandstone. The Kingia Sandstone has been highly prospective in the northern part of the North Perth Basin over the last 10 years, with a number of discoveries and subsequent developments being made. This is the first test of the Kingia Sandstone reservoir in the mid to southern area of the North Perth Basin.

The Yarra, Gadee and Condor leads target the thick Jurassic Yarragadee Formation intersected by nearby wells (e.g. Dandaragan-1, Dandaragan Deep-1) and the Warro Field approximately 80 km to the north. The Yarra and Gadee leads are identified from possible direct hydrocarbon indicators (flat spots) interpreted from two 2D seismic lines. If the flat spots and the structural closures of the Yarra and Gadde Leads are validated and matured following the approved 3D seismic survey, they will become potentially attractive lower-risk prospects.

Project EP 511

EP 511 comprises a single graticular block of approximately 73km2 and is located immediately west of EP 494. Following Admission, the Company intends to undertake a 2D seismic program at EP 511 which aims to improve definition of a possible lead in EP 511 and mature the lead to prospect status. Commencement of the 2D seismic program at EP 511 is subject to finalising landholder approvals.

Natural Hydrogen and Helium Potential

CSIRO and Macallum New Energy funded research has confirmed the potential for naturally occurring hydrogen and helium across the Projects. Further, recent geological and seismic investigations have indicated that the Darling Fault Zone acts as a conduit for the migration of natural hydrogen, helium, and other associated gases, which indicates a natural pathway for these resources to accumulate.

Attractive Western Australia Gas Market Outlook and Policy

Gas consumption in Western Australia is forecast to experience significant growth between 2027 and 2031, driven primarily by growth in the mining, minerals processing and industrial sectors. This anticipated growth in demand is expected to lead to a domestic market supply shortfall prior to 2030 if supply projects are unable to be accelerated to accommodate increased demand. The exposure to supply risk is expected to increase after 2030 as production from existing fields declines.

Key uncertainties affecting future gas adequacy include the limited flexibility in the gas market, with gas production facilities operating close to maximum capacity. This constraint could expose the Western Australian gas market to immediate short-term supply disruptions should a major gas plant undergo an operational shutdown.

Further, under the renewed Western Australia domestic gas policy, new and expanded onshore gas projects will be required to reserve 80% of their gas production for Western Australia domestic use up until 31 December 2030 and then 100% from 2031 onward. In addition, state-owned coal power stations are on track to be retired by 2030.

Given the history of success of the other Perth Basin projects, the quality of long-term infrastructure in place which will reduce development risk and having regard to the Western Australia domestic gas market outlook, the Board considers that the Projects have market potential and there is an opportunity, if and when, it seeks to commercialise the Projects.

Management and Board

Macallum New Energy Ltd is led by an experienced Board and management team with a broad range of oil and gas, project development, corporate finance and technical skills in the resources and oil and gas industry. These include:

Phil Thick – Non-Executive Chairman

Phil has over 35 years’ experience as a senior executive in oil and gas, mining and chemical processing spanning small to multi-national public and private companies. He also has extensive experience on many boards and has chaired many of them for extended periods. Phil enjoyed a 20-year career with Shell and for the last three he was on the board of Shell Australia as Downstream Director. This was followed by five years as a director and CEO of Coogee Chemicals, four years as CEO of New Standard Energy drilling exploration and production wells in the Canning Basin in WA and in Texas, and then four years as CEO of Tianqi Lithium Australia. Phil is currently a Non-Executive Director of ASX listed companies Livium Limited and Patriot Resources Limited and Chairs the board of private mineral sands company TiGa Minerals and Metals.

Rance Dorrington – Executive Director (Commercial)

Rance has worked within the resources industry for over 24 years with experience in the petroleum and minerals industries globally, including acting as CFO & Company Secretary for Extract Resources Ltd from its ASX junior listed inception up until commencement of takeover proceedings by Chinese interests for over A$2 billion. Rance has predominantly worked in capital markets, financial and governance roles within a small team environment where, having the constant exposure to all facets of exploration and commercial operations, has given him substantial knowledge from the coal face and at all other levels of the exploration business.

Trinity Nofal – Non-Executive Director

Trinity has over 15 years' experience in corporate finance and the natural resources sector. She spent nine years with RFC Ambrian Limited where she was an Associate Director and was involved in strategic reviews, IPO’s and mergers and acquisitions with a specific focus on mining and oil and gas companies. During her tenure at RFC Ambrian, Trinity conducted comprehensive market research, due diligence, and financial analysis to evaluate investment opportunities and provide recommendations to clients. Trinity joined Labonne Enterprises Pty Ltd in 2019 in a corporate advisory role and became a director of MNE in June 2023. Trinity is also a director of Labonne Enterprises Pty Ltd (a substantial Shareholder).

Andy Furniss – Chief Executive Officer (CEO)

Andy has 35 years of global experience in senior executive roles in upstream oil and gas and geoscience technology businesses. Most recently, Andy was Vice President Exploration & Geoscience at Mitsui E&P Australia following the company's 2018 acquisition of ASX-listed AWE Limited where he served as GM Exploration & Geoscience. Andy was responsible for leading the team that lead to the discovery, appraisal and development of the Waitsia Gas Field in the North Perth Basin, one of Australia's largest onshore gas discoveries. Andy has also held positions with global Exploration and Production (E&P) company, Chevron, and Paradigm Geophysical where, as Global Technical Director, he led a team of geoscientists across the globe to innovate exploration workflows and was directly involved in the world's largest discovery of 2002, the 14 Tcf KG-D6 Gas Field operated by India's Reliance Industries.

Jeff Schrull – Manager Petroleum Projects

Jeff has over 30 years' experience in all aspects of the upstream exploration and production (E&P) industry, delivering growth through the drill bit. Most recently Jeff was the Group Executive of Exploration and Appraisal (E&A) at Beach Energy in Adelaide during the transformational years of 2017-2021. Prior to this he held the position of General Manager of E&P at Cue Energy in Melbourne. Jeff previously held several senior international roles with Chevron over a 19 year period and was subsequently at Addax Petroleum as the Corporate General Manager of Exploration. Jeff has significant experience in project development, delivering growth through exploration, development, operations and mergers and acquisitions.

Silfia Morton – Company Secretary

Silfia is a Chartered Accountant specialising in financial management, reporting services, and risk compliance and management with experience in the local and international markets. Silfia spent 12 years as senior audit manager at one of the leading international audit, tax and advisory firms, where she was responsible for managing the assurance and compliance requirements of a diversified group of large, medium and small companies in a range of industries, including the mining, technology and manufacturing sectors. Silfia is currently CFO and Company Secretary of Ore Resources Limited, Solstice Minerals Limited and Kali Metals Ltd.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

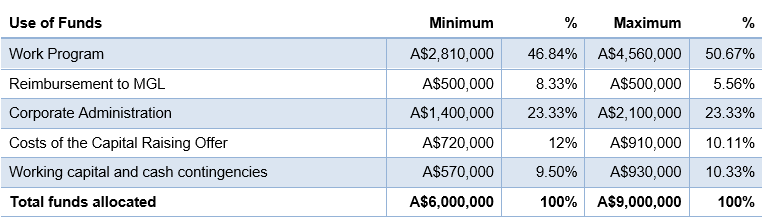

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risk

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 5 of the prospectus, Macallum New Energy Ltd is subject to a range of risks, including but not limited to future capital requirements, exploration risks, exploration permits, development, joint venture risks and limited operating history.

Section 734(6) disclosure: The issuer of the securities is Macallum New Energy Limited ACN 628 953 122. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.