Drill ready large scale copper gold project in the Macquarie Arc region of NSW

Live LinQ Minerals Ltd ASX: LNQ

LinQ Minerals Limited (ASX: LNQ) IPO

Commitments in excess of the minimum $7.5m offer size. OnMarket has a limited allocation.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

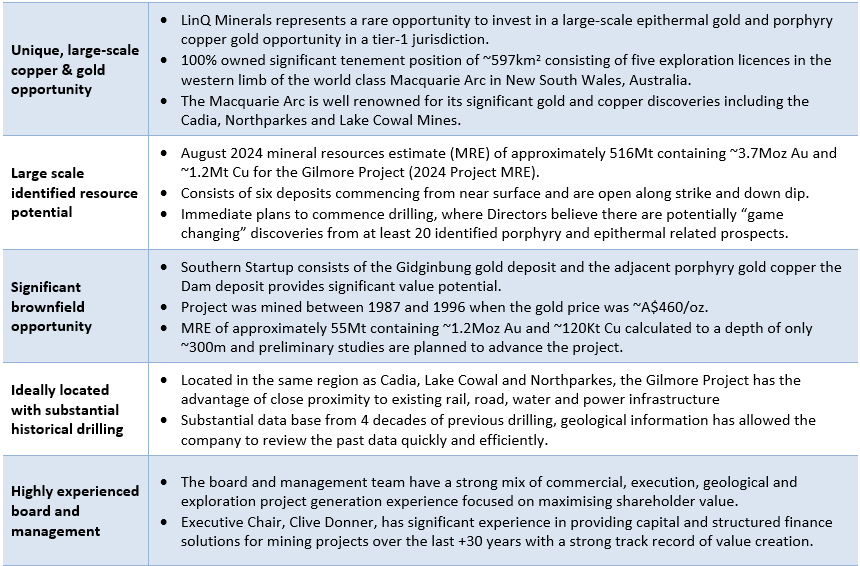

Key Investment Highlights

Introduction

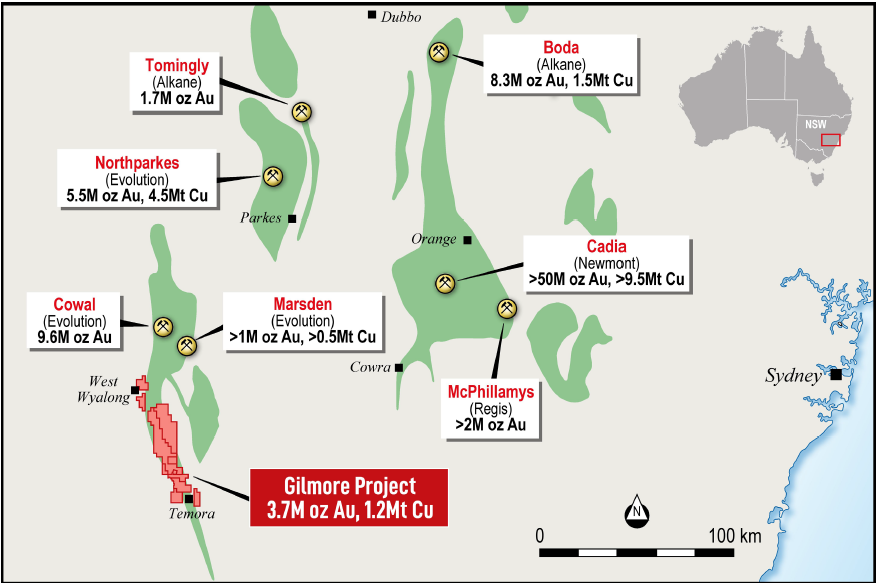

LinQ Minerals Limited (ASX: LNQ) is an Australian gold-copper exploration company that owns 100% of five exploration licences in the Gilmore project in the world class Macquarie Arc in central west NSW - known for its significant epithermal gold and porphyry copper gold discoveries. The Macquarie Arc is well renowned for its significant epithermal gold and porphyry copper gold discoveries including the Cadia, Northparkes and Lake Cowal Mines.

LinQ Minerals represents a rare opportunity to invest in a large scale epithermal and porphyry district in a tier-1 jurisdiction. In August 2024, LinQ Minerals released a JORC Mineral Resources Estimate (MRE) of approximately 516Mt containing ~3.7Moz Au and ~1.2Mt Cu for the Gilmore Project (2024 Project MRE).

LinQ Minerals’ immediate priority is to drill test the significant exploration potential that exists within their tenement package, as they believe there are potentially “game changing” discoveries from at least 20 identified porphyry and epithermal related prospects at varying levels of prospect maturity. Their initial focus will be on drill testing a number of known mineralised prospects in the central and southern zones of the tenement belt.

LinQ Minerals’ will also undertake work to advance their brownfield gold project within the Gilmore Project, comprising the Gidginbung gold deposit and the adjacent porphyry gold copper the Dam deposit (Southern Startup). The intent is to upgrade and extend the known epithermal gold and porphyry copper-gold resources at Gidginbung and the Dam, and potentially other nearby deposits.

Gidginbung was previously mined between 1987 and 1996 when the gold price was ~A$460/oz. The combined MRE of our Southern Startup is approximately 55Mt containing ~1.2 Moz Au and ~120Kt Cu (~60% Indicated, ~40% Inferred) (Southern Startup MRE).

LinQ Minerals represents a rare opportunity to invest in a large scale epithermal and porphyry district in a tier-1 jurisdiction.

Regional Geological setting of the Gilmore Project showing neighbouring projects estimated pre-production geological endowment

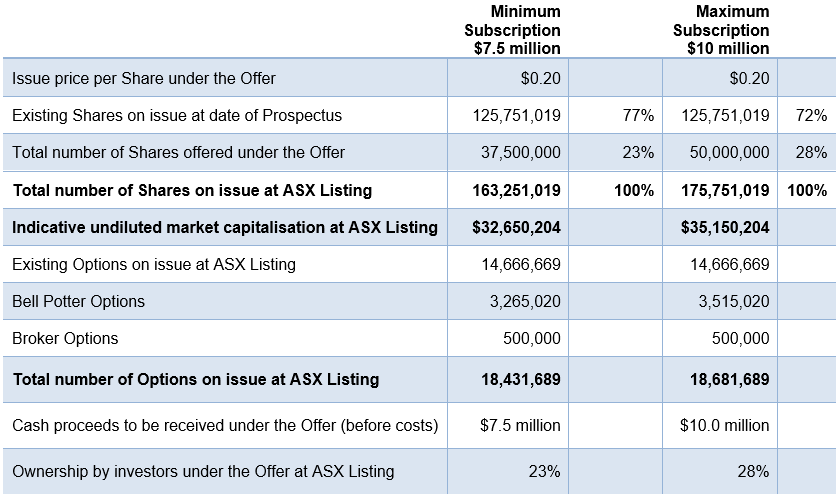

Terms of the Offer

LinQ Minerals Limited is looking to undertake an IPO on ASX to raise between $7.5 million and $10 million via the issue of between 37.5 million shares and 50 million shares under the Offer at an offer price of $0.20.

The funds raised through the Public Offer will be used primarily to drill high priority mineralised prospects in the central and southern areas and also to advance the Southern Startup project.

The IPO is being led by Lead Managers Bell Potter Securities and Alpine Capital.

Company Overview

LinQ Minerals Limited is a gold-copper exploration company incorporated in WA on 9 February 2023 and focused on its Gilmore Project located between Temora and West Wyalong in central-west NSW. The Company’s 100% owned large scale gold-copper project covers an ~597km tenement package.

The Company’s objectives are to:

- explore a number of well identified and highly prospective gold and copper prospects with a view to eventual resource definition by drilling;

- expand the mineral resource base for the Gilmore Project by further resource drilling; and

- assess the potential for mine development options on one or more of the above prospects, in particular the Southern Startup deposits at Gidginbung and the Dam.

Gilmore Project

LinQ Minerals Limited owns 100% of the Gilmore gold-copper project located between Temora and West Wyalong in central west NSW. The Gilmore Project hosts the full suite of the Macquarie Arc intrusive related gold-copper systems (analogues to the nearby Cadia, Cowal and Northparkes systems).

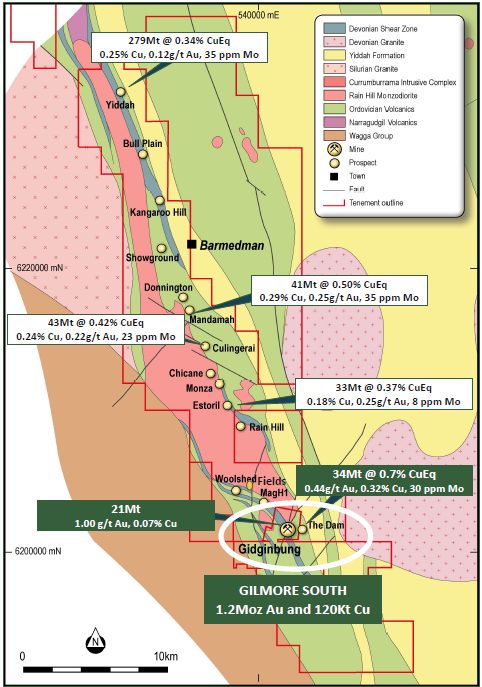

In August 2024 the Company released Mineral Resource Estimates reported in accordance with the JORC Code for 6 deposits at the Gilmore Project comprising porphyry related copper gold deposits at the Dam, Estoril, Culingerai, Mandamah and Yiddah and the epithermal sulphide gold deposit at Gidginbung. Porphyry copper-gold and epithermal gold mineral resource estimates totalled approximately 516Mt containing ~3.7 million ounces of gold and ~1.2 million tonnes of copper (2024 Project MRE).

The southern end of the Gilmore Project includes a brownfields gold project comprising the Gidginbung gold deposit and the adjacent porphyry gold copper Dam deposit (Southern Startup). The combined MRE of the two deposits comprising the Southern Startup is approximately 55Mt containing ~1.2 Moz Au and ~120Kt Cu (~60% indicated, ~40% inferred) (Southern Startup MRE).

All of the six current deposits in the 2024 Project MRE have to date only been drilled to relatively shallow depths (300m to 450m depending on the deposit). Enticingly, each of the deposits remain open at depth and along strike and the Company wishes to pursue both infill and step out drill testing with the ambition of further enhancing the quantity and grade of MREs.

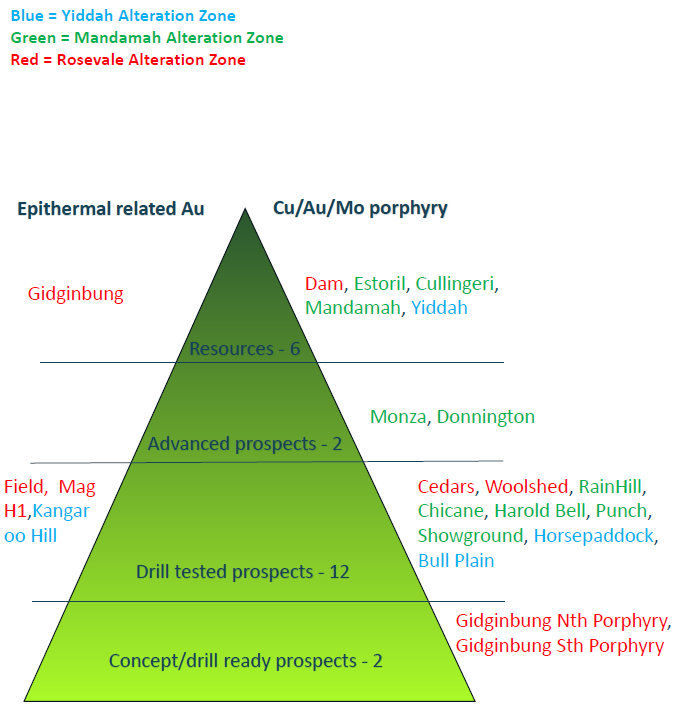

Past exploration and geological review and analysis by LinQ Minerals has, in addition to the six deposits in the 2024 Project MRE, identified exciting exploration upside across the 40km strike length of known prospects in the Gilmore Project. The project benefits from a database compiled from over 40 years of exploration by various explorers and over 20 porphyry and epithermal related prospects have been identified at varying levels of prospect maturity. These prospects include Gidginbung North, MagH1, Fields and Woolshed in the Southern Zone, Donnington and Monza in the Central Zone and Kangaroo Hill in the Northern Zone.

Exploration potential

Significant exploration potential exists within the Tenement package to pursue identified additional prospective porphyry and epithermal prospects. In addition to the 6 deposits in the 2024 Project MRE, the Gilmore Project benefits from a database compiled from over 40 years of exploration by various explorers and boasts over 20 porphyry and epithermal related prospects identified at varying levels of maturity over an approximate 40km strike.

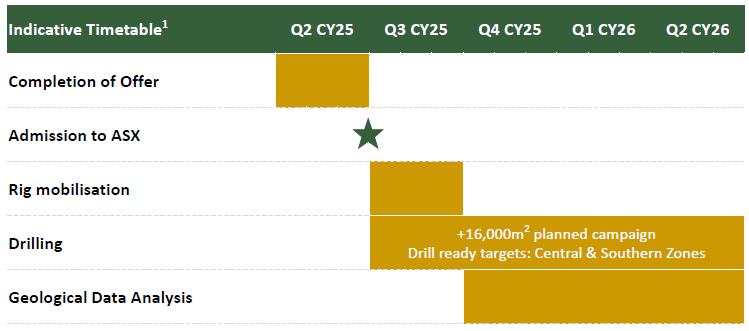

Planned Activities by Quarter

Management and Board

LinQ Minerals Limited is led by a board and management team with a strong mix of commercial, execution, geological and exploration project generation experience and are focused on maximising shareholder value. These include:

Clive Donner – Executive Chair

Mr Clive Donner founded the LinQ Group in 2004, a Private Equity group which successfully built and managed 2 private equity mining funds over 16 years which primarily focussed on emerging mining producers. Prior to his Private Equity career, he spent 16 years as a banker with NM Rothschild Australia and Citibank globally, providing capital and structured finance solutions for mining projects. He was a Director of NM Rothschilds Australia for ~10 years and ran their project financing business in Western Australia where two thirds of Rothschild’s deal flow emanated. Prior to that he spent 9 years at Citibank in Australia and offshore in senior management positions. Mr Clive Donner provides strong private equity style management, evaluation and governance skills and has a strong track record of value creation.

Michael George Gibson – Executive Director

Mr Gibson has a long history as an advisor to the resources and energy sectors, both as a partner of a top tier law firm and subsequently as an executive of mining companies with operations in Australia and internationally, and most recently as Principal of a specialist advisory firm. Mr Gibson has been an advisor to numerous mining companies and industry investors, including private equity, on IPOs and fundraisings, project financings and development, and mergers & acquisitions. Mr Gibson provides commercial and legal skills and governance.

Harrison Patrick Donner – Executive Director (& Company Secretary until Listing)

Mr Harrison Donner is a Chartered Accountant (EY) with previous accounting, corporate finance and private equity experience in New York and Australia. More recently he held a General Manager position in a base metal mining company reporting to the COO where he built detailed financial feasibility modelling, working very closely with the technical team. He was also responsible for undertaking the BD and IR functions. Mr Harrison Donner is also currently Company Secretary but intends to resign that function immediately prior to Listing when Ms Kyla Garic commences as Company Secretary

Geoffrey Michael Jones – Non-Executive Director

Mr Jones is an internationally recognised project developer in the mining industry, with a global career spanning more than 35 years. He has been involved in the evaluation and development of major projects across a diverse range of commodities (including Copper and Gold) both in Australia and overseas. Mr Jones was previously the Managing Director of GR Engineering Services Limited, a specialist EPC Engineer and Constructor to the resource sector. Prior experience included Baulderstone Hornibrook, John Holland, Minproc Engineers and Signet Engineering before serving as Group Development Manager for Resolute Mining Limited. Mr Jones is currently a Non-executive Director of Rumble Resources Limited (ASX:RTR).

Dr Evan Kirby – Non-Executive Director

Dr Kirby has over 40 years’ experience in the mining sector at senior level, covering the development of a wide range of mining and processing projects. He has held senior positions with operating and engineering companies including Minproc Engineering and Bechtel Corporation and is familiar with porphyry copper gold projects both in Australia and overseas. Dr Kirby’s involvement has included the detailed financial modelling of all aspects of mine development and operations. Of particular relevance, Dr Kirby was the Bechtel study manager for the development of a life of mine operating cost and production budget for Newcrest’s Cadia Mine during the time when plant commissioning was in progress. Dr Kirby is currently a non-executive director of Bezant Resources plc, Europa Metals Ltd and Kendrick Resources PLC.

Kyla Garic – Proposed Chief Financial Officer (CFO) & Company Secretary

Ms Garic is an accounting and corporate governance professional with over 20 years’ experience in accounting, external audit and corporate governance. Ms has a Bachelor of Commerce, Master of Accounting, Grad Dip Institute of Chartered Accountants Australia and New Zealand and Grad Dip in Applied Corporate Governance. Ms Garic is a current member of the Institute of Chartered Accountants in Australia and New Zealand and a Fellow of the Governance Institute of Australia. Ms Garic is the owner of a Corporate Advisory Firm in Perth that provides corporate and other advisory services to public listed companies.

Scott Munro – Chief Geologist

Mr Munro is an experienced geologist who has substantial experience in the Lachlan Fold Belt in NSW. Mr Munro provides LinQ Minerals with geological management, logistics input and field work assistance in NSW and is familiar with the Gilmore project having worked on the Project for over 7 years with previous owners. Mr Munro has been involved with several metallogenic discoveries and resource upgrade projects within the Lachlan Fold Belt.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

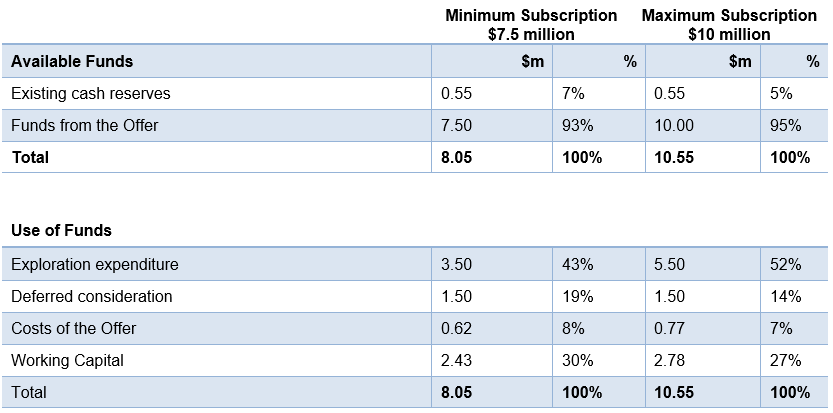

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 8 of the prospectus, LinQ Minerals Limited is subject to a range of risks, including but not limited to challenge to exploration and development, additional funding, key personnel, mineral resource estimates, liquidity and commodity price.

Section 734(6) disclosure: The issuer of the securities is LinQ Minerals Limited ACN 665 642 820. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.