Specialising in the electrification of heavy road transport through innovative swappable battery technology

Live Janus Electric Hold. Ltd ASX: JNS

Janus Electric Holdings Ltd Offer | ASX: JNS

Firm commitments in excess of $6 million, including $2 million cornerstone.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

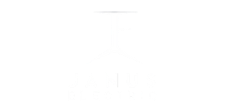

Key Investment Highlights

Introduction

Janus Electric Holdings Ltd (ASX:JNS) is an Australian company specialising in the electrification of heavy road transport through its innovative swappable battery technology and supporting infrastructure. Janus is focused principally on converting diesel trucks to electric using its patented battery-swap systems, manufacturing batteries and charging stations, and generating multiple revenue streams through truck conversion fees, battery hire fees, electricity usage fees and subscription fees for access to the Janus Ecosystem.

Janus’ ecosystem integrates Australian-manufactured hardware with patented software and analytics technology via its Janus Charge and Change swappable battery solution, enabling a 4-minute battery exchange.

This system offers a competitive alternative to both traditional fossil fuel-powered vehicles and original equipment manufacturer (OEM) electric vehicle (EV) trucks, which often require extended recharging periods. This system addresses the prolonged downtimes associated with traditional EVs, offering a competitive edge over current industry standards. As at the Prospectus Date, the technology platform has already facilitated the conversion of 23 trucks, with a total of 142 binding orders in the pipeline.

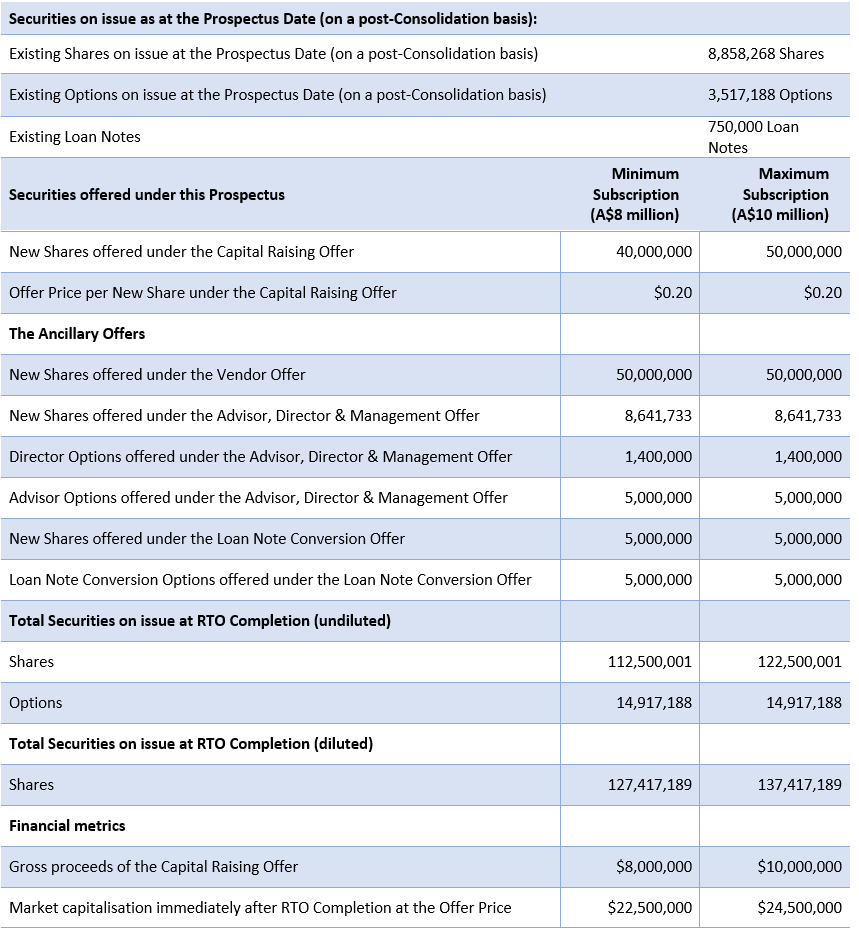

Overview of the Offer

The issuer of the prospectus is ReNu Energy Limited (ACN 095 006 090), to be renamed Janus Electric Holdings Limited. Janus Electric Holdings Limited will trade under the ticker ASX: JNS.

As announced to the ASX on 19 February 2025, ReNu intends to acquire 100% of the fully paid ordinary shares in Janus Electric Limited (Janus) in exchange for the issue to the Target Shareholders and Target Noteholders of a total of 50,000,000 New Shares on a post-Consolidation basis (with the New Shares being issued in proportion to the Target Shareholders’ and Target Noteholders’ holdings in Janus) (Proposed Acquisition). For more information, please refer to the Prospectus.

The Company is looking to undertake an offer on ASX to raise between $8 million and $10 million via the issue of between 40 million and 50 million shares at an offer price of A$0.20 per share. The company will have an indicative market capitalisation of approximately A$24.5 million at maximum subscription.

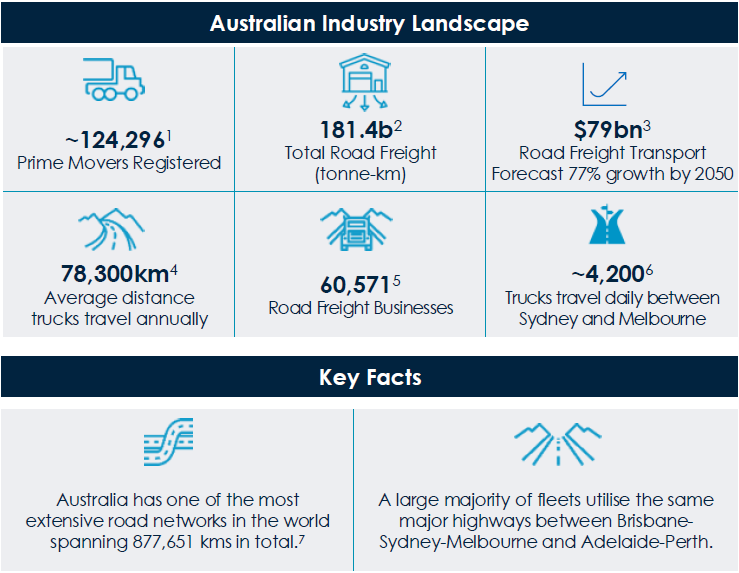

Industry Overview

Janus operates in Australia, with a network of charging stations across key locations in New South Wales, Victoria, South Australia, Western Australia, and Queensland. Janus’ headquarters and production facility are based in Berkeley Vale, NSW.

As global economies shift towards renewable energy and prioritise carbon emissions reductions, the electrification of heavy road vehicles is emerging as a key focus within the transportation sector.

Around the world, support for zero-emission solutions in heavy transport is strengthening and is driven by rapid advancements in battery and charging technologies, evolving regulatory frameworks, and escalating fuel costs. Many nations have set ambitious emissions reduction targets, pressuring commercial fleet operators to transition to sustainable practices that align with these goals.

In 2020–21, Australia’s transport sector contributed $164.4 billion to GDP, representing 7.9% of the nation’s economic output. The road freight transport industry, valued at $79 billion, is expected to grow by 77% between 2020 and 2050.

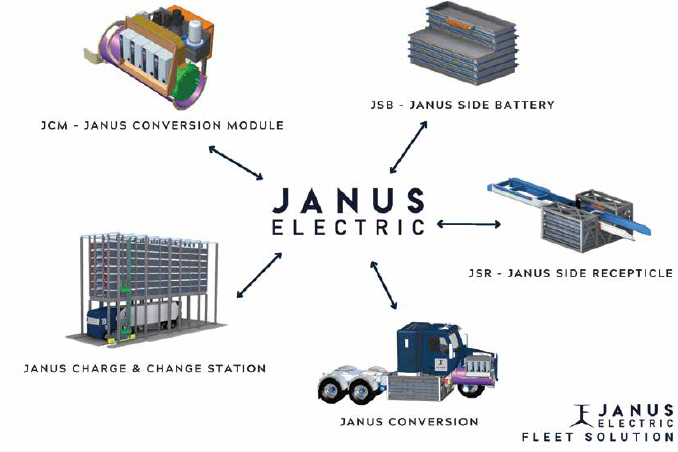

In Australia, the trend towards electric heavy vehicles is gaining momentum. The transport sector is responsible for approximately 17% of Australia’s total carbon emissions. Major fleet operators and logistics companies increasingly recognise the long-term cost savings, efficiency improvements, and environmental benefits EV technology offers. Blue-chip companies facing compulsory reporting requirements for scope 2 and 3 emissions are particularly motivated to adopt solutions that reduce their carbon footprint. Supportive government policies and incentives are beginning to emerge, setting Australia on a path to align more closely with international sustainability targets within the heavy transport sector.

Australian Emissions by Sector (368 metric tonnes of CO2 per year total)

The Australian heavy transport sector is integral to the national economy, with ~124,296 registered prime movers supporting vital industries such as mining, agriculture, and logistics. This significant number of prime movers highlights the essential role of heavy vehicles in the nation’s supply chain and underlines the strong, ongoing demand for effective transport solutions. Given Australia’s extensive road network, spanning nearly 877,651 kilometres, and the high demand for long-haul transport across vast distances, there is a unique need for efficient, sustainable solutions.

In 2022, heavy truck sales reached nearly 15,000 units, with around one-third of these sales being prime movers, highlighting the ongoing demand in this sector. The trucking industry is increasingly seeking alternatives to traditional fuel-based vehicles, motivated by operational cost savings and alignment with carbon reduction targets.

Company Overview

On 19 February 2025, ReNu Energy announced a Share Purchase Agreement to acquire 100% of the issued share capital of Janus. This strategic acquisition transitions ReNu Energy from having a focus on green hydrogen infrastructure to driving the electrification of heavy road transport through Janus’ innovative swappable battery solution.

With a proven, scalable technology already in operation and strong market demand, Janus offers a growth opportunity and an attractive revenue model. This Proposed Acquisition aligns with ReNu Energy’s commitment to clean energy, positioning the Company to generate value for shareholders while supporting Australia’s zero-emission future.

Janus Energy, established in 2020 in Australia, serves as the dedicated research and development arm of Janus, which followed in 2020. Together, they deliver a revolutionary zero-emission solution for truck electrification, leveraging swappable battery technology and innovative conversion kits to transform the future of transport.

The Janus Charge and Change swappable battery solution enables a 4-minute battery exchange, in contrast to OEM EV trucks, which require a minimum of 90 minutes downtime to recharge. By converting existing diesel-powered heavy vehicles into electric trucks, Janus can facilitate a transition to zero-emission heavy transport.

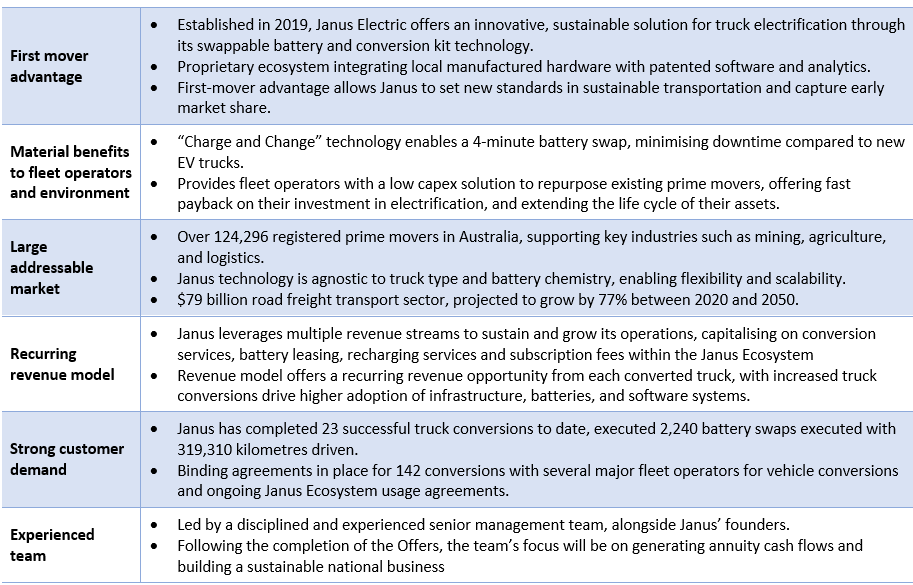

Janus’ core operations revolve around three key infrastructure assets that are integral to its electrification ecosystem:

- Truck conversion facility: Janus operates a truck conversion facility at its leased site in Berkeley Vale, NSW. This facility has the capacity to convert up to two diesel prime movers to electric vehicles per week, with scalability options to meet growing demand. Each converted truck is equipped with Janus’ patented electric drivetrain and requires a subscription to the Janus Ecosystem for seamless operation post-delivery. These conversions typically target high-utilisation heavy vehicles used by fleet operators transitioning to zero-emission solutions.

- Battery manufacturing: Janus assembles its JSBs at the same Berkeley Vale facility. Each JSB consists of 525 Lithium-Ion NMC cells, imported from China, and offers a capacity of 310kWh per module. Paired together, these batteries provide a total of 620kWh, enabling a rapid 4-minute swap using a forklift. Currently, production capacity is one battery per week, with plans to scale up to three batteries weekly. Customers can either lease the JSB’s or purchase them outright, providing flexibility in transitioning to electric fleets.

- Charge station manufacturing: The JCCSs are also constructed at the Berkeley Vale facility using locally and internationally sourced components. These stations are offered in two configurations, a single 180kW charger that recharges one battery in four hours; or a dual 180kW charger that recharges two batteries simultaneously.

Packaged in a 20-foot shipping container, the JCCS is shipped fully assembled and ready for quick installation at customer or Janus-leased sites. Customers can opt to lease or purchase these charging stations, further enhancing the accessibility and scalability of Janus’ products.

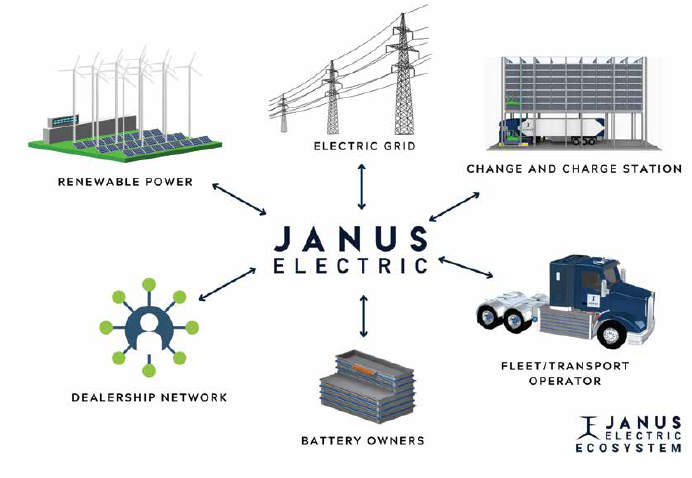

The Janus Ecosystem

The Janus Ecosystem is the foundation of Janus’ solution. It is designed to manage, optimise, and integrate every aspect of electric vehicle operations for fleet owners. The Janus Ecosystem connects all elements of the Janus business, ensuring seamless interaction between customers, assets, and energy usage.

The patented Janus Ecosystem software offers a robust digital platform designed to optimise fleet management while seamlessly supporting the transition to electric trucking. This innovative solution integrates advanced analytics and operational tools, empowering businesses to enhance efficiency, reduce emissions, and embrace sustainable transport.

Key features of the Janus Ecosystem include real-time tracking, battery management, route optimisation and predictive maintenance, allowing fleet operators to maximise efficiency and reduce operational costs. The Janus Ecosystem integrates with Janus’ swappable battery technology, being the JSB, enabling seamless scheduling for battery exchanges and ensuring that trucks are consistently powered.

With advanced data analytics, the software provides actionable insights into vehicle performance and energy usage, developed to drive both cost savings and enhanced sustainability for fleet operators.

Key Components of the Janus Ecosystem

The key components of the Janus Ecosystem are detailed below:

- Software platform: Janus’ patented platform manages all transactions and interactions within the ecosystem, including the real-time monitoring of trucks, batteries, and charge stations. It provides key data on asset performance, energy consumption, and battery health, ensuring smooth operational flow and facilitating accurate billing.

- Energy and management: The system optimises energy consumption, ensuring efficient power use across the fleet. It does this by tracking energy usage, allowing fleet operators to monitor and manage consumption patterns, leading to cost-effective and sustainable operations.

- Asset utilisation and verification: The software platform verifies that only certified assets, such as trucks, batteries, and charge stations, can access the ecosystem, ensuring safety, security, and optimal performance across the network. This verification supports seamless integration and maximises asset utilisation.

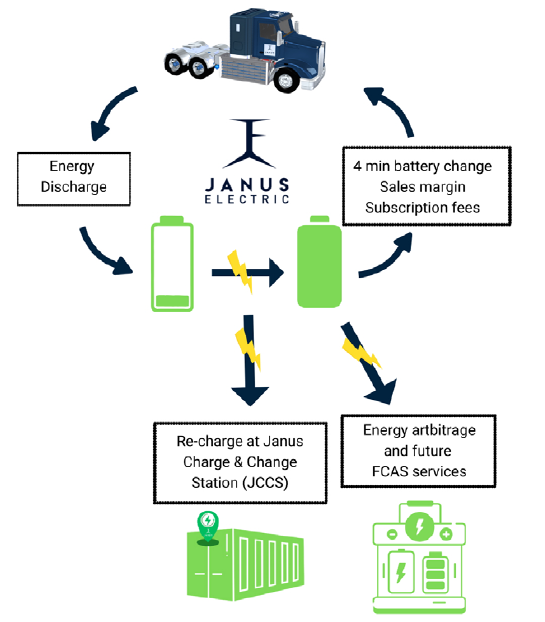

Business Model

The Janus business model revolves around converting existing diesel trucks to electric vehicles using Janus’ patented, exchangeable battery technology and extensive network of charging stations.

By focusing on retrofitting rather than replacing vehicles, Janus enables transport fleets to transition smoothly to zero-emission operations. In this model, Janus not only provides the battery technology but also maintains long-term revenue through ongoing energy supply and battery services, supporting fleets with sustainable solutions throughout the vehicle’s operational life.

The below diagram depicts the Janus business model, illustrating the integrated approach that combines truck conversions, battery technology, and energy management services.

Revenue

Janus leverages multiple revenue streams to sustain and grow its operations, capitalising on conversion services, battery leasing, recharging services and subscription fees within the Janus Ecosystem.

A breakdown of these income sources is provided below:

- Conversion fees: Janus charges a fee for each truck converted from diesel to its EV system, being the JCM. A truck conversion requires a 50% deposit before beginning the conversion and the remaining balance prior to the truck being delivered.

- Battery hire fees: Fleet operators are charged a daily hire fee for the use of Janus batteries, being the JSBs, which allows them to access the charging network and utilise multiple batteries at various locations.

- Usage fees: As part of its business model, Janus charges fleet owners for every kilowatt-hour (kWh) consumed by the JCM in trucks and the JCCS for charging batteries.

- Electricity fees: Janus charges customers for electricity used when swapping and recharging batteries at its network of charge stations.

- Authentication fees: These fees cover the forklift swap service and validation of the battery at each swap. On average, a truck swaps its battery 1.5 times in a 24-hour period.

- Subscription fees: Janus offers a subscription model that provides clients access to the Janus Ecosystem. This software platform delivers real-time data and insights on customer assets in operation, empowering businesses to monitor performance, optimise fleet efficiency, and enhance operational decision-making. The subscription fees cover comprehensive access to key features, such as live tracking, predictive maintenance alerts, energy usage analytics, and safety monitoring. Designed to maximise value and minimise downtime, the subscription ensures clients have the tools they need to manage their electric trucking fleets effectively while benefiting from ongoing software updates and dedicated support.

Growth Strategy

Janus’ relationship with each of its customers extends beyond the initial truck JCM conversion, generating multiple ongoing revenue streams and annuity-style income through battery hire, electricity usage, and other services.

The growth strategy will focus on expanding Janus’ operations within the Australian heavy transport industry.

Following completion of the Offers, Janus aims to ramp up production and grow its customer base by entering into more truck conversion and Janus Ecosystem use agreements. This expansion will prioritise quality, cost-effective manufacturing, and support Janus’ pathway to profitable operations through a scalable model.

Key Offer Statistics

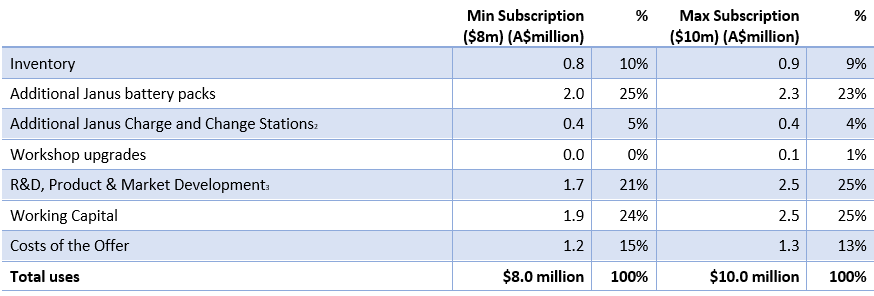

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Key Board and Management

Janus Electric Holdings Ltd is led by a disciplined and experienced senior management team, alongside Janus’ founders. Following the completion of the Offers, the team’s focus will be on generating annuity cash flows and building a sustainable national business. These include

Mr Dennis Lin – Chairman, Non-executive Director

Mr. Lin practised as a solicitor, Chartered Accountant and corporate advisor on equity markets and mergers and acquisitions for over 20 years, including as a Partner at BDO, before retiring from professional services. He now focuses on high growth businesses that are looking to expand globally as the Managing Partner of TAKE Global Pty Ltd, a strategic advisory firm with a focus on advising private and public companies on M&A and capital management in renewable technologies and decarbonisation sectors.

Mr Ian Campbell – CEO, Executive Chair

Mr Ian Campbell is a seasoned executive with over 23 years of experience in sustainability, finance, and capital markets. Previously the Managing Director and Head of Debt Capital Markets at Citi, Mr Campbell led teams responsible for executing over USD 500 billion in transactions across multiple industries and geographies. A recognised leader in green financing and ESG advisory, Mr Campbell has developed and executed innovative sustainability strategies, including green bonds and sustainability-linked financing for major organizations like Fortescue, Woolworths, and Lendlease.

Mrs Kristy Carr – Non-executive Director

Mrs Kristy Carr is an accomplished entrepreneur with over 30 years of experience building successful brands across Australia, Asia, and the USA. Featured in Forbes 2022 Asia’s Power Businesswomen List and named Australian Exporter of the Year in 2022, Mrs Carr has a proven track record in global business leadership. As Founder and Managing Director of Bubs Australia (ASX:BUB) (22 December 2016 to 6 April 2023), she led the company to grow revenues from zero to over $100 million, with market capitalisation reaching a peak of $800 million in the ASX300. Mrs Carr also co-founded TAKE Global Pty Ltd, focusing on climate action investments in areas such as carbon capture, green steel, renewable energy, and the circular economy.

Mr Tony Fay – Non-executive Director

Mr Tony Fay is a current independent non-executive director of Janus. Mr Fay has held several MD/CEO positions with 30 years of experience managing derivative broking businesses. He has worked in Financial Markets for several leading Investment Banks and Brokerage Firms. He was instrumental in establishing the Agricultural Derivatives markets and holds investments in a diverse portfolio of start-up ventures and listed equities. Mr Fay was Chairman of Raiz Invest Ltd (ASX:RZI) from May 2018 to December 2020.

Mr Greg Watson – CFO and Company Secretary

Mr Watson joined ReNu Energy as Chief Financial Officer and Company Secretary in September 2019 and was appointed as Chief Executive Officer in February 2020. Mr Watson was appointed as the Managing Director of ReNu Energy on 2 September 2024. Mr Watson has a strong background in finance, tax, legal and company secretarial disciplines with nearly three decades of experience in professional services, the resources and clean energy sectors.

Mr Alexander Forsyth - COO

Mr Forsyth is the current managing director of Janus. Mr Forsyth combines decades of personal heritage and professional expertise to lead the charge in sustainable transportation. Hailing from a family with over 50 years of deep roots in the trucking industry, Mr Forsyth possesses an intrinsic understanding of road transport and the unique challenges faced by fleet operators. This legacy has equipped him with invaluable insights into the logistical demands and operational complexities critical to shaping effective transportation solutions.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in Janus Electric Holdings Ltd carries risk. As set out in Section 6 of the prospectus, Janus Electric Holdings Ltd is subject to a range of risks, including but not limited to early stage and revenue risk, product and performance, opportunity conversion, commercialization risk, battery supply, dilution, and liquidity.

Section 734(6) disclosure: The issuer of the securities is ReNu Energy Ltd (to be renamed Janus Electric Holdings Ltd) ACN 095 006 090. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).