Australia's Ultimate Food Waste Solution

Open for investment Goterra Pty Ltd

Goterra Pty Ltd | Equity Crowdfunding

Min reached. Now targeting $1.5 million

$981,833

Raised354

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

A Scalable Solution to Australia's Waste Crisis

Automated Technology to Solve the Infrastructure Gap.

Food waste is a critical problem, with up to 90% ending up in landfills, driving 8% of global emissions.

Major metropolitan landfills will reach capacity by 2025, prompting governments to mandate waste diversion from 2026 onward. As capacity shrinks, disposal costs are rising sharply. Meanwhile, centralised alternatives like new landfills and anaerobic digestion facilities are too slow and expensive to meet the urgent demand, leaving a significant gap in viable infrastructure solutions.

Our technology harnesses the power of robotics and insects, using Black Soldier Fly larvae in automated Modular Infrastructure for Biological Services (MIBS) units deployed on-site or close to waste sources. These larvae consume twice their body weight daily, processing food organics and reducing emissions by up to 97% compared to landfill while creating two high-value products: insect protein for animal and aquaculture feed and premium frass fertiliser for agriculture.

With NSW's commercial food waste ban starting July 2026 and residential mandates by 2030, there simply isn't enough infrastructure available. Less than 10% of commercial organic waste currently meets new legislative requirements - creating a $3B+ opportunity in a $15B waste sector as over 90% must be diverted by 2030.

Want to know more? Watch the Investor Q&A here

From Australia to the World

A Global Crisis, A Scalable Solution

Food waste is a planet-wide opportunity. Globally, 1.05 billion tonnes of food waste is generated annually, with most buried in landfills producing 8% of global greenhouse gas emissions. Landfill capacity is declining worldwide while disposal costs rise sharply everywhere.

Regulatory Momentum Is Worldwide

The same regulatory shift transforming Australia is accelerating worldwide. The EU mandates 65% biodegradable waste reduction by 2035, and multiple nations have implemented or are implementing food waste bans. This creates urgent demand for Goterra’s infrastructure on a global scale.

Built for Global Deployment

Our technology is built to travel. Modular MIBS units are containerised for global shipping and deploy in months. Black Soldier Fly biology thrives across climates, while automated systems adapt to any regulatory environment. Five years of proven Australian operation has created battle-tested, export-ready infrastructure.

The Contamination Advantage Travels

Processing post-consumer waste in dense urban environments works everywhere. Our capabilities unlock the 90% of food waste that centralised solutions can’t handle, regardless of geography.

Local Proof for Global Scale

Australia validates the model; but every market faces the same crisis, creating a truly global opportunity for proven infrastructure.

Progress That Speaks Volumes

- Established commercial operations: 21 operational MIBS units across ACT, NSW, and VIC, solving the sustainability needs for over 45 pioneering customers, processing thousands of tonnes annually with proven reliability since 2020.

- Australian-first innovation: Only solution processing residential food waste in urban environments. City of Sydney facility servicing 22,500+ households processing 40 tonnes monthly.

- Backed by leading Australian venture capital: Investors include Tenacious Ventures, Rampersand, Giant Leap, Flying Fox Ventures, and Singaporean billionaire Michael Kum's M&L Investments. Strong investor support demonstrated through our $4.3M convertible note and $7.2M Series A1.

- Award-winning technology: Most Innovative Startup (2024), Smart50 Top 10 (2025) and Best Sustainability Startup (2024), Impact 100 Top 10 (Norrsken Foundation, 2025), Forbes Asia Top 100 to Watch, KPMG Tech Innovator Award. Founder Olympia Yarger named 2023 ACT Australian of the Year.

- Innovation partnerships: Research collaborations with CSIRO, End Food Waste Australia, ANU, University of Canberra, University of Queensland. Partnerships with leading waste Service Providers including: ORG, Bingo Industries. $17.9M total R&D tax incentives received.

- Contracted growth pipeline: $5M in contracted revenue across waste processing agreements, MIBS deployment, and offtake arrangements, with ~$2.9M committed demand awaiting capital deployment for activation.

Built for Scale and Impact

Our fully modular hub-and-spoke model deploys where customers need it, significantly reducing transport costs and emissions while creating value from waste streams that currently cost money to dispose of. We're the only Australian producer processing post-consumer organics at commercial scale with robotics and insects, enabling compliance with regulations competitors can't meet.

Four Revenue Streams: Waste processing fees competitively priced versus landfill alternatives with long-term take-or-pay contracts. MIBS lease fees for dedicated customer sites. High-value offtake sales: insect protein to aquaculture, poultry, and pet food markets (proven to increase yield, extend layer lifespan by six months, improve shell quality); frass fertiliser to agriculture and horticulture (improves soil structure, microbial activity, yields).

Network Effects Compound Value: Each MIBS unit acts as a processing node. Denser networks drive higher margins and lower per-unit costs. Geographic clustering strengthens competitive moat and operational leverage. 21 units creating Australia's first distributed organics processing network - positioning us to capture the infrastructure gap as regulatory pressure intensifies.

Scalable Technology: Modular MIBS design proven over five years. Standardised Australian manufacturing with Allied Engineering delivers four units every 17 days. Automated systems with integrated sensors optimise biological processing 24/7.

Customer Validation

What Our Partners Say

Melbourne Airport – Gigi Yuen, Head of Environment and Sustainability:

"Goterra is a science-driven, commercially viable enterprise that Australia should champion. Their technology is a mature, well-engineered solution based on robust biological science and modular manufacturing, delivering effective results in organic waste management. Goterra's infrastructure is operational, scalable, and already contributing to goals such as emissions reduction, waste circularity, and regional economic development."

Woolworths Group – Jasmine Medwell, Head of Planet:

"Working with Goterra has brought innovation to the way we manage non-edible food waste. Together we're forging new, scalable systems that help Woolworths recycle non-edible food waste and increase our circularity programs."

Hyatt Regency Sydney – Jane Lyons, General Manager:

"Goterra plays perfectly into Hyatt's World Of Care, Environmental, Social and Governance efforts. By adopting this innovative waste management system, we are reducing our environmental impact as well as supporting Hyatt's culinary ethos of 'Food. Thoughtfully Sourced. Carefully Served'."

$3B+ Market Opportunity

The Infrastructure Gap Is Widening

Australia generates 7.6 million tonnes of food waste annually. In NSW alone, over 550,000 tonnes of commercial food waste plus 1.5 million tonnes of residential organics must find compliant solutions by 2030.

Market Drivers Creating Urgency

Sydney will have no landfill capacity within five years - a potential $23 billion annual cost to NSW's economy. Commercial food waste bans from July 2026 create immediate demand, while residential organics (food and garden) mandates by 2030 expand the market exponentially. There is not enough infrastructure to process the mandated demand. Goterra is the fastest solution to solve this problem for customers and governments.

Traditional Solutions Can't Scale

Current technologies struggle in urban environments. Composting can't handle contaminated streams. Anaerobic digestion takes years to build and approve. Centralised facilities face development opposition and lengthy planning, driving them from waste sources.

Goterra's Advantage

Our decentralised hub-and-spoke model deploys in months, not years. On-site processing reduces transport costs and emissions. Modular units scale with demand. We process contaminated waste others reject. CSF and Series B funding will rapidly expand our network across NSW and ACT, plugging a massive gap competitors can't fill.

Why Invest Now

- Proven Technology: Five years of commercial operation with 21 units across three states. IP-protected automated systems processing 100+ tonnes weekly. First-in-world residential urban food waste solution.

- Blue-Chip Validation: Woolworths (partnership since 2020, dedicated 6,000-tonne facility), City of Sydney (22,500+ households, Australia's first municipality using insect processing), Lendlease / JLL Barangaroo, Hyatt Regency Sydney, Melbourne Airport, Coles, IGA. $5M in contracted revenue, and a further ~$2.9 committed revenue demonstrates compelling unit economics.

- Market Tailwinds: NSW landfill levies at $170.10/tonne and rising. 2026 commercial ban creates immediate demand. Infrastructure shortfall of ~2+ million tonnes processing capacity needed by 2030. Over 550,000 tonnes of commercial food waste in NSW alone seeking compliant solutions.

- Capital-Efficient Growth: Modular design enables SaaS-like scaling. Non-dilutive government support: $2.7M Industry Growth Program pending, $1.1M NSW Environmental Trust received, $17.9M total R&D tax incentives. Network effects improve margins with each deployment.

- Last Retail Opportunity: Our $25M Series B institutional raise is closing in early 2026. Once complete, Goterra exceeds CSF eligibility - closing retail access during this high growth phase of the company’s evolution. Invest alongside institutions at $52M pre-money valuation before national scale-up.

Investor Rewards

In addition to equity ownership, Goterra is offering three tiers of Investor Rewards that provide immediate benefits and a deeper engagement with our mission.

$5,000+ | Insider Access

Annual meeting / Q&A with Olympia and the leadership team. Get the story behind our mission, learn the science of what we're building, and hear what's next on our roadmap.

$10,000+ | Behind the Curtain

Annual meeting / Q&A with Olympia and the leadership team + experience our operation firsthand with access to a scheduled tour of one of our sites in NSW or the ACT. See the MIB units in action, understand the process from waste to resource, and discover why black soldier fly larvae are revolutionising how we think about sustainability.

$20,000+ | Legacy Maker

All other rewards, plus collaborate with us to name one of our new MIB units. Leave your mark on the future of waste transformation with a custom name that will live on our facility and in our story.

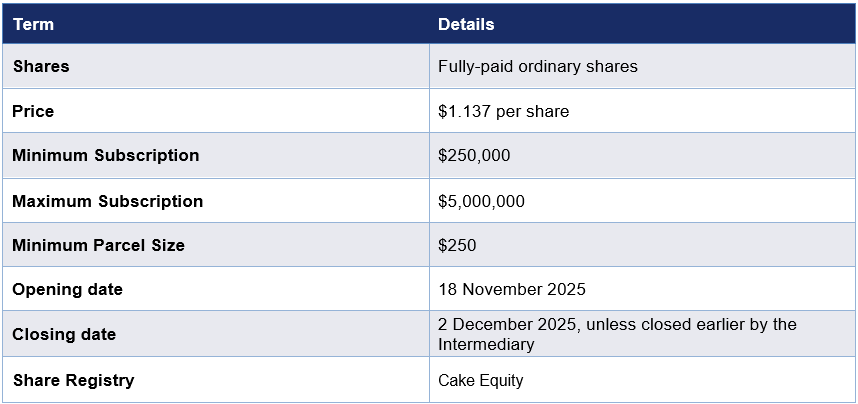

Terms of the Offer

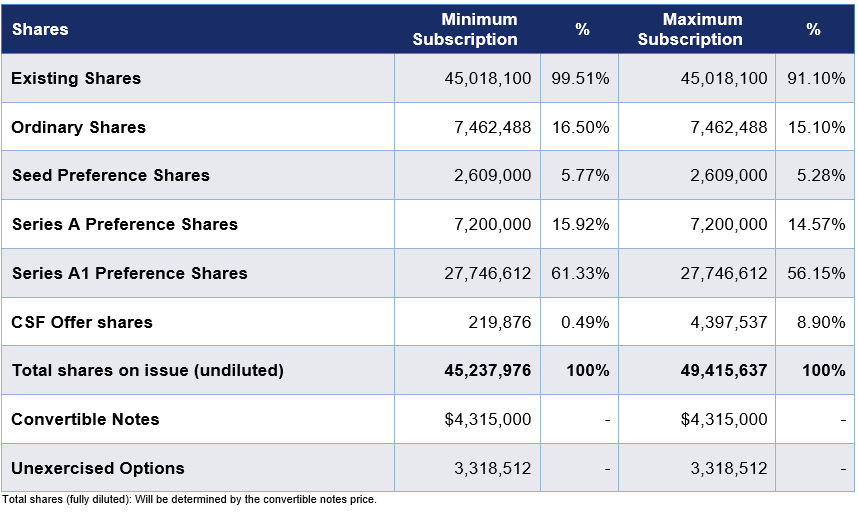

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

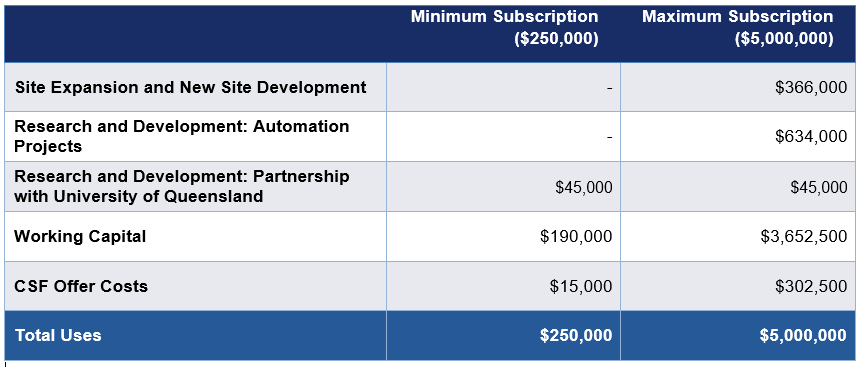

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risk

Goterra transforms food waste into high-value protein and fertiliser using cutting-edge technology, serving blue-chip customers including Woolworths, Lendlease/JLL and the City of Sydney. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, funding, intellectual property, safety, scaling, supplier, or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $5,000,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.5% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Goterra Pty Ltd ACN 612 974 688. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

Can you provide the specific biological containment protocols for your Black Soldier Fly operations, including:

Melissa A (OnMarket member) on 19/11/2025(a) how reproductive adult numbers are controlled,

(b) the maximum allowable larvae density before automatic population suppression is triggered,

(c) the engineering features that prevent escape of adult flies, eggs, or larvae, and

(d) the emergency procedures in place if a module experiences uncontrolled reproduction, containment breach, or environmental release?

Also, has an independent environmental risk assessment confirmed that a runaway population or local establishment is not feasible?

I could not find this information in the Company Offer Documents. Can you please point them out to me should I have missed it.

Kind Regards

Melissa

Hi Melissa,

Daniel P (Goterra Pty Ltd representative) replied to Melissa A on 19/11/2025Thank you for sharing such a great set of questions. We are always glad to see strong engagement on the biological importance of this species and how our technology is unique in commercialising their processing power.

Refer below for a response to each of your points.

a) Control of reproductive adult numbers

We follow Animal Health Australia's farm biosecurity framework, adapted for insect production. Key controls include:

- Robe-in/robe-out procedures so insects cannot leave on clothing.

- Double-door entry systems to ensure adults cannot move unintentionally between rooms or exit the breeding area.

- Defined adult numbers per aviary, set to maintain healthy mating behaviour and prevent colony collapse. Multiple aviaries allow us to scale production without overcrowding.

b) Maximum larvae density before automatic suppression

This metric isn't used in commercial BSF farming. BSF are purpose-raised in controlled environments rather than managed as a potential pest species, so there is no suppression threshold.

We instead manage density by room and by colony to ensure animal welfare, consistent growth, and overall colony stability needed for production.

c) Engineering features preventing escape

As noted in (a), containment relies on layered physical and operational controls, including:

- Double-door and sealed-room designs

- Robe-in/robe-out procedures

- Standard operating procedures to ensure insects remain in their designated aviaries and grow rooms

These systems are designed to optimise production by reliably keeping insects where they are intended to be.

d) Emergency procedures for uncontrolled reproduction, containment breach, or release

Emergency processes follow EPA guidelines for hazardous spill response for the waste-processing unit.

If insects were ever to leave a module unintentionally:

- BSF are a non-pest, non-vector species, which significantly limits biosecurity concern.

- Units have specific seals that trap any stray larvae, allowing a technician to recover them.

- We treat insect escape with the same seriousness as any livestock escape event.

In relation to concerns of a runaway population or local colony establishment, there is strong independent information that highlights that this is very low risk

Presence of the species naturalised to Australia has been explored and explained here by our partners the CSIRO - https://researchdata.edu.au/the-hermetiinae-soldier-flies-australia/1305817

Notably, our colony is made from local species recovered from the wild in Canberra, Brisbane and Perth.

This suggests that if there were a huge risk of runaway population in wild environments, it likely would have manifested already, given the long presence of BSF in Australia.

Farmed species of BSF have become purposefully accustomed to electric lights - not sunlight. There's evidence at this link to demonstrate they are not able to reproduce well in the wild due to not recognising sunlight in the same way as the lights they have been raised on.

https://pubmed.ncbi.nlm.nih.gov/32524667

Another partner - the university of Southern QLD have have noted that, despite BSFs global spread, they are not considered a threat to local environments in Australia.

Finally Their saprophytic nature (feeding on decaying organic matter rather than live plants or animals) reduces the ecological risk compared to more classic invasive species.

https://www.scu.edu.au/news/2025/black-soldier-flies-the-unassuming-insect-transforming-rubbish-into-resources-/?utm

Kind regards

Olympia Yarger

Please sign in to post a question