QLD gas explorer and developer with highly prospective, 100% owned assets in the Surat and Cooper Basins.

Live Eastern Gas Corp Ltd ASX: EGA

Eastern Gas Corporation Limited IPO | ASX: EGA

The company has received strong interest from institutional and HNW investors.

OnMarket has a limited allocation.

The 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

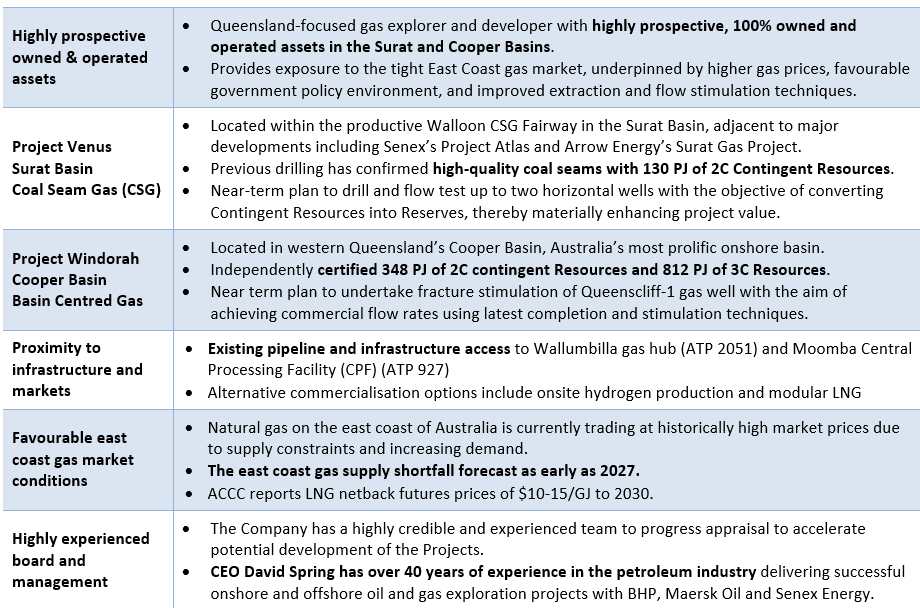

Investment Highlights

Introduction

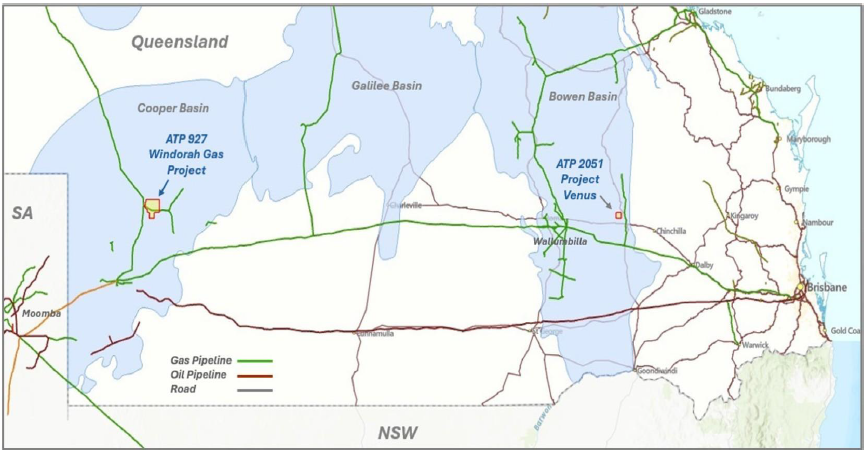

Eastern Gas Corporation Ltd (ASX: EGA) is an energy and resources company focused on natural gas and coal seam gas (CSG) development and production. The Company holds two Queensland exploration permits: ATP 2051 (Venus) in the Surat Basin in South-East Queensland and ATP 927 (Windorah) in the Cooper Basin close to the border of South Australia and Queensland.

Eastern Gas has significant independently certified gas resources, comprising 479 PJ of 2C and 970 PJ of 3C gas resources. At an IPO valuation of $12.5 million pre-money, the company represents a “ground-floor” entry into substantial gas resources within both the highly productive Walloon CSG Fairway (Surat Basin) and the highly prospective BCG play in the Cooper Basin.

The Venus Project holds 130.3 PJ of 2C Contingent Resources in the Upper Walloon Coal Measures which is expected to achieve commercial flow rates following horizontal drilling. The Windorah Gas Project contains a further 330.3 Bscf of 2C Contingent Resources, with potential for an upgrade depending on drilling and flow testing. The success of these activities would ultimately prove viability of future gas development and production to become a gas producer providing energy to the East Coast market.

The Australian Competition & Consumer Commission has identified a deteriorating east coast supply outlook for 2026/2027, expected to increase with time. This represents a rare opportunity for Eastern Gas to capitalise on its substantial position in the Surat and Cooper Basins to prove commercial viability.

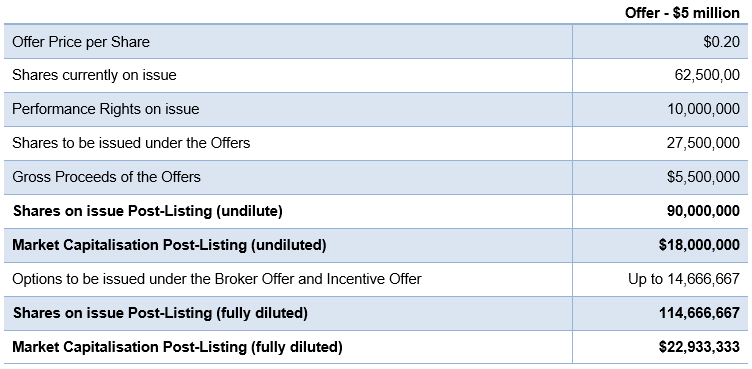

Terms of the Offer

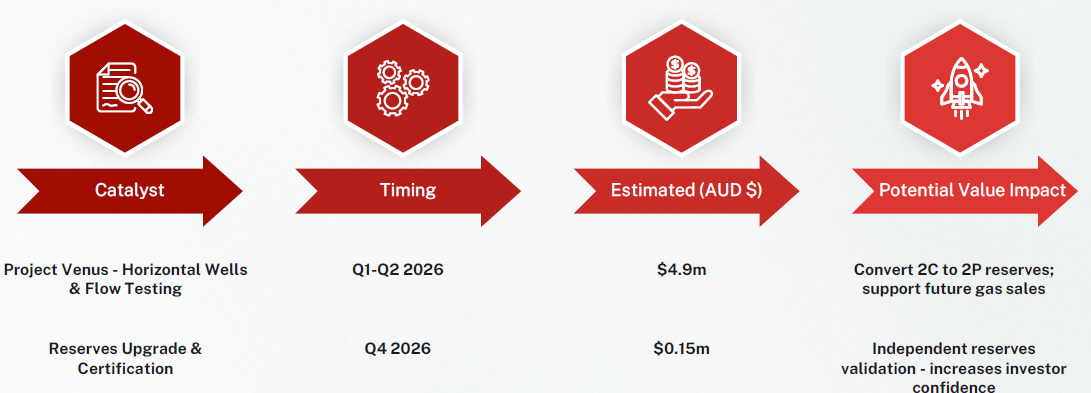

Eastern Gas Corporation Ltd is looking to undertake an IPO on ASX to raise $5.5 million via the issue of 27.5 million shares under the Offer at an offer price of $0.20. The company will have an indicative fully diluted market capitalisation of $22.9 million.

The proceeds of the Offers and the Company’s existing cash reserves will be used for:

- implementing the Company’s business objectives and appraisal programs

- expenses of the Offers; and

- working capital.

Company Overview

Eastern Gas Corporation Ltd was incorporated in October 2025 as a wholly owned subsidiary of ASX listed Australian energy company, Pure One Corporation Limited (ASX:PH2), a company specialising in Hydrogen energy systems and fuel. On 15 November 2024, Pure announced that, following a strategic review, it would demerge its gas projects situated in Queensland via a spin-out of these assets to the Company (Spin-Out). The Company has been recently incorporated as a vehicle for development of the Projects.

Eastern Gas is focussed on creating an economic return for investors through selling natural gas into the Australian East Coast Gas market or other gas-based opportunities. Natural gas on the east coast of Australia is currently trading at historically relatively high market prices due to supply constraints and increasing demand for natural gas as a transition energy source in the current transition to renewable energy sources. This is a strong market environment for development of new natural gas projects for sale in Queensland.

The certified 2C Resources in Project Venus and the Windorah Gas Project represent a material in- the-ground value at current gas market prices. Eastern Gas believes it can develop these gas resources for a cost significantly under the revenue available from sale of the gas resources. The potential profit available from sale of natural gas from the projects would add significant value to Eastern Gas shares, resulting in a potential profit for shareholders.

The Company’s primary objective is to demonstrate commercial gas flows from Jurassic-age Walloon Coal Measures (WCM), particularly the Upper Juandah Coal Measures (UJCM). Project Venus is designed to produce coal seam gas from the UJCM. A thicker Macalister seam (around 4 - 5.8 m thickness) intersected by Venus-1, and Connor-1, -2, -3 and -4 wells, will be the target of horizontal drilling and planned extended production testing using the proceeds of the Offers. The Upper Macalister is the thickest coal seam and offers the best potential for horizontal wells. UJCM Macalister Seam/s currently considered one of the most prospective for commercial hydrocarbons based on minimum permeability cut-offs.

Projects

Eastern Gas holds two Queensland exploration permits: ATP 2051 (Venus) in the Surat Basin in South-East Queensland and ATP 927 (Windorah), in the Cooper Basin on the border of South Australia and Queensland. The Venus Project holds 130.3 PJ of 2C Contingent Resources in the Walloon CSG field. The Windorah Gas Project contains a further 330.3 Bscf of 2C Contingent Resources, with potential for an upgrade depending on drilling and flow testing

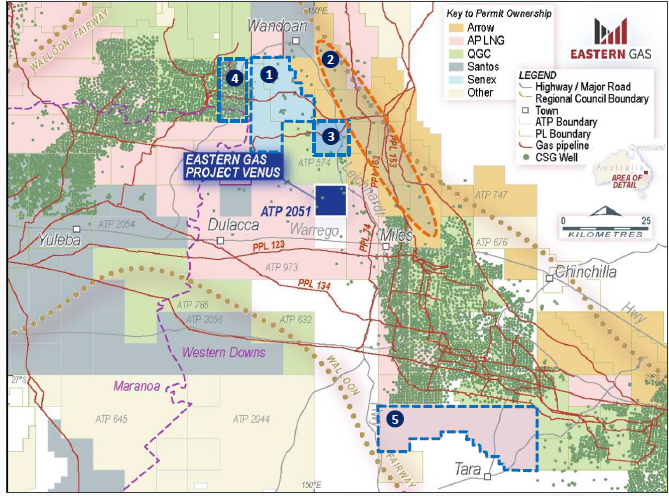

Venus Project (ATP 2051)

ATP 2051, the Venus Project, covers an area of 78 km2 within the highly productive Walloon Coal Seam Gas (WCSG) fairway on the northeastern flank of the Surat Basin in SE Queensland.

Over 10,000 wells have been drilled and connected to gas processing and transportation infrastructure along the WCSG fairway, with historical production rates of up to 3.5PJ/day.

ATP 2051 is strategically positioned near vital infrastructure, including key pipelines and processing plants, benefiting from close proximity to established CSG production in nearby areas.

- Proximate to the original Surat Basin infrastructure and gas hub located on the Undulla Nose;

- APA operated gas transmission pipeline PPL 123 (Berwyndale - Wallumbilla) is located on the southern boundary of the tender area and has a capacity 150TJ/day;

- APA operated PPL 74 (Peat/Scotia to RBP) is 7.5 km east; and

- QGC operated Bellevue central processing plant (CPP) is 35 km to the southeast.

Project Venus is located amongst significant gas producers/developers, namely the Senex Energy Pty Ltd (ACN 008 942 827) (Senex) Project Atlas and the Arrow Energy Pty Ltd (ACN 078 521 936) (Arrow Energy) Surat Gas Project.

- Senex is developing Project Atlas and adjacent blocks in a $1 billion stage 3 expansion; and

- Arrow Energy is expanding the Surat Gas Project (SGP). Planned SGP North development is targeting first gas in 2026. To-date five vertical wells have been drilled in ATP 2051, each confirming the presence of thick coal seams.

The Upper Macalister is the thickest coal seam and offers the best potential for horizontal wells. UJCM Macalister Seam/s currently considered one of the most prospective for commercial hydrocarbons based on minimum permeability cut-offs.

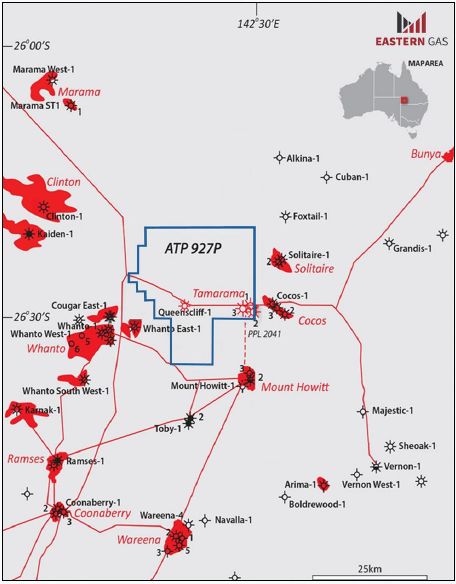

Windorah Project (ATP 927)

ATP 927, the Windorah Project is a 100% owned Basin Centred Gas (BCG) play covering an area of 488km2 located in the prolific Cooper Basin. ATP 927 was awarded a 15-year PCA and ATP renewal in June 2025.

The Company’s primary objective in relation to ATP 927 is to establish a productive and commercial BCG play by demonstrating commercial flow rates to surface in the previously drilled Queenscliff-1 well by working on improvements of fracture stimulation techniques used by operators in the Cooper Basin and Taroom Trough.

Eastern Gas also owns 100% of PPL 2041, granted in 2019 to Real Energy for gas transportation between Tamarama well area and Mt Howitt processing facility, allowing connection to Santos’ pipeline infrastructure to Moomba Central Processing Facility.

While it is currently anticipated that only minimal proceeds of the Offers will be expended on the Windorah Project, the Project is highly valuable to the Company and has been granted the status of a “potentially commercial area” (PCA) by the Queensland Government which essentially means that the Minister is satisfied that the gas production and storage in the area is likely to become viable within 15 years. The granting of the PCA effectively extends the term of the Windorah Project work programme to 15 years.

Commercialisation Options

Successful increase in gas flow rates following fracture stimulation of Queenscliff-1 in ATP 927 and horizontal drilling in ATP 2051, could support conversion of Contingent Resources to Proven Reserves, which could in turn support negotiation of gas sales contracts in both assets. This outcome may deliver significant value for Eastern Gas shareholders in the way of increased asset value, and potential positive cash flow from a development in the future as well as provide direction for techniques to be utilised for future production testing.

Both projects are surrounded by gas fields and gas processing and transportation infrastructure, providing efficient opportunities to produce to market. Eastern Gas will consider alternate development scenarios for ATP 927 and ATP 2051, noting that commerciality will depend on Eastern Gas's ability to complete wells to achieve economic production rates.

East Coast Gas Infrastructure

ATP 2051 and ATP 927 are extremely well located in prolific gas production and sales regions, with access to strong demand from East Coast domestic natural gas usage for commercial and industrial needs, and international natural gas demand via the Queensland LNG export projects.

ATP 2051 is well-located to access Berwyndale-Wallumbilla (PPL123) and Peat Lateral (PPL74) pipelines, and close to the Wallumbilla and Bellevue CPP facilities. Gas pipelines in the vicinity of ATP 2051 are connected to the broader East Coast gas market and export facilities.

ATP 927 is located in the Cooper Basin with straightforward development options for processing and transporting gas to the South Australian and Eastern Australian gas markets and export facilities.

Key Board and Management

Eastern Gas Corporation Ltd is led by an experienced board and management team with 40+ years upstream expertise and proven delivery track record. These include:

David Spring - CEO & Managing Director

Eastern Gas CEO and Managing Director, David Spring has a degree in geophysics and a career of over 40 years within the petroleum industry, as an executive/senior manager and geoscientist delivering successful onshore and offshore international oil and gas exploration, appraisal, development and business development projects. While working for BHP, Maersk Oil, Mubadala Petroleum and Senex Energy, David was responsible for gas exploration and development projects in Australia, South America/ Caribbean and North Africa, including management responsibility for the El Merk gas project in Algeria for Maersk Oil and Gas. David is a graduate of the Australian Institute of Company Directors

James Canning-Ure - Chairman

James Canning-Ure as the Company’s Chair brings over 30 years’ experience in accounting (PwC), banking (Barclays) and investor relations (Republic PR). His corporate wheelhouse includes capital raisings, mergers and acquisitions, IPOs and crisis management. In October 2008 James was part of the team that advised UK-based BG Group, which launched a $4.8 billion takeover of Queensland Gas Company (QGC) and he worked on restructuring QGC for 3 years. James has also advised Comet Ridge on capital raisings. In addition to several Board appointments for ASX and TSX listed companies, he has acted as a strategic advisor to industry leaders including British Gas, QGC, Orocobre, Sayona and Lake Resources.

Scott Brown - Non-Executive Director

Eastern Gas director Scott Brown Scott has over 30 years’ experience as a director and executive in public companies including with the Company’s majority shareholder, Pure. Prior to Pure, Scott was instrumental in the listing of several companies in the US and on the ASX including Real Energy and Objective Corporation (ASX:OCL). Scott was CFO of ASX listed Mosaic Oil, an energy company with a broad portfolio of oil and gas production and exploration assets, and CFO of Allegiance Mining NL, Turnbull & Partners & Objective Corporation Limited. Mr Brown is a Chartered Accountant that worked at KPMG and the Ernst Young.

Karl Schlobohm - Chief Financial Officer and Company Secretary

Karl Schlobohm (B.Comm, B.Econ, M.Tax, CA, FGIA) is a Chartered Accountant with over 30 years’ experience across a wide range of industries and businesses. He has extensive experience with financial accounting, corporate governance, company secretarial duties and board reporting. Karl has acted as Company Secretary and / or CFO of a large number of resource companies listed on the ASX, LSE and / or TSX over the past 20 years. He is currently the Company Secretary of ASX-listed Gold Hydrogen and is a Non-Executive Director of the Australian Shareholders’ Association.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

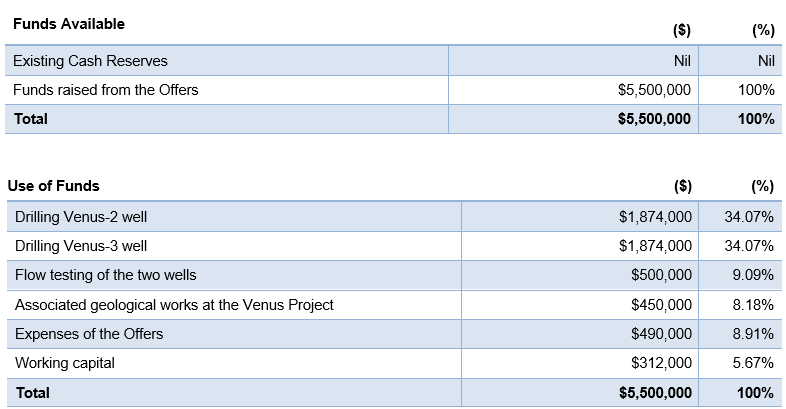

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risk

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 7 of the prospectus, Eastern Gas Corporation Ltd is subject to a range of risks, including but not limited to permit renewal, conditional prospectus, limited history, PH2’s substantial interest and control, additional requirements for capital, and gas development.

Section 734(6) disclosure: The issuer of the securities is Eastern Gas Corporation Limited ACN 692 331 838. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.