Critical minerals exploration company with acquisition plans for REE-Uranium Project in Guinea, West Africa

DMC Mining Ltd ASX: DMM

DMC Mining Ltd IPO | ASX: DMM

The Company has received firm commitments in excess of [the $5 million minimum offer size]. OnMarket has a limited allocation

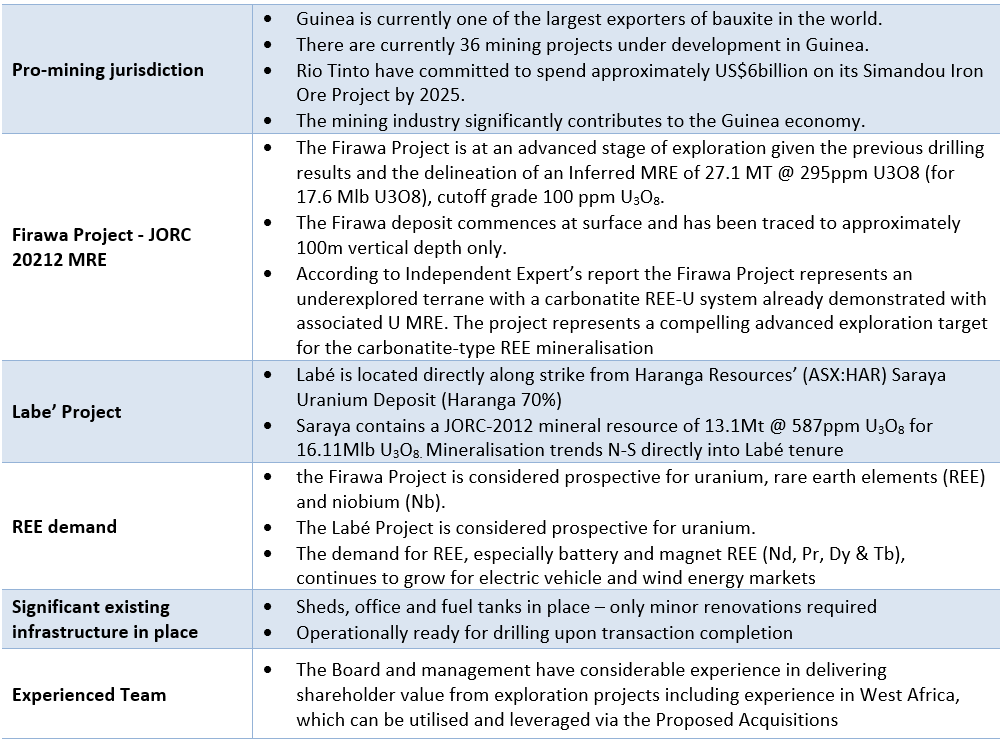

Key investment highlights

Introduction

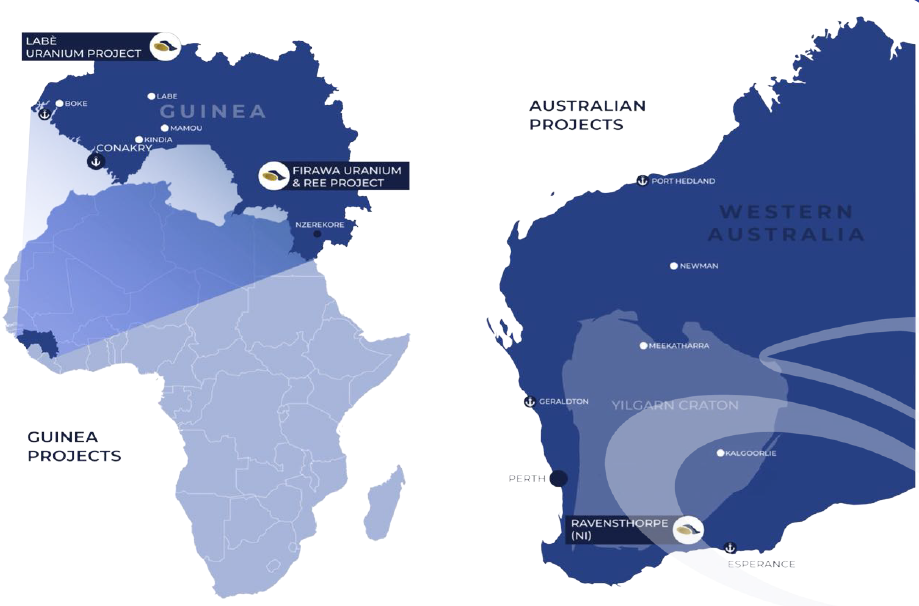

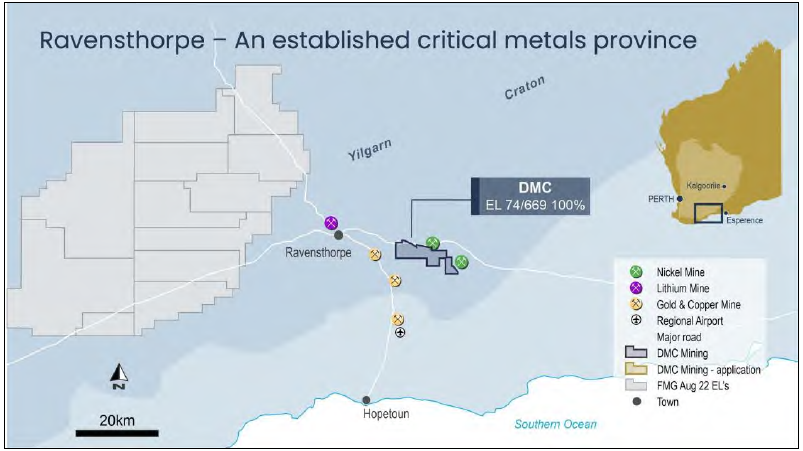

DMC Mining Ltd (ASX: DMM) is a critical minerals exploration company focused on the progression of projects related to new energy and low emissions technologies with their existing project, the Ravensthorpe Nickel Project in Western Australia prospective for Nickel sulphide.

The Company has entered into a share sale agreement (Veridis SSA) pursuant to which it has conditionally agreed to acquire 100% of the issued capital of Veridis Energie SARL (Veridis) which is the holder of two reconnaissance permits and two exploration licence applications over the reconnaissance permits located in the Kissidougou-Mafran region of Guinea known (Firawa Project).

The Company also entered into a share sale agreement pursuant to which it has conditionally agreed to acquire 100% of the issued capital of Mining Development Resources SARLU (Mining Development) which is the holder of one reconnaissance permit application and one exploration licence application which has been applied for over the reconnaissance permit application located in the Labé district of Guinea (Labé Project).

The Firawa Project is a carbonatite style deposit with an existing a JORC (2012) inferred Mineral Resource Estimate (MRE) of 27.1 MT @ 295ppm U3O8 (for 17.6 mill lbs U3O8), cutoff grade 100 ppm U3O8. The Company considers that there is potential to upgrade the resource classification through additional infill drilling and geological evaluation of the deposit. Additionally, rare earth elements (REE) and niobium mineralisation has been identified at the Firawa Project.

Terms of the Offer

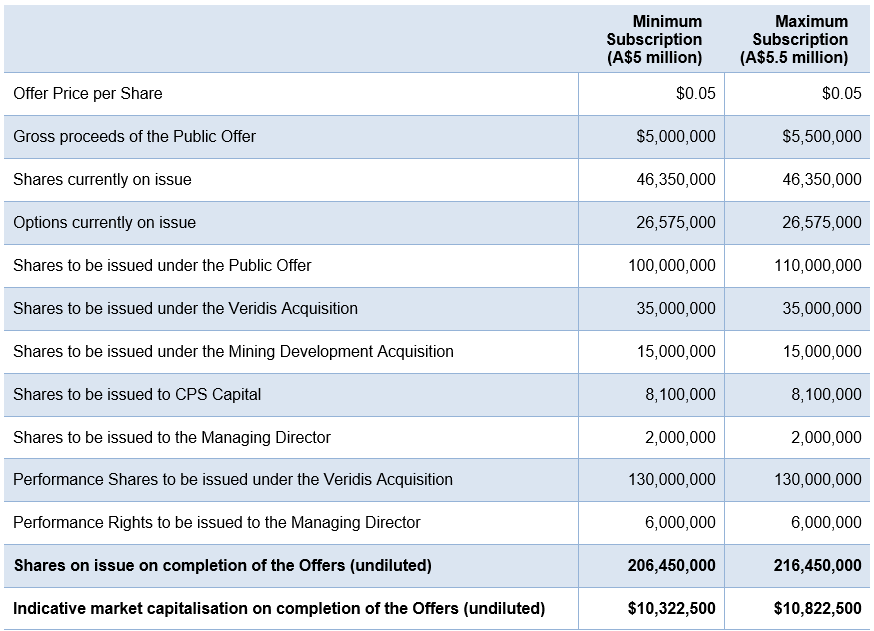

DMC Mining Ltd is looking to undertake an ASX re-listing to raise between $5 million and $5.5 million via the issue of between 100 million and 110 million shares under the Offer at an offer price of $0.05. The Prospectus is a re-compliance prospectus for the purposes of satisfying Chapters 1 and 2 of the ASX Listing Rules and to satisfy the ASX requirements for re-admission to the Official List following a change in nature and scale of the Company’s activities. The company will have an indicative market capitalisation of approximately $10.82 million on completion of the offer.

The purposes of the Offer is to:

- assist the Company to meet the re-admission requirements of ASX under Chapters 1 and 2 of the ASX Listing Rules;

- provide the Company with additional funding to progress exploration and development of the Projects;

- remove the need for an additional disclosure document to be issued upon the sale of any Shares that are to be issued under the Public Offer; and

- provide the Company with sufficient working capital to pursue its business objectives.

The Public Offer is not underwritten. However, Celtic Capital Pty Ltd, an entity controlled by Jason Peterson, has agreed to cornerstone the Public Offer by agreeing to subscribe for, or procure the subscription for, 10,000,000 Shares under the Public Offer for a commitment of $500,000.

The Projects

DMC Mining is an Australian public company, which was incorporated on 2 March 2021 and admitted to the Official List on 20 December 2021. DMC Mining is a critical minerals exploration company, focused on the progression of projects related to new energy and low emissions technologies. The Company’s existing project is the Ravensthorpe Nickel Project (Australian Project) (which is prospective for nickel sulphide), located in Western Australia.

In addition to the Ravensthorpe Nickel Project and subject to the successful completion of the Share Sale Agreements, the Company will hold:

- two reconnaissance permits and two exploration licence applications over the reconnaissance permits located in the Kissidougou-Mafran region of Guinea (Firawa Project);and

- one reconnaissance permit application and one exploration licence application which has been applied for over the reconnaissance permit application located in located in the Labé district of Guinea (Labé Project)

Firawa Project

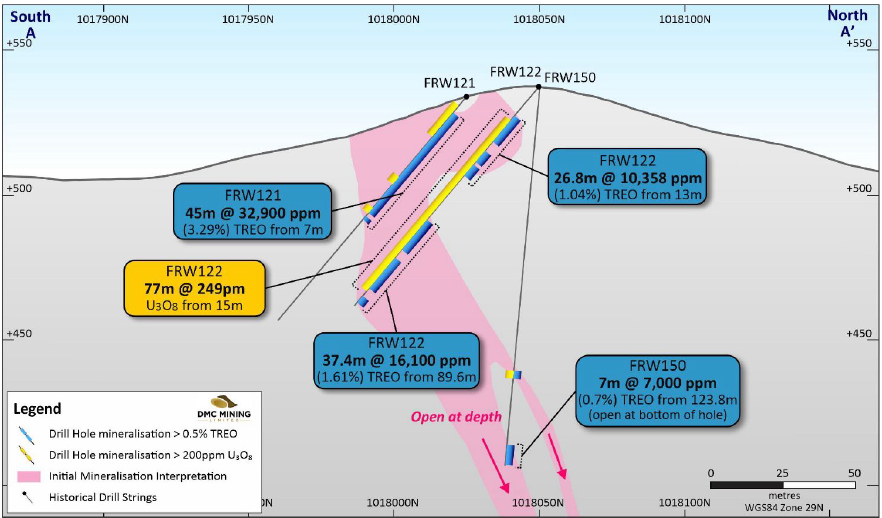

The Firawa Project is a carbonatite style deposit with an existing a JORC (2012) inferred Mineral Resource Estimate (MRE) of 27.1 MT @ 295ppm U3O8 (for 17.6 mill lbs U3O8), cutoff grade 100 ppm U3O8. As outlined in an independent Technical Assessment Report, there is good potential to upgrade the resource classification through additional infill drilling and geological evaluation of the deposit. The REE mineralisation at Firawa also contains significant concentrations of phosphorus (P2O5) and niobium (Nb2O5) which may potentially be economic by-products of any possible future U-REE operation.

The Firawa Project is located near the town of Kissidougou. The town has a 1.2 km long airstrip which has been reasonably maintained. An exploration camp was established by Forte Energy NL, a company formerly listed on ASX and AIM, from 2007 to 2012 (Forte) nearby.

The uranium & REE mineralisation follows an east-west trending tectonic structure, an interpreted fault zone, over a distance of approximately five kilometres. The current understanding of the mineralisation, due to relatively shallow drilling, is mostly limited to the weathered zone. However, two of the historic drill-holes intersected mineralisation in fresh bedrock.

Geology & mineralisation results so far have shown a positive correlation between the uranium and the REE content. Furthermore, untested radiometric uranium anomalies to northwest and east of the drilled-out area indicate a good potential for further discoveries. Exploration is also recommended to focus along the prospective deep-tapping faults running across the licence area, which host diamondiferous kimberlite pipes nearby.

Labé Project

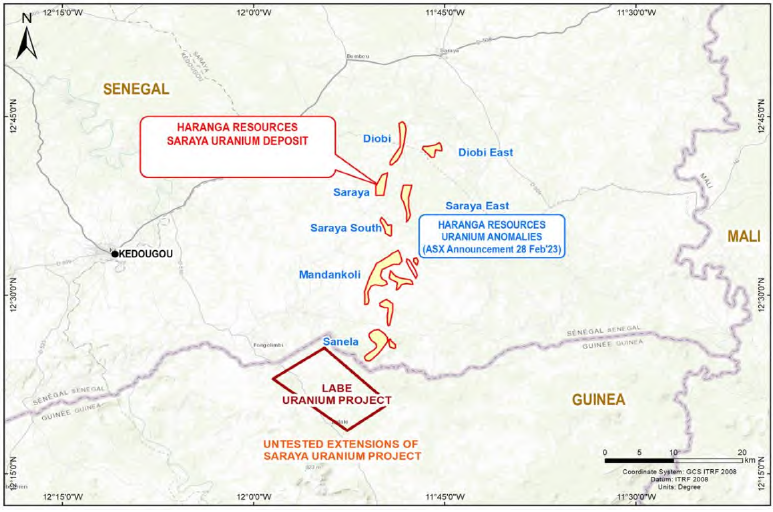

The Labé Project, comprising one reconnaissance permit application and one exploration licence application which has been applied for over the reconnaissance permit application covering approximately 100km2, is located approximately 360km northeast from the capital city, Conakry. The Labé Project is early stage and considered prospective for uranium.

The Labé Project is early stage and considered prospective for uranium. Existing information on previous exploration activities in the focus area is very limited with one historical occurrence of stratiform coffinite mineralisation reported. Also, two strong uranium anomalies were reported within the permit at Bitari and also 3 km northeast, across the Senegal border at Magnafe. Labé is located directly along strike from Haranga Resources’ (ASX:HAR) Saraya Uranium Deposit (13.10Mt @ 588ppm U3O8 for 16.11Mlb U3O8). Mineralisation trends N-S directly into Labé tenure.

Ravensthorpe Project

The Ravensthorpe Nickel Project comprises EL 74/669, is approximately 61km2 in size and is a nickel and gold exploration project adjacent to the First Quantum Minerals (FQM) open-pit nickel mine and the RAV8 sulphide nickel mine, located in the Esperance region of Western Australia, approximately 500km southeast of Perth.

The Ravensthorpe Nickel Project is located in a highly prospective geological setting for nickel sulphide deposits. The Project has at least 15km strike length of the Bandalup ultramafics, the target host rocks that are prospective for Kambalda-style nickel sulphide deposits. The tenement is considered prospective for nickel sulphide mineralisation of a similar style to the RAV8 to the north, with soil surveys identifying several “nickel anomalous” samples in the ultramafic horizons.

Results of recent MLEM and FLEM surveys following up the RAV 9 and RAV 11 airborne electromagnetic (EM) targets have delineated high-priority conductivity anomalies associated with what are interpreted to be buried komatiite volcanic sequences.

Business Model

Following completion of the Public Offer and the Proposed Acquisitions, DMC Mining’s proposed activities and business model will be the exploration and development of the Guinean Projects.

Following completion of the Proposed Acquisitions and the Public Offer, the Company aims to progressively transition from being a junior explorer (subject to the results of exploration activities, technical studies and the availability of suitable funding), to exploiting the value of its Guinean Projects by undertaking project development, construction and mining activities, including:

- conducting systematic exploration activities on the Guinean Projects, with the aim of discovering significant deposits and following discovery, delineating a mineral resource estimate on such deposits;

- conducting systematic exploration activities on the Firawa Project with the aim of, subject to the results of exploration activities:

- completing a mineral resource estimate for combined uranium, niobium (Nb) and magnet rare earth elements (REE);

- augmenting the current resource estimate; and/or

- upgrading the resource classification to a higher category;

- undertaking economic and technical assessments of the priority Guinean Projects in line with standard industry practice (for example, completion of a scoping study, then a prefeasibility study followed by a definitive feasibility study);

- undertaking project development and construction;

- ultimately exploiting the Guinean Projects through mining operations;

- assessing new strategic acquisitions and investment opportunities that may present;

- implementing a growth opportunities strategy and actively canvassing other mineral exploration and resource opportunities which have the potential to maximise Shareholder value; and

- providing working capital to implement the objectives set out above.

In addition to the above, upon re-admission, the Company intends to undertake a limited targeted exploration program on its Australian Project in order to build sufficient value as part of a potential disposal strategy for this asset.

Management and Board

DMC Mining Ltd is led by a skilled Board, comprising Directors who have a wide range of experience, with a proven track record of successful mineral exploration, discovery and development and extensive African knowledge to build the projects. These include:

Mr Michael Minosora – Non-Executive Chair

Mr Minosora is a fellow of Chartered Accountants Australia and New Zealand and has extensive experience in the professional services sector as a former managing partner of Ernst and Young, managing director of Azure Capital and in the resources sector including as CFO of Woodside Petroleum Limited and Fortescue Metals Group Limited. He has also been Chairman of ASX listed companies Atlantic Limited, Golden Deeps Limited and a founder of Bauxite De Kimbo Limited which developed the Kimbo bauxite project.

Mr David Sumich – Managing Director

Mr David Sumich has a track record of over 25 years in the mining industry, including 15 years as MD operating mining and/or exploration projects across west African countries including Gabon, Mali, Republic of Congo, Burkina Faso, & Guinea.

He oversaw the development of the Kanyika REE-Uranium project in Malawi from grassroots stage to feasibility stage and a State Agreement with the Malawian government.

Mr Sebastiano (Sam) Randazzo – Non-Executive Director

Mr Sam Randazzo is a mineral resources industry professional with over 35 years’ experience encompassing various senior roles including executive and non-executive directorships, chairman, CEO, CFO and company secretary in public companies listed on the ASX, TSX, JSE and AIM stock markets.

He has extensive operational experience in project identification, merger and acquisitions, initial and secondary public offerings, capital raisings in international markets, corporate finance, feasibility studies and project development. His mineral industry exposure spans companies involved in mining, exploration, engineering and construction of gold, diamonds, base metals, mineral sands, coal and uranium projects.

Dr Andrew Wilde – Non-Executive Director

Dr Wilde is a geologist with over 35 years industry experience, including 10 years as chief geologist for uranium mining and exploration companies Paladin Energy Ltd (ASX: PDN) and Deep Yellow Ltd (ASX: DYL). In these roles he was responsible for leading technical aspects of uranium exploration and project assessment in Namibia, Malawi, Canada and Australia among others, and played an important role in the discovery of Deep Yellow’s Barking Gecko and Iguana uranium deposits in Namibia. More recently he provided the technical basis for the ASX listing of 92 Energy Ltd (ASX: 92E) and was pivotal in the discovery of that company’s GMZ uranium deposit in Saskatchewan, Canada.

Key Offer Statistics

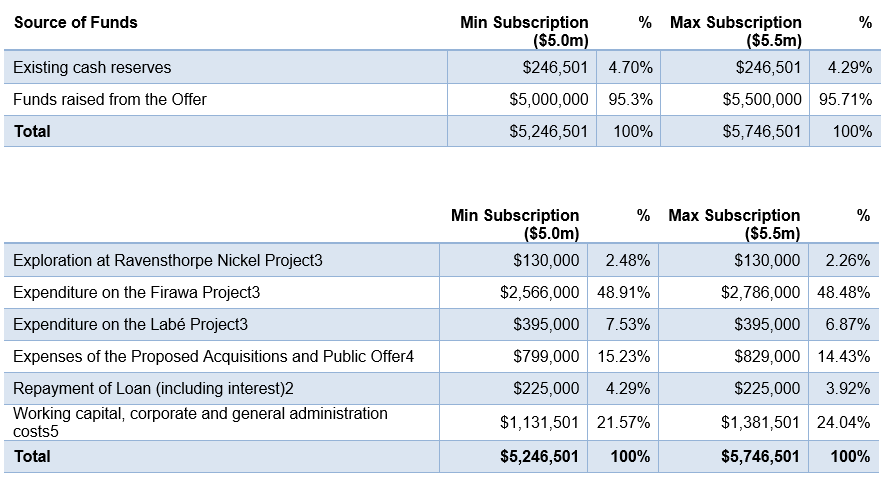

Use of Funds

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 6 of the prospectus, DMC Mining Ltd is subject to a range of risks, including but not limited completion of the acquisition risk, dilution, sovereign, foreign agreements and operations, grant and renewal tenure, change of control tenure, going concern and the risk of additional requirements for capital.

Section 734(6) disclosure: The issuer of the securities is DMC Mining Limited ACN 648 372 516. The securities to be issued are ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

OnMarket has a limited allocation. The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled