From Farm to Table to Experience - Nuts with a Story to Share

Offer Closed Carboor Farms Pty Ltd

Carboor Farms Pty Ltd | Equity Crowdfunding

Offer Closed

$849,200

Raised177

InvestorsPlease consider the offer document and general risk warning before investing.

Retail investors are entitled to a 5 day cooling-off period.

Investments over $10,000 are restricted to Sophisticated investors - Apply here

Click here to learn more about Equity Crowdfunding

Provenance-Led Food, Trusted from Paddock to Plate

Carboor Farms is a premium Australian nut company specialising in hazelnuts and operating a dedicated cracking and processing facility under the Carboor Harvest brand. Beyond hazelnuts, we curate a range of other high-quality local nuts, positioning ourself as a one-stop destination for flavour and provenance. We have built a loyal following through transparency, quality, and storytelling — and are now scaling that connection through immersive customer experiences and accessible premium retail.

Want to learn more? Watch the Investor Webinar here.

Australia's Almond Moment, Reimagined with Hazelnuts

Competitive Advantage in a $10.5B Market

Carboor is Australia’s only vertically integrated hazelnut company with a commercial-scale cracking facility and exclusive access to OSU hazelnut varieties, positioning it strongly in a growing global market.

Counter-Seasonal Premium Supply

With 70% of global hazelnuts concentrated in Turkey and exposed to climate shocks, Australian counter-seasonal supply offers buyers reliability, sustainability, and traceability.

World-Class Genetics and Propagation

Carboor is rolling out modern OSU varieties (Yamhill, Jefferson, Dorris) with superior yield and density (800 trees/ha). Backed by propagation and orchard partnerships, the company is targeting 1,000+ hectares of new orchards.

Scalable Retail and Tourism Growth

Funds from this raise will launch a flagship Carboor Harvest store in Melbourne and develop Beltie Park, an agri-tourism destination that builds brand visibility, new high-margin revenue streams, and future franchise growth.

Established Traction

Carboor is an established brand, having already achieved over $3 million revenue to date with B2B sales to major food brands and foodservice customers, and an active online store shipping almost 10,000 sales to almost 9,800 retail customers. This foundation supports scalable national and international expansion.

Farm to Brand to Customer

Founded in 2015 in North East Victoria, Carboor Farms grows premium hazelnuts and operates a dedicated cracking and processing facility at our Beltie Park farm in Wangaratta under our Carboor Harvest brand. While hazelnuts are our specialty, we curate a range of other high-quality Australian nuts to offer customers a one-stop destination for flavour and provenance.

We serve three key market segments:

- Industrial – Contract cracking and supply of pallet volumes of raw and roasted hazelnuts, diced hazelnuts, and hazelnut gelato base to some of Australia's most recognized food brands.

- Foodservice – Convenient carton-size packs of premium nuts for high-end restaurants, chocolatiers, and cafes.

- Retail – Through our omni-channel model, including direct-to-consumer online sales, our future Beltie Park farmgate store, and the upcoming launch of Carboor Farms nut stores.

We’ve built a loyal following through transparency, quality, and storytelling — and now we’re scaling that connection through immersive customer experiences and accessible premium retail.

Seizing a Global Nut Market in Transition

The global hazelnut market is valued at ~US$10.5 billion with production averaging ~337,000 tonnes of kernel per year. Turkey usually supplies over 70% of world output, but in the most recent season, production fell by nearly 40%, leaving global buyers exposed to price spikes and supply shortages. Buyers believe this is a structural change.

Australia is currently a net importer, consuming ~2,000 tonnes annually while producing less than 5% of national demand. This imbalance highlights a structural gap that Carboor Farms is positioned to fill.

Our counter-seasonal southern hemisphere harvest allows us to deliver fresh supply to northern hemisphere buyers exactly when shortages bite. Combined with Australia’s strict quarantine measures, we remain free of devastating diseases such as Eastern Filbert Blight, which impact major producing regions.

Carboor is leveraging exclusive Australian access to modern OSU hazelnut genetics (Yamhill, Jefferson, Dorris) to underpin new plantings through grower partners. These varieties deliver higher yields and quality, while our Beltie Park processing hub gives Australia its only scaled commercial cracking facility.

Together, these advantages position Carboor Farms as the foundation for supply diversity and resilience in a tightening global market — while also capturing unmet domestic demand and premium export opportunities across Asia.

Solid Foundations with a Loyal Following

Carboor Farms has already demonstrated strong traction and execution, building the foundations for scalable growth. We secured $260,000 in government grants to establish Australia’s only scaled commercial hazelnut processing facility, which underpins our vertically integrated business model. From there, we built out eCommerce, wholesale, and industrial sales channels, ensuring diversified revenue streams across retail, foodservice, and bulk supply.

Customer trust is central to our brand. We hold a 4.6/5 Trustpilot rating across 305 reviews and have amassed more than 1,500 verified photo reviews through Loox, reflecting deep customer engagement. Today, we manage over 9,800 active retail profiles, have served 6,200 unique customers, and fulfilled nearly 10,000 orders across retail, wholesale, and industrial markets.

To date, we have generated over $3.1 million in revenue, validating both market appetite and our ability to convert provenance and storytelling into sales. Importantly, we have also secured planning approval for Beltie Park, which will house our flagship farmgate store and agri-experience. This project will anchor the Carboor Harvest brand, expand high-margin retail, and enhance customer connection through immersive experiences.

These milestones demonstrate not just early traction but a proven ability to execute — positioning Carboor Farms for rapid scale in the years ahead.

Carboor Farms: Provenance, Positioning, and Scale Advantage

Vertical Integration

From nursery to orchard to retail shelf, Carboor controls every step — growing, cracking, roasting, branding, and retailing. This ensures quality, efficiency, and consistent provenance storytelling.

Proprietary Access to High-Performing Trees

Through partnership with Hazelnut Marketing Company LTDA, Carboor is planning for propagating modern OSU varieties (e.g., Yamhill, Jefferson, Dorris) at scale. These trees offer higher yields, better flavour, and denser plantings than traditional hazelnut varieties, giving Carboor a production edge.

Counter-Seasonal Global Positioning

Hazelnuts grown in Australia are counter-seasonal to 90% of world supply. This gives Carboor a unique export advantage, particularly when northern hemisphere harvests are disrupted — as seen with Turkey’s 2025 frost and drought driven shortage.

Strategic Assets & Location

Carboor’s Beltie Park development — located on the iconic Great Alpine Road — will serve as a high-traffic showcase for the brand, combining retail, food, and farm experiences. This creates unmatched visibility and customer connection, especially compared to importers or remote growers.

Premium Brand & Omni-Channel Strategy

Carboor Harvest is more than a product label — it’s a growing lifestyle brand with applications across grocery, eCommerce, and experiential retail. This gives Carboor margin uplift and direct consumer relationships not available to bulk-focused competitors.

Exclusive Rewards for Every Investment Level

By investing in Carboor Farms, you can access exclusive rewards based on your investment size.

All discounts and in-kind offerings apply for 5 years post-close of the offer

Terms of the Offer

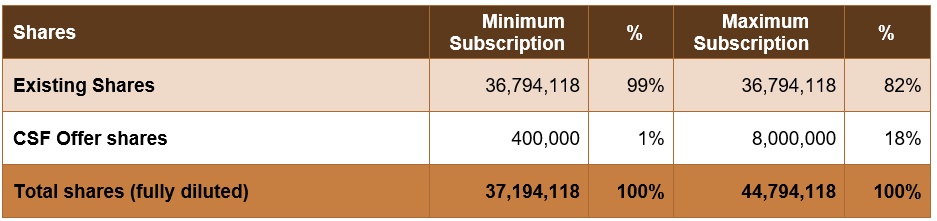

Issued Capital

For more detailed information, please read the Capital Structure section of the offer document.

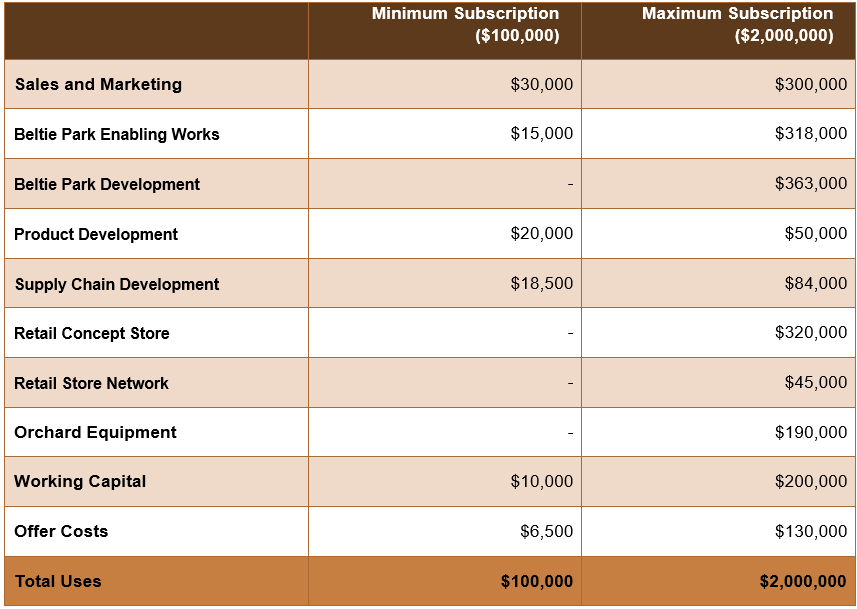

Use of Funds

For more information, please read the Use of Funds section of the offer document.

Company Risk

Carboor Farms is creating Australia’s next iconic food brand. With planned retail stores, their Beltie Park agri-tourism location, and direct-to-consumer channels, they’re blending provenance with scale. Exclusive hazelnut genetics secure future supply, while their omni-channel model drives loyalty, margin, and solid growth in premium, sustainable nuts. As with any growth business, an investment in the Company should be seen as high-risk and speculative. A description of the main risks that may impact their business are listed in the offer document. Investors should read this section carefully before deciding to apply for shares under the Offer. There are also other, more general, risks associated with the Company (for example, primary production, market demand, competition, reliance on new products. changes in legislation, key personnel, or the inability to sell their shares). See the Risk section in the Offer Document for further information.

The Offer is subject to a Maximum Subscription amount of $2,000,000. If the Maximum Subscription is reached, the Offer will close early. Applications will be treated on a time priority basis and may be subject to scale back, so please fund your application as soon as possible.

RISK WARNING: Crowd-sourced funding is risky. Issuers using this facility include new or rapidly growing ventures. Investment in these types of ventures is speculative and carries high risks. You may lose your entire investment, and you should be in a position to bear this risk without undue hardship. Even if the company is successful, the value of your investment and any return on the investment could be reduced if the company issues more shares. Your investment is unlikely to be liquid. This means you are unlikely to be able to sell your shares quickly or at all if you need the money or decide that this investment is not right for you.

Even though you have remedies for misleading statements in the replacement offer document or misconduct by the company, you may have difficulty recovering your money. There are rules for handling your money. However, if your money is handled inappropriately or the person operating this platform becomes insolvent, you may have difficulty recovering your money. Ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

5 DAY COOLING OFF PERIOD: There is a 5 business day cooling off period for retail investors. During this period, you may withdraw your application and receive a full refund into your nominated refund account. Please note: After the 5 day cooling off period has expired, you will be unable to withdraw your application. More information here.

ONMARKET FEES: Upon successful completion of the Offer, a maximum fee of 6.5% of the funds raised will be paid to OnMarket by the Company.

ONMARKET INTERESTS: OnMarket and its associates may be participating in this offer.

ONMARKET INTERESTS AND AMOUNTS SUBJECT TO COOLING OFF: The funding bar displayed under each crowd funding offer may include applications where payments are yet to be made and amounts that are subject to the cooling off period.

Section 734(6) disclosure: The issuer of the securities is Carboor Farms Pty Ltd ACN 609 934 189. The securities to be issued are fully-paid ordinary shares. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above)

Discover investment opportunities here.

Question time

We'd love to answer your questions, we'll have one of the OnMarket team or the company representative of the offer get back to you asap. So ask away ...

What is meant by Nut Club Membership in the Investor Rewards section (section 2.3)? Is Nut Club already in existance, and if yes, where are the costs/revenue attributed for this in the financial statements?

Adnan B (OnMarket member) on 07/10/2025Hi Adnan, thanks for your question. The Nut Club Membership is a loyalty program that will be published in the next few weeks. As such, the costs and revenues are reflected in the Sale of Goods and Cost of Goods Sold lines. Our Shopify platform that manages the online store and POS data does not breakdown the Nut Club data.

Ben B (Carboor Farms Pty Ltd representative) replied to Adnan B on 08/10/2025I cannot get past page one of the form( !-6).Investment amount $2500 form says my BSB is invalid

Ralph D (OnMarket member) on 16/10/2025how can I proceed

Hi Ralph

Carla L (OnMarket staff) replied to Ralph D on 16/10/2025Could you please contact us directly on support@onmarket.com.au and we will be able to assist you.

or am i too late to invest dont know much about shares

Ralph D (OnMarket member) on 16/10/2025Proof of unit economics at the first Melbourne store: weekly revenue, gross margin, and 90-day CAC/LTV evidence.

Pranav N (OnMarket member) on 19/10/2025Beltie Park monetization cadence: bookings/run-rate, per-visitor spend, seasonality, payback on build cost.

HACCP + wholesale/industrial contracts: forward commitments that raise base throughput for the plant.

OSU variety pipeline: credible hectares under contract, yield curves, and off-take aligned to counter-seasonal windows.Store math: Whats your target weekly sales, gross margin, and break-even for the first Melbourne store? Show last 8 weeks daily POS.

Beltie Park cash plan: Capex left, opening date, and month-by-month revenue forecast for year 1. Whats the payback in months?

Plant utilization: Whats current % utilization of cracking/roasting capacity; whats the cost/ton at 50% vs 80%?

Wholesale pipeline: List top 5 B2B accounts with volumes and pricing. Any 12-month commitments?

Working capital: Supplier terms vs customer terms; how much cash is tied up at 2 and 3 current sales?

Director loans: Are founder loans contractually subordinated to new equity until FY27? Any triggers to convert them to equity?

Can you please advise if there is a shareholders agreement in existence. Thanks

Sally C (OnMarket member) on 22/10/2025Hi Sally, thanks for you question. No, there is no shareholders agreement as it is not practical to get all CSF shareholders to sign off on - the constitution (linked above) serves the same purpose.

Ben B (Carboor Farms Pty Ltd representative) replied to Sally C on 22/10/2025Please sign in to post a question