Globally focussed gold exploration, development and production company

Live Ariana Resources Plc ASX: AA2

Ariana Resources Ltd IPO | ASX: AA2

Company has received commitments in excess of the minimum transaction. OnMarket has a limited allocation.

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.

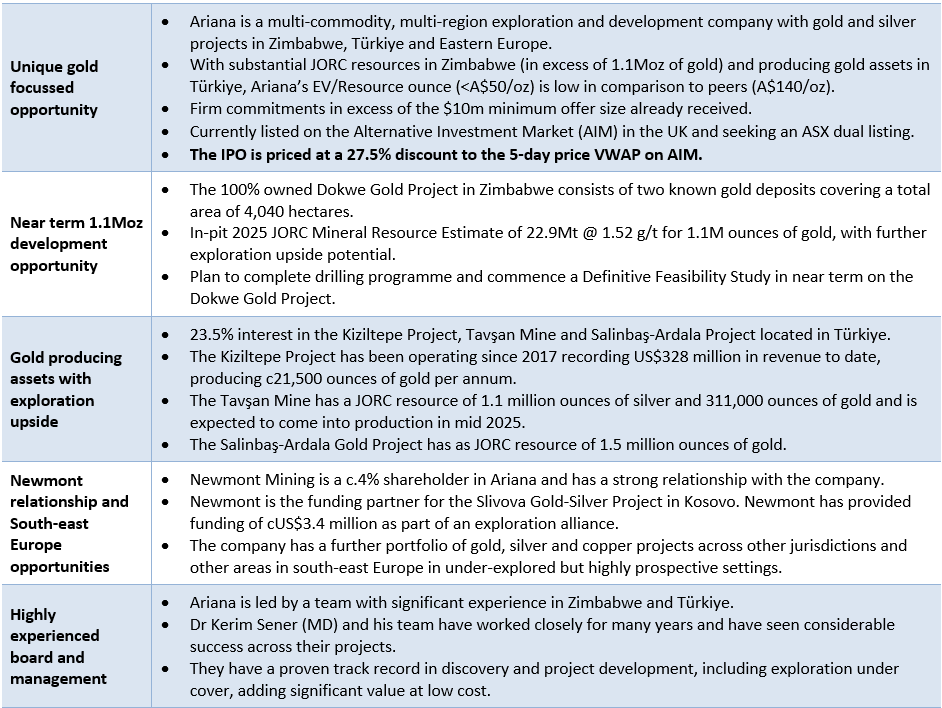

Key Investment Highlights

Introduction

Ariana Resources Plc (ASX: AA2) is a globally focused gold exploration, development and production company with assets in Zimbabwe, Türkiye and Kosovo.

The company’s major asset and primary focus is the 100%-owned Dokwe Gold Project in Zimbabwe, which has shown exceptional potential through exploration activities to date, hosting a substantial in-pit global JORC Mineral Resource Estimate of 22.9Mt @ 1.52 g/t for 1.1 million ounces of gold (0.6 g/t Au cut-off) that underscores the region's rich geological endowment. With the funds raised, Ariana will seek to accelerate the exploration and development efforts at Dokwe, and work towards a Definitive Feasibility Study that will bring the Company closer to production and realising the full potential value of this asset.

In Türkiye, Ariana Resources have successfully executed its project generation strategy, developing their production assets, now held 23.5% by the Company. These have generated strong revenue streams, which have been used to develop the Tavsan Gold Mine. The company is looking towards the scale up of the Tavsan Gold Mine with its JORC (2012) Measured, Indicated and Inferred Resource of 311,000 ounces gold and 1.1 million ounces silver, underpinning a planned production profile of up to 30,000 ounces of gold per annum, with potential for further enhancement. The Salinbaş-Ardala Project, located in north-eastern Türkiye, provides additional exploration potential with a global JORC (2012) Measured, Indicated and Inferred Resource of 1.5 million ounces of gold.

Ariana Resources is also progressing a portfolio of gold, silver and copper projects across other jurisdictions and other areas in south-east Europe. The project generation strategy in these regions continues, most notably through the exploration alliance funded by Newmont Mining Corporation. Such projects are situated in under-explored, yet highly prospective geological settings.

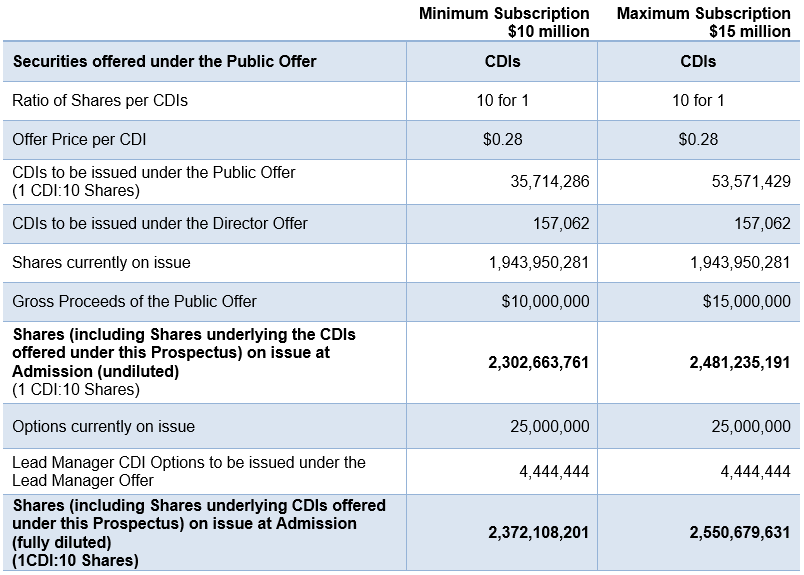

Terms of the Offer

Ariana Resources Plc is looking to undertake an IPO on ASX to raise between $10 million and $15 million via the issue of between 35,714,286 CDIs and 53,571,429 CDIs under the Offer at an offer price of $0.28.

The Company is offering CHESS Depositary Interests (CDIs) over ordinary shares. CDIs represent the beneficial interest in the underlying shares in a foreign Company and are traded in a manner similar to shares of Australian companies listed on the ASX. 10 Shares will be equivalent to 1 CDI.

The Company has been listed on the AIM Market of the London Stock Exchange plc (LSE) (AIM) since July 2005, with its shares quoted under the ticker code AAU. It has a current market capitalisation of approximately £34.02m and is trading at a 27.5% discount to the 5-day VWAP price on AIM.

The Company is bound by the AIM Rules, including its principles of disclosure. The Company will continue to be bound by the AIM Rules.

Company Overview

Ariana Resources was incorporated on 24 March 2005 and its securities commenced quotation on AIM on 28 July 2005. Since listing on AIM, the Company has acquired and subsequently entered into several agreements to acquire whole or part interests in predominantly gold and silver-focused projects located in Zimbabwe, Türkiye, Kosovo and Cyprus.

Ariana has an interest in multiple advanced projects and leverages several competitive advantages:

- a proven exploration track record;

- industry-leading exploration and production costs;

- confidence of robust international and local partners; and

- a track record of being in profit since 2016.

Ariana has a multi-commodity, multi-region, exploration and development strategy, involving:

- deployment of cutting-edge exploration technologies including drone and pXRF technology, Geotek BoxScan and PortablePPB technologies;

- development of in-house skills to deliver results efficiently; and

- leverage of in-country expertise in diverse regions.

The Projects

Dokwe Gold Project (exploration asset in Zimbabwe)

The Company holds a 100% interest in the Dokwe Project, which is located in Matabeleland North Province, Zimbabwe approximately 110km west of Bulawayo. The project comprises two known gold deposits; Dokwe North and the smaller satellite resource referred to as Dokwe Central. The Dokwe Project comprises 81 blocks of gold claims and a further 22 blocks of copper and copper base metal claims covering a total area of 4,040 hectares.

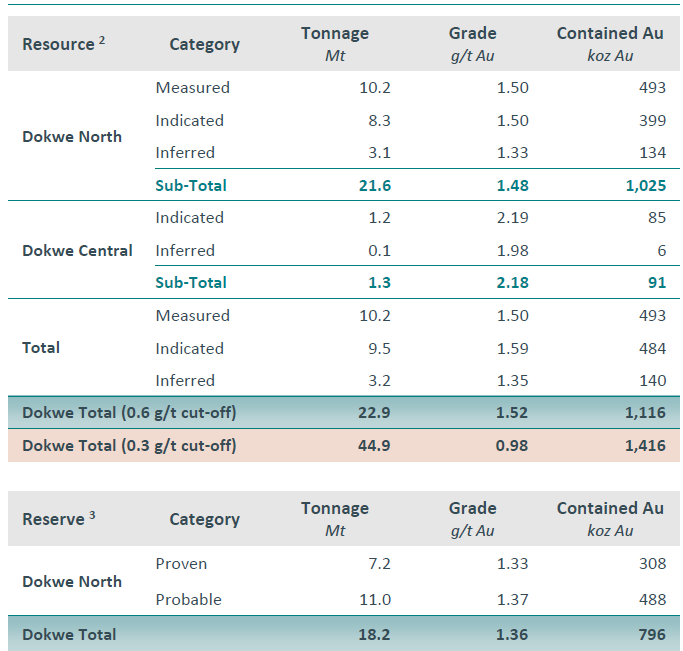

The Company released an updated in-pit Mineral Resource Estimate for Dokwe North and Central on 4 March 2025 which is in compliance with the JORC Code (2012). This showed 1.1 million ounces of gold (based on the higher 0.6 g/t Au cut-off grade) in JORC (2012) Measured, Indicated and Inferred Resources, with significant scope to grow.

The project targets greenstone hosted gold mineralisation and is planned as an open pit mining operation, with a treatment capacity of 125,000 tonnes per month of ore to the plant during steady state production, based on the PFS. The PFS evaluated two processing options, with the Carbon-in-Leach (CIL) option advanced to a Reserve schedule.

Other key aspects of the project include its proximity to infrastructure, well-maintained road access and site facilities. The site facilities include a well-established field camp with a fast satellite data connection and with over 42,000 metres of drill core stored on site.

Dokwe Project Resources and Reserves

Türkiye Projects

Ariana Resources has an indirect 23.5% interest in the Kiziltepe Project (including the Kiziltepe Mine), Tavşan Mine and Salinbaş-Ardala Project located in Türkiye through its holding in Zenit.

Zenit is a pro-rata fully contributing incorporated joint venture, i.e., to the extent that the Zenit Board makes a cash call, Ariana or the other shareholders would need to make a pro-rata contribution or be diluted. However, since the Kiziltepe Mine commenced profitable production in 2017, Zenit has been entirely self-funding through operating cash flows and no cash calls have been made in its history. Ariana expects Zenit to continue as a self-funding joint venture entity with no need for any cash calls to be made from Ariana or the other two joint venture partners.

The Kiziltepe Mine (in which the Company has a minority interest) has been operating successfully since 2017 recording US$328 million in revenue to the end of 2024. The operation paid down US$49.6 million in debt and paid dividends to its shareholders from 2018 through to early 2021, and is funding the development of a second operation at the Tavşan Mine which commenced construction in the second half of 2022.

Ariana confirms that Zenit’s current intentions are to re-invest all profits generated from the Kiziltepe gold-silver mine into the completion of construction of the gold-silver mine at Tavsan and to repay the Zenit finance facility.

Kiziltepe and Tavsan Projects

Slivova & Hertica Projects (gold-silver & gold-copper projects(Kosovo Projects)

Ariana Resources Plc has an interest in the Slivova, Hertica and Paruci Projects, located in Kosovo. The Company has an interest in the Kosovo Projects through its 76% interest in Western Tethyan Resources Limited (WTR). WTR has a 51% interest in the Slivova Project and a 100% interest in the Hertica Project.

The most advanced project in the portfolio, the Hertica Project (WTR has a 100% interest), was diamond drill-tested in 2024, demonstrating the potential for a porphyry copper-gold system. The Hertica licence expired on 14 July 2025 and prior to the expiry, WTR submitted an application for an exploration license extension, covering 29.99km² over the Hertica Project (previously 59.99km²). Under the previous granted license, WTR completed significant geological mapping, geochemical sampling, geophysical surveys and drilling across a large porphyry system. Up until the date of this Prospectus, the work on the Hertica Project has been funded primarily though the exploration alliance agreement with Newmont.

Cyprus Projects

The Company has several projects in Cyprus through its 61% owned Venus Minerals Limited. The most advanced exploration project is the Magellan Project.

The Magellan project is housed within 61% owned Venus Minerals Limited and related arrangements. It is an advanced copper-gold-silver-zinc project containing an Indicated and Inferred JORC (2012) Resource of 16.6Mt @ 0.45% to 0.80% copper (grade difference across individual deposits), providing Ariana with a solid foundation on which to build its resource base. Scoping and pit-optimisation studies for the project have been completed.

Additionally, Venus Minerals Limited has entered into an access agreement with Red Metal Cyprus Ltd, a privately owned Cypriot Company, pursuant to which Red Metal Cyprus Ltd has granted Venus Minerals Limited exclusive and nontransferable licences to explore and develop permitted minerals within three exploration licences that fall within the Magellan Project area.

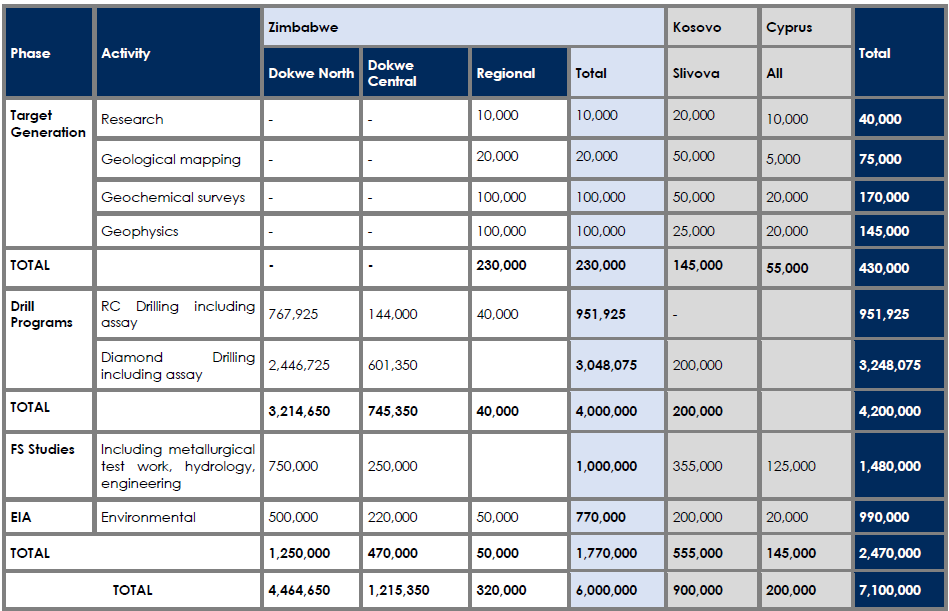

Proposed Exploration Programme and Development Plan

The Company’s proposed exploration programme and development plan based on maximum subscription over the first 12 months following Admission is outlined in the below tables.

Key Business Objectives

Ariana Resources Plc’s main objectives upon Admission will be to:

- achieve sustainable long-term growth via robust and cost-efficient mineral exploration and development;

- undertake a drilling programme and continue work on its Definitive Feasibility Study at the Dokwe Project;

- systematically explore and seek to develop the Dokwe Project and other projects within the broader portfolio;

- continued gold production at the Kiziltepe Mine until current Reserves, including potential satellites, are exhausted (expected in 2026);

- continue gold production and complete construction of the heap leach facility at the Tavşan Mine (expected to achieve operational status in July 2025);

- maintain a strong team with excellent technical, financial and commercial skills;

- form robust business partnerships for the development of its Projects;

- ensure safe operating procedures and minimise environmental impact; and

- provide working capital for the Company.

Board and Management

Ariana Resources Plc is led by a board and management team with experienced operators in Zimbabwe and Türkiye with a proven track record in discovery and project development, including exploration under cover, adding significant value at low cost. These include:

Michael de Villiers - Non-Executive Chairman and UK Company Secretary

Michael qualified as a Professional Accountant with Ernst & Young in Cape Town. He gained his experience as Financial Manager at mining and chemicals operations in Botswana, Bulgaria, FSU, Ghana, Namibia and the United Kingdom. He was previously CFO of Eurasia Mining plc, Finance Director of Mercator Gold (now ECR Minerals plc), Oxus Gold plc and Navan Mining plc. He has over 0 years’ experience in the mining industry. Michael is Chairman of the Audit Committee and serves on the Sustainability Committee.

Michael Atkins - Non-Executive Deputy Chairman

Michael brings over 35 years of global experience in restructuring, development, capital raising and financing for numerous successful public companies and has experience working in many countries including in Africa (including Botswana, Zimbabwe, Ghana, Cameroon, Djibouti, South Africa), and Europe. Michael was founder and Executive Chairman of Gallery Gold Ltd and was responsible for Gallery’s acquisition of the Galane Gold Project in Botswana, which is situated in the Zimbabwe Craton in which Ariana’s Dokwe Project also lies. Michael is a Non-Executive Director of SRG Global Limited (ASX:SRG). In the last 3 years, Michael was a Non-Executive Chairman of ASX listed companies Castle Minerals Limited (ASX:CDT), and Legend Mining Limited (ASX: LEG), and Non-Executive Director of Australian listed companies Warrego Energy Limited (ASX:WGO) and Memphasys Limited (ASX:MEM).

Kerim Sener - Managing Director

Kerim graduated from the University of Southampton with a first class BSc (Hons) degree in Geology in 1997 and from the Royal School of Mines, Imperial College, with an MSc in Mineral Exploration in 1998. After working in gold exploration and mining in Zimbabwe, he completed a PhD at the University of Western Australia in 2004. Since then, he has been responsible for the discovery of over 4.3Moz of gold (including gold equivalent) in eastern Europe. Kerim is also Non-Executive Chairman of ASX-listed Panther Metals Limited (ASX:PNT). Kerim is a Fellow of The Geological Society of London, Member of The Institute of Materials, Minerals and Mining, Member of the Chamber of Geological Engineers in Türkiye and a member of the Society of Economic Geologists.

William Payne - CFO and Non-Executive Director

William studied Accountancy at Exeter University before training and qualifying as a Chartered Accountant with KPMG in London. In 2003, he became a partner in top 20 accountancy practice Wilkins Kennedy LLP at their London office, which is now part of Azets, where he continues to act as partner.

Chris Sangster - Non-Executive Director

Chris is a mining engineer with over 45 years’ experience in the mining industry. He has a first class BSc Hons in Mining Engineering from the Royal School of Mines, Imperial College in London and a GDE in Mineral Economics from the University of Witwatersrand and is a Fellow of the Institute of Materials Minerals and Mining. Chris has extensive experience in gold, diamond and base metal production environments. He held positions of Vice President Mining Services at KCM PLC and Principal Mining Engineer for Australian Mining Consultants. He co-founded ASX / AIM listed Scotgold Resources in 2007 and was its Managing Director following which he became a Non-Executive Director and Technical Consultant from late 2014 until 2021.

Andrew du Toit - Operations Director

Andrew has over 35 years’ experience in the Zimbabwean mining industry in roles from project geologist to general manager. He began his career with the Zimbabwe Geological Survey and he has been a consultant to Independence Gold/Lonmin PLC and SRK and manager for Reunion Mining PLC and Zimplats Limited (ASX:ZIM). Andrew has extensive operational experience in the gold, copper and platinum sectors.

Nicholas Graham - Non-Executive Director

Nick is a Chartered Geologist with over 50 years of experience in mineral exploration and mine development, primarily in Zimbabwe, working for Falconbridge Exploration Inc., Kamativi Tin Mines Ltd., Cluff Resources PLC and Reunion Mining PLC. He pioneered heap-leaching in Zimbabwe and discovered and developed the largest gold mine in the country: Freda Rebecca. He co-founded Reunion Mining, discovered the Maligreen gold deposit and developed the Sanyati copper mine in Zimbabwe and Dunrobin gold mine in Zambia.

Key Offer Statistics

See ‘Summary of Offer’ section of the Prospectus for further information.

Use of Funds

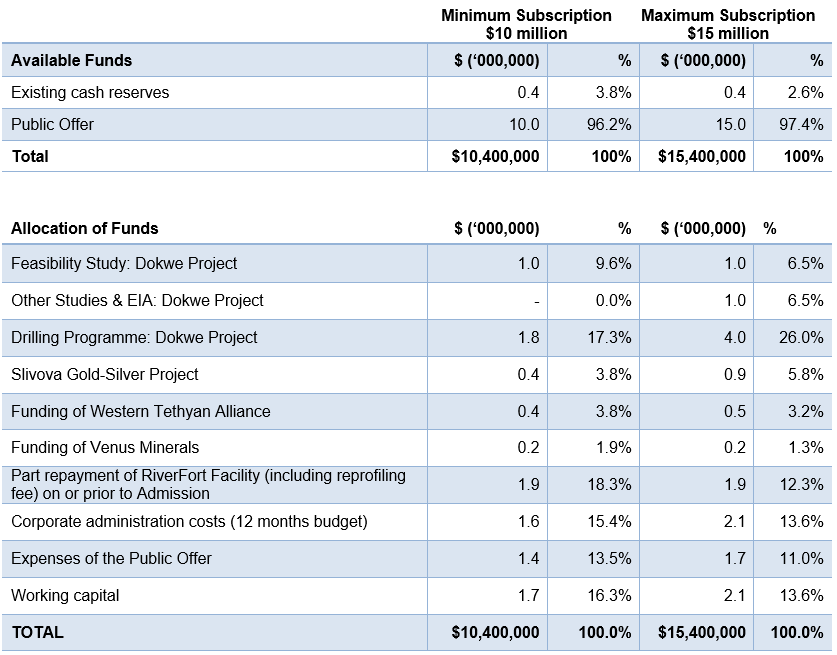

Funds raised from the Offer will be applied as follows:

For further information on the Key Offer Statistics and Use of Funds, please see the prospectus.

Risks

You are encouraged to read the Prospectus carefully as it contains detailed information about the Company and the Offer. Like all investments, an investment in the Company carries risk. As set out in Section 7 of the prospectus, Ariana Resources Plc is subject to a range of risks, including but not limited to joint venture, foreign agreements and operations, future funding requirements, debit funding risk, exploration, operation, development and production risk.

Section 734(6) disclosure: The issuer of the securities is Ariana Resources Plc ARBN 681 342 334. The securities to be issued are CHESS Depositary Interests (CDIs) over ordinary shares in the capital of Ariana Resources Plc, to be quoted on ASX. The disclosure document for the offer can be obtained by clicking on the link above. The offers of the securities are made in, or accompanied by, a copy of the disclosure document. Investors should consider the disclosure document in deciding whether to acquire the securities. Anyone who wants to acquire the securities will need to complete the application form that will be in or will accompany the disclosure document (which can be done via the electronic application form which will become available by clicking the bid button above).

The offer may close early and the 'Pay By' dates may change. Duplicate bids under the same investment profile, investor name or residential address may be cancelled.