Crowd-Sourced Funding. Invest with impact

Your opportunity to invest in Australia's most exciting growth businesses

302

Successful Raisings

$218M

Capital Raised

68,848

OnMarket Crowd

Discover Equity Crowdfunding investment opportunities here

Equity Crowdfunding is risky. Please read the general risk warning.

Become part of the OnMarket Crowd

Explore opportunities

It is simple to join the OnMarket crowd and start exploring early and growth stage businesses who are making a difference.

Ready, set, invest

Invest from $50 to $10,000 in companies who you feel passionate about and be part of their journey.

Be rewarded

Congratulations! You now own part of a company who is providing a new business solution - watch them grow.

What types of companies can I invest in?

OnMarket provides you with the opportunity to invest in companies from seed through to IPO.

SEED

Pre or nominal revenue

Funds used to develop idea/concept

Raising $100k - $500k

EARLY STAGE

Product in beta stage or later

May have revenues, but not profit

Raising $250k - $1m

GROWTH STAGE

Progressing commercial operations

Customer traction/ solid revenues

Raising $500k - $5m

The OnMarket Gatekeeper Commitment

We take our Gatekeeping responsibilities seriously.

So that you can better understand our process, the potential risks and rewards of investing, we have developed The Gatekeeper Commitment that details the approach of our dedicated team of professionals.

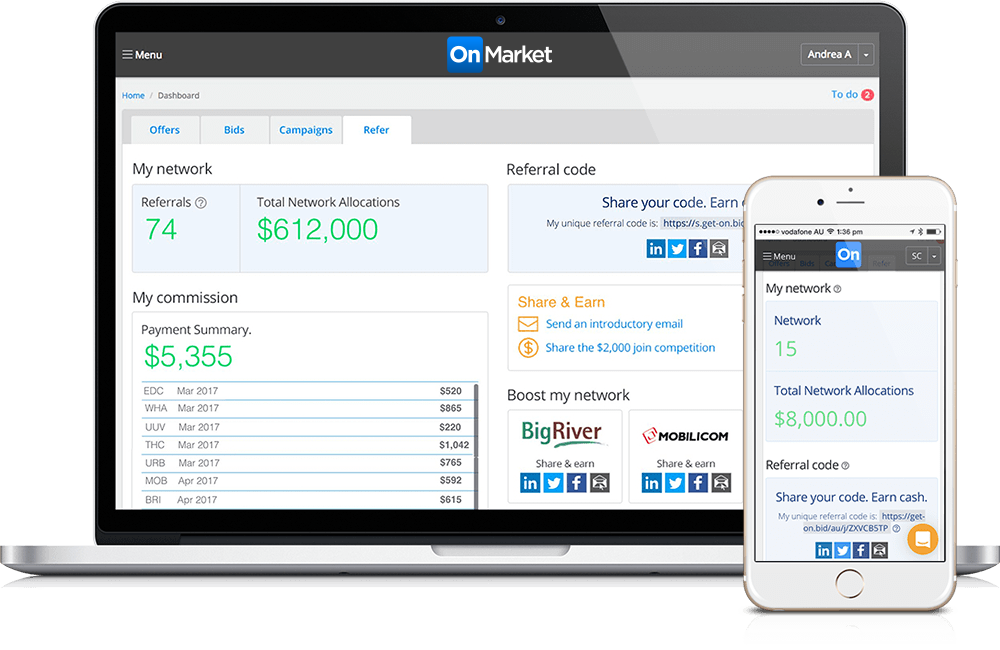

Refer OnMarket

Over $346,746 in reward payments so far

Join OnMarket

Refer OnMarket

Earn 25% of our selling fee